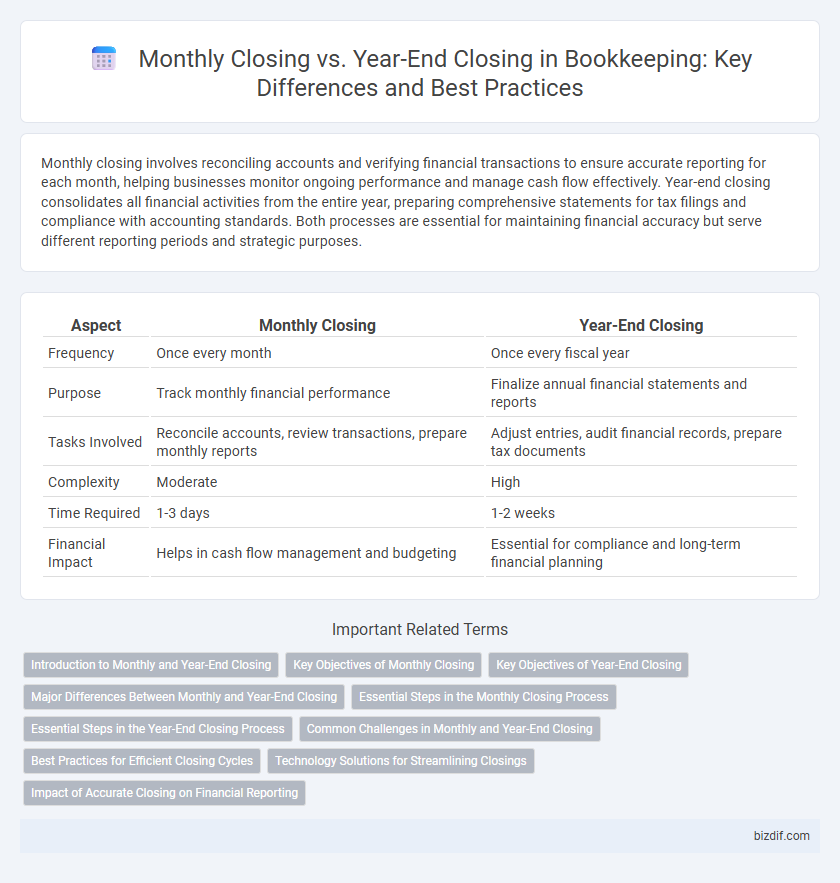

Monthly closing involves reconciling accounts and verifying financial transactions to ensure accurate reporting for each month, helping businesses monitor ongoing performance and manage cash flow effectively. Year-end closing consolidates all financial activities from the entire year, preparing comprehensive statements for tax filings and compliance with accounting standards. Both processes are essential for maintaining financial accuracy but serve different reporting periods and strategic purposes.

Table of Comparison

| Aspect | Monthly Closing | Year-End Closing |

|---|---|---|

| Frequency | Once every month | Once every fiscal year |

| Purpose | Track monthly financial performance | Finalize annual financial statements and reports |

| Tasks Involved | Reconcile accounts, review transactions, prepare monthly reports | Adjust entries, audit financial records, prepare tax documents |

| Complexity | Moderate | High |

| Time Required | 1-3 days | 1-2 weeks |

| Financial Impact | Helps in cash flow management and budgeting | Essential for compliance and long-term financial planning |

Introduction to Monthly and Year-End Closing

Monthly closing involves systematically reconciling accounts, verifying transactions, and preparing financial statements to ensure accurate and up-to-date records for each fiscal month. Year-end closing requires a comprehensive review of all financial activities, adjusting entries, and finalizing reports to comply with accounting standards and prepare for audits. Both processes are essential for maintaining financial integrity, supporting decision-making, and ensuring regulatory compliance throughout the fiscal year.

Key Objectives of Monthly Closing

Monthly closing focuses on accurately recording all financial transactions within the month to ensure up-to-date financial statements and effective cash flow management. It aims to identify discrepancies early by reconciling accounts, reviewing expenses, and confirming revenue recognition. These timely processes support informed decision-making and streamline the year-end closing procedure.

Key Objectives of Year-End Closing

Year-end closing in bookkeeping focuses on finalizing all financial transactions to ensure accurate annual financial statements, complying with tax regulations, and preparing for audits. It involves reconciling accounts, adjusting entries, and reviewing depreciation and inventory valuations to reflect true financial health. Completing these tasks provides a clear foundation for strategic planning and regulatory reporting in the new fiscal year.

Major Differences Between Monthly and Year-End Closing

Monthly closing involves reconciling accounts, verifying transactions, and preparing financial statements to provide timely insights into business performance. Year-end closing requires comprehensive account reviews, adjustments for tax compliance, depreciation, accruals, and preparation for audited financial statements. The major differences lie in the scope and detail: monthly closing emphasizes operational accuracy and regular reporting, while year-end closing focuses on regulatory compliance, complete financial consolidation, and resetting accounts for the new fiscal year.

Essential Steps in the Monthly Closing Process

Monthly closing in bookkeeping involves reconciling bank statements, verifying account balances, and recording all financial transactions accurately to ensure data integrity. Essential steps include reviewing and adjusting journal entries, accruing expenses, and reconciling accounts receivable and payable. Timely completion of these tasks supports accurate financial reporting and smooth year-end closing processes.

Essential Steps in the Year-End Closing Process

Year-end closing involves crucial steps such as reconciling all accounts, verifying accuracy of financial statements, and ensuring compliance with tax regulations. It requires reviewing and adjusting journal entries, confirming fixed asset inventories, and calculating depreciation accurately. Proper documentation and finalizing audit reports are essential to provide a clear financial picture for stakeholders and regulatory authorities.

Common Challenges in Monthly and Year-End Closing

Monthly closing often faces challenges such as incomplete transaction entries, reconciliation discrepancies, and time constraints that impact accuracy. Year-end closing intensifies these issues with additional complexities like comprehensive financial statement preparation, tax compliance, and audit readiness. Both processes demand meticulous attention to detail and effective coordination across accounting teams to ensure financial integrity and regulatory adherence.

Best Practices for Efficient Closing Cycles

Monthly closing involves reconciling accounts, reviewing financial statements, and ensuring accuracy to provide timely insights for decision-making, while year-end closing requires comprehensive adjustments, audit preparation, and finalizing tax reports. Implementing standardized checklists, automating routine tasks, and maintaining clear communication between departments enhance accuracy and reduce the time required for both closing processes. Leveraging accounting software with workflow management features significantly improves the efficiency of monthly and year-end closings by minimizing errors and streamlining data consolidation.

Technology Solutions for Streamlining Closings

Technology solutions like cloud-based accounting software and automated reconciliation tools significantly enhance the efficiency of monthly closing by reducing manual data entry and real-time error detection. Year-end closing benefits from advanced analytics platforms that consolidate financial data across periods, ensuring accurate adjustments and compliance with tax regulations. Integration of AI-driven reporting systems accelerates both monthly and year-end processes by providing customizable dashboards and instant financial insights.

Impact of Accurate Closing on Financial Reporting

Accurate monthly closing ensures timely detection of discrepancies, enabling businesses to maintain reliable financial records throughout the fiscal year. Year-end closing consolidates these records, providing a comprehensive and precise overview essential for regulatory compliance and strategic decision-making. Consistent accuracy in both processes significantly enhances the credibility and transparency of financial reporting.

Monthly Closing vs Year-End Closing Infographic

bizdif.com

bizdif.com