Bank feed integration automates transaction imports directly from financial institutions, reducing errors and saving time compared to manual bank entry. Manual bank entry requires inputting data by hand, increasing the risk of mistakes and consuming more time. Businesses benefit from bank feed integration by enhancing accuracy and streamlining bookkeeping processes.

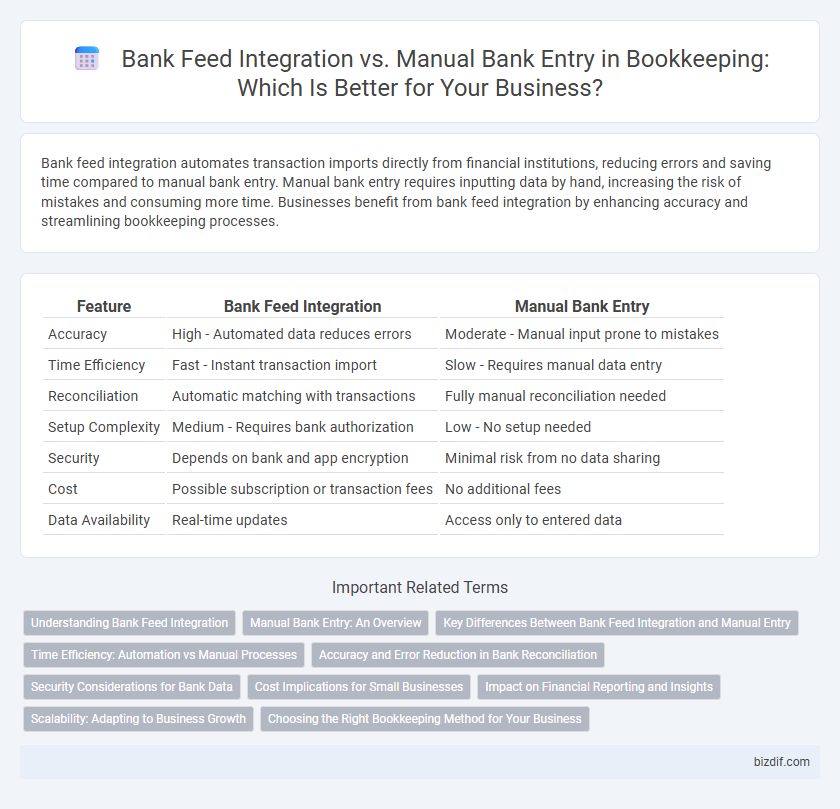

Table of Comparison

| Feature | Bank Feed Integration | Manual Bank Entry |

|---|---|---|

| Accuracy | High - Automated data reduces errors | Moderate - Manual input prone to mistakes |

| Time Efficiency | Fast - Instant transaction import | Slow - Requires manual data entry |

| Reconciliation | Automatic matching with transactions | Fully manual reconciliation needed |

| Setup Complexity | Medium - Requires bank authorization | Low - No setup needed |

| Security | Depends on bank and app encryption | Minimal risk from no data sharing |

| Cost | Possible subscription or transaction fees | No additional fees |

| Data Availability | Real-time updates | Access only to entered data |

Understanding Bank Feed Integration

Bank feed integration automates the import of transaction data directly from financial institutions into bookkeeping software, reducing errors and saving time compared to manual bank entry. This seamless connection ensures real-time updates, enabling accurate cash flow tracking and faster reconciliation processes. By leveraging bank feed integration, businesses enhance data accuracy and financial visibility while minimizing manual input efforts.

Manual Bank Entry: An Overview

Manual bank entry involves recording financial transactions directly from bank statements into bookkeeping software without automated data import. This process provides greater control over data accuracy but requires more time and attention to detail compared to bank feed integration. Businesses with low transaction volumes or specific reconciliation needs often prefer manual bank entry for its precision and customization.

Key Differences Between Bank Feed Integration and Manual Entry

Bank feed integration automates transaction syncing by connecting accounting software directly to bank accounts, significantly reducing errors and saving time compared to manual bank entry. Manual bank entry requires users to input each transaction individually, increasing the risk of data inaccuracies and consuming more labor hours. Bank feed integration supports real-time updates and streamlined reconciliation, whereas manual entries often delay data availability and complicate financial reporting.

Time Efficiency: Automation vs Manual Processes

Bank feed integration streamlines bookkeeping by automatically importing and categorizing transactions, significantly reducing the time spent on manual data entry. Manual bank entry requires frequent, detailed input and cross-referencing, increasing the risk of errors and time consumption. Leveraging automation enhances time efficiency and accuracy, allowing businesses to focus on financial analysis and decision-making.

Accuracy and Error Reduction in Bank Reconciliation

Bank feed integration automates the import of transaction data directly from financial institutions, significantly enhancing accuracy by eliminating manual data entry errors in bank reconciliation. Manual bank entry often leads to discrepancies due to human mistakes such as typos or missed transactions, which can prolong reconciliation and increase the risk of inaccuracies. Utilizing bank feed integration ensures real-time transaction updates and consistent data alignment, substantially reducing errors and improving the overall reliability of financial records.

Security Considerations for Bank Data

Bank feed integration enhances security by encrypting data transfers directly between banks and accounting software, minimizing the risk of human error and unauthorized access compared to manual bank entry. Manual entry involves handling sensitive bank data manually, increasing the chances of data breaches through phishing or input mistakes. Businesses prioritizing security typically prefer bank feed integration for its automated, secure protocols and real-time monitoring capabilities.

Cost Implications for Small Businesses

Bank feed integration automates transaction imports directly from financial institutions, reducing the time and labor costs associated with manual data entry for small businesses. Manual bank entry requires extensive manual labor, increasing the risk of errors and often resulting in higher bookkeeping expenses due to additional reconciliation efforts. Small businesses benefit from bank feed integration through lower operational costs, improved accuracy, and streamlined cash flow management.

Impact on Financial Reporting and Insights

Bank feed integration automates transaction imports, providing real-time data accuracy that enhances the reliability of financial reporting and enables timely business insights. Manual bank entry increases the risk of errors and delays, potentially leading to outdated or inaccurate financial statements, which can impair decision-making. Automated bank feeds streamline reconciliation processes and improve cash flow visibility, directly impacting the quality of financial analysis.

Scalability: Adapting to Business Growth

Bank feed integration enables seamless synchronization of transactions directly from financial institutions, facilitating faster reconciliation and reducing manual errors critical for scaling businesses. Manual bank entry requires increased time and resources as transaction volumes grow, limiting efficiency and increasing the risk of inaccuracies during periods of rapid expansion. Automated bank feeds support scalable bookkeeping by accommodating higher transaction volumes without proportional increases in administrative workload, making them essential for growing enterprises.

Choosing the Right Bookkeeping Method for Your Business

Bank feed integration automates transaction imports directly from financial institutions, reducing errors and saving time compared to manual bank entry, which requires manually inputting each transaction. For businesses with high transaction volumes or multiple accounts, bank feed integration ensures real-time accuracy and improved cash flow management. Small businesses with fewer transactions may benefit from manual entry due to lower costs and simpler setup.

Bank Feed Integration vs Manual Bank Entry Infographic

bizdif.com

bizdif.com