Manual bookkeeping involves recording financial transactions by hand, which can lead to increased errors and time consumption compared to computerized bookkeeping. Computerized bookkeeping uses software to automate calculations, improve accuracy, and generate real-time financial reports, enhancing efficiency and decision-making. While manual bookkeeping offers simplicity for small-scale records, computerized systems scale better for growing businesses needing detailed financial analysis.

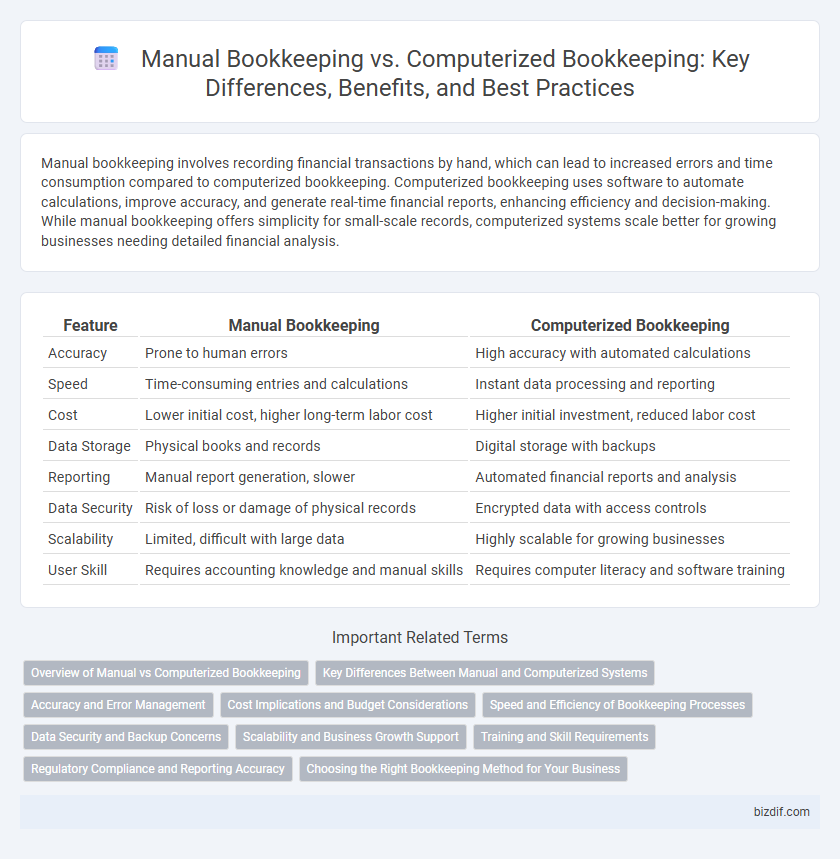

Table of Comparison

| Feature | Manual Bookkeeping | Computerized Bookkeeping |

|---|---|---|

| Accuracy | Prone to human errors | High accuracy with automated calculations |

| Speed | Time-consuming entries and calculations | Instant data processing and reporting |

| Cost | Lower initial cost, higher long-term labor cost | Higher initial investment, reduced labor cost |

| Data Storage | Physical books and records | Digital storage with backups |

| Reporting | Manual report generation, slower | Automated financial reports and analysis |

| Data Security | Risk of loss or damage of physical records | Encrypted data with access controls |

| Scalability | Limited, difficult with large data | Highly scalable for growing businesses |

| User Skill | Requires accounting knowledge and manual skills | Requires computer literacy and software training |

Overview of Manual vs Computerized Bookkeeping

Manual bookkeeping involves recording financial transactions by hand in physical ledgers, providing a tangible method that requires meticulous attention to detail but is prone to human error and time-consuming processes. Computerized bookkeeping utilizes specialized accounting software to automate data entry, improve accuracy, and expedite financial reporting with integrated tools for real-time analysis and data backup. The choice between manual and computerized bookkeeping depends on business size, complexity, and the need for efficiency, accuracy, and scalability.

Key Differences Between Manual and Computerized Systems

Manual bookkeeping relies on physical ledgers and handwritten entries, making it prone to human errors and time-consuming reconciliations, whereas computerized bookkeeping uses accounting software for automated data entry and error detection, enhancing accuracy and efficiency. Manual systems provide limited reporting capabilities and slower data retrieval, while computerized systems offer real-time financial reports, easy data access, and integration with other business tools. Security measures in computerized bookkeeping are more robust, including encryption and user access controls, compared to the physical vulnerability of manual records.

Accuracy and Error Management

Manual bookkeeping relies heavily on human input, which increases the risk of errors such as miscalculations or data entry mistakes, making error detection time-consuming. Computerized bookkeeping systems utilize automated calculations and real-time error checking, significantly enhancing accuracy by minimizing human error. The integration of software tools enables efficient error management through instant alerts and audit trails, improving overall financial data reliability.

Cost Implications and Budget Considerations

Manual bookkeeping involves lower initial costs due to minimal technology requirements but demands higher ongoing labor expenses and increased likelihood of human error, which can lead to costly corrections. Computerized bookkeeping requires upfront investment in software and hardware but enhances accuracy, reduces labor hours, and improves scalability, offering better long-term cost efficiency. Businesses should evaluate their budget constraints and volume of transactions to determine the most cost-effective bookkeeping method.

Speed and Efficiency of Bookkeeping Processes

Manual bookkeeping relies on physical ledgers and handwritten entries, significantly slowing down the recording and retrieval of financial data compared to computerized systems. Computerized bookkeeping leverages accounting software like QuickBooks and Xero, enabling instant calculations, automatic error detection, and faster generation of financial reports. Businesses adopting computerized bookkeeping experience increased efficiency, reduced human error, and streamlined workflow in managing invoices, payroll, and tax preparation.

Data Security and Backup Concerns

Manual bookkeeping involves physical records that are vulnerable to loss, damage, or unauthorized access, making data security a significant concern. Computerized bookkeeping systems offer robust encryption and automated backup solutions, enhancing data protection and recovery options. Cloud-based accounting software further safeguards financial data by enabling real-time backup and secure remote access.

Scalability and Business Growth Support

Manual bookkeeping limits scalability due to time-consuming data entry and increased error risks, hindering efficient handling of growing transaction volumes. Computerized bookkeeping systems offer automated processes, real-time data access, and seamless integration with other business tools, enabling faster financial analysis and decision-making. These digital solutions support business growth by adapting to increasing records, reducing operational costs, and enhancing accuracy.

Training and Skill Requirements

Manual bookkeeping demands a deep understanding of accounting principles and meticulous attention to detail, requiring extensive training in ledger management and error detection. Computerized bookkeeping, however, necessitates proficiency with accounting software such as QuickBooks or Xero, emphasizing digital literacy and technical skills over traditional calculation techniques. Training in computerized systems often includes learning automated data entry, reconciliation processes, and software-specific reporting functions, reducing manual errors and accelerating workflow.

Regulatory Compliance and Reporting Accuracy

Manual bookkeeping often faces challenges in maintaining regulatory compliance due to increased risks of human error and inconsistent data entry, impacting reporting accuracy. Computerized bookkeeping systems enhance regulatory compliance by automating data validation and generating standardized reports that align with legal requirements. Accurate financial reporting is substantially improved through real-time data processing and audit trail features inherent in computerized bookkeeping solutions.

Choosing the Right Bookkeeping Method for Your Business

Selecting the right bookkeeping method depends on your business size, complexity, and budget. Manual bookkeeping offers control and simplicity for small businesses with limited transactions, while computerized bookkeeping provides efficiency, accuracy, and scalability for growing enterprises. Consider factors such as transaction volume, reporting needs, and software costs to determine the most effective system for your financial management.

Manual Bookkeeping vs Computerized Bookkeeping Infographic

bizdif.com

bizdif.com