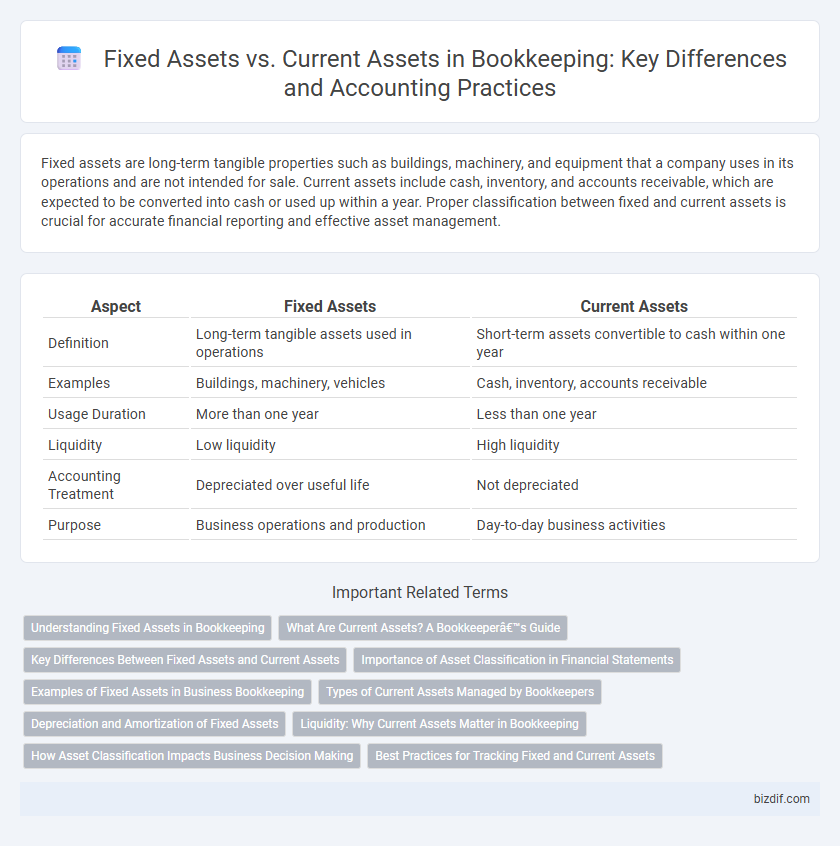

Fixed assets are long-term tangible properties such as buildings, machinery, and equipment that a company uses in its operations and are not intended for sale. Current assets include cash, inventory, and accounts receivable, which are expected to be converted into cash or used up within a year. Proper classification between fixed and current assets is crucial for accurate financial reporting and effective asset management.

Table of Comparison

| Aspect | Fixed Assets | Current Assets |

|---|---|---|

| Definition | Long-term tangible assets used in operations | Short-term assets convertible to cash within one year |

| Examples | Buildings, machinery, vehicles | Cash, inventory, accounts receivable |

| Usage Duration | More than one year | Less than one year |

| Liquidity | Low liquidity | High liquidity |

| Accounting Treatment | Depreciated over useful life | Not depreciated |

| Purpose | Business operations and production | Day-to-day business activities |

Understanding Fixed Assets in Bookkeeping

Fixed assets in bookkeeping represent long-term tangible items such as buildings, machinery, and equipment that a company uses to generate revenue over several years. These assets are recorded on the balance sheet at their original cost minus accumulated depreciation, reflecting their usage and wear over time. Understanding fixed assets is essential for accurate financial reporting and ensures proper asset management and depreciation tracking within accounting practices.

What Are Current Assets? A Bookkeeper’s Guide

Current assets are short-term resources owned by a business, including cash, accounts receivable, inventory, and marketable securities, that are expected to be converted into cash within one fiscal year. These assets play a crucial role in maintaining liquidity and day-to-day operations, enabling a company to meet its short-term obligations. Bookkeepers meticulously track current assets to ensure accurate financial reporting and effective cash flow management.

Key Differences Between Fixed Assets and Current Assets

Fixed assets are long-term tangible assets such as buildings, machinery, and equipment used for operations and are not expected to be converted into cash within a year. Current assets include cash, inventory, accounts receivable, and other assets likely to be converted to cash or used up within one fiscal year. The key differences lie in liquidity, usage duration, and purpose within the business's accounting cycle.

Importance of Asset Classification in Financial Statements

Accurate classification of fixed assets and current assets is crucial for financial statements, ensuring clear representation of a company's financial health and liquidity. Fixed assets provide long-term value and depreciation details, while current assets reflect short-term resources available for operational needs. Proper asset classification enhances decision-making, investor confidence, and compliance with accounting standards such as GAAP or IFRS.

Examples of Fixed Assets in Business Bookkeeping

Examples of fixed assets in business bookkeeping include property, plant, and equipment such as buildings, machinery, and vehicles used in operations. These long-term assets provide value over multiple accounting periods and are recorded on the balance sheet at historical cost minus accumulated depreciation. Proper classification and tracking of fixed assets ensure accurate financial reporting and compliance with accounting standards.

Types of Current Assets Managed by Bookkeepers

Bookkeepers manage various types of current assets including cash and cash equivalents, accounts receivable, inventory, and prepaid expenses to ensure accurate financial reporting and liquidity tracking. Proper classification of these assets enables timely monitoring of short-term financial health and supports effective cash flow management. Maintaining detailed records of current assets facilitates compliance with accounting standards and enhances decision-making for operational activities.

Depreciation and Amortization of Fixed Assets

Fixed assets, such as machinery, buildings, and equipment, undergo depreciation to allocate their cost over their useful life, reflecting wear and tear on the balance sheet. Current assets, including cash, inventory, and accounts receivable, are not subject to depreciation because they are expected to be converted to cash or used within one year. Amortization applies to intangible fixed assets like patents and trademarks, systematically reducing their book value over time in line with their limited economic lifespan.

Liquidity: Why Current Assets Matter in Bookkeeping

Current assets are crucial in bookkeeping because they represent a company's most liquid resources, including cash, accounts receivable, and inventory, which can be quickly converted to cash within a fiscal year. Fixed assets like property and equipment provide long-term value but lack liquidity, making current assets essential for meeting short-term financial obligations and maintaining operational stability. Properly managing current assets ensures accurate cash flow forecasting and effective working capital management in financial reporting.

How Asset Classification Impacts Business Decision Making

Asset classification into fixed assets, such as machinery and buildings, and current assets, like inventory and cash, directly influences business decision making by determining liquidity and long-term investment strategies. Proper categorization enables accurate financial analysis, guiding decisions on capital allocation, operational efficiency, and risk management. Understanding the distinct characteristics of fixed and current assets helps businesses optimize resource utilization and plan for sustainable growth.

Best Practices for Tracking Fixed and Current Assets

Implement asset management software to accurately track fixed assets such as machinery, vehicles, and buildings, ensuring depreciation schedules are properly maintained for financial reporting. Regularly update inventory records for current assets like cash, accounts receivable, and inventory to optimize liquidity management and prevent stock discrepancies. Implement standardized procedures for asset tagging, periodic audits, and reconciliation to enhance accuracy and compliance in bookkeeping practices.

Fixed Assets vs Current Assets Infographic

bizdif.com

bizdif.com