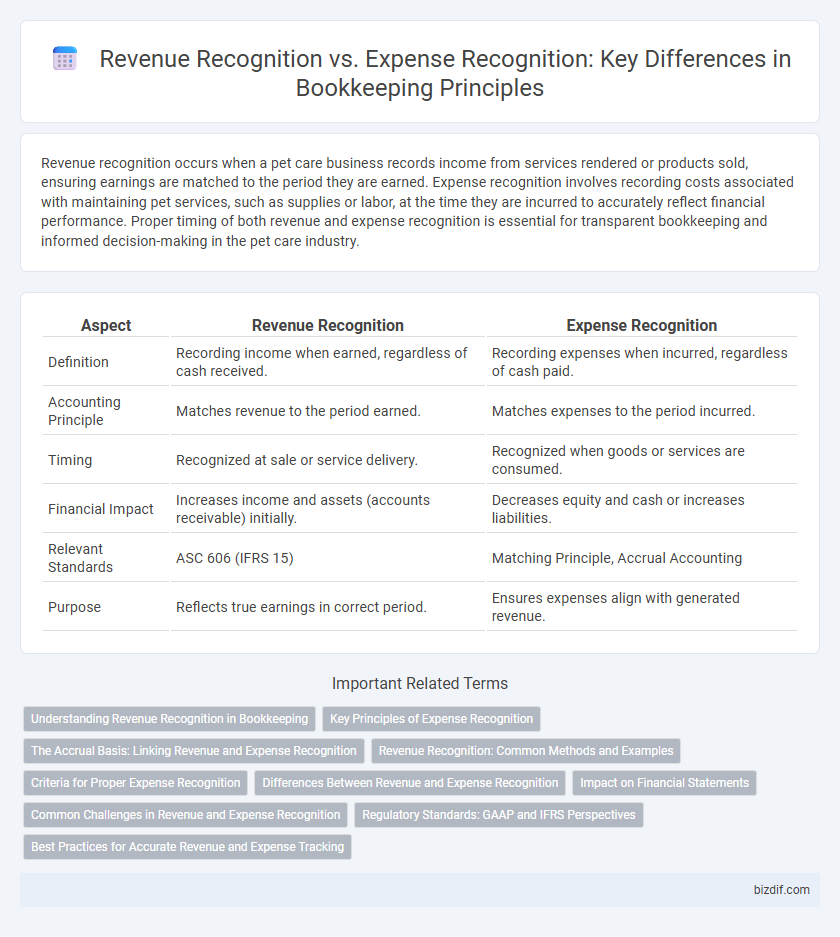

Revenue recognition occurs when a pet care business records income from services rendered or products sold, ensuring earnings are matched to the period they are earned. Expense recognition involves recording costs associated with maintaining pet services, such as supplies or labor, at the time they are incurred to accurately reflect financial performance. Proper timing of both revenue and expense recognition is essential for transparent bookkeeping and informed decision-making in the pet care industry.

Table of Comparison

| Aspect | Revenue Recognition | Expense Recognition |

|---|---|---|

| Definition | Recording income when earned, regardless of cash received. | Recording expenses when incurred, regardless of cash paid. |

| Accounting Principle | Matches revenue to the period earned. | Matches expenses to the period incurred. |

| Timing | Recognized at sale or service delivery. | Recognized when goods or services are consumed. |

| Financial Impact | Increases income and assets (accounts receivable) initially. | Decreases equity and cash or increases liabilities. |

| Relevant Standards | ASC 606 (IFRS 15) | Matching Principle, Accrual Accounting |

| Purpose | Reflects true earnings in correct period. | Ensures expenses align with generated revenue. |

Understanding Revenue Recognition in Bookkeeping

Revenue recognition in bookkeeping involves recording revenue when it is earned and realizable, regardless of when cash is received, ensuring compliance with accounting standards such as GAAP or IFRS. Accurate revenue recognition impacts financial statements by matching income with the period it relates to, providing a clear view of business performance. Understanding revenue recognition principles helps prevent misstated earnings and supports effective financial decision-making.

Key Principles of Expense Recognition

Expense recognition is based on the matching principle, which requires expenses to be recorded in the same period as the related revenues they help generate. Key principles include recognizing expenses when incurred, regardless of cash payment timing, and ensuring accurate allocation to the correct accounting period. This approach ensures financial statements reflect true operational performance and maintain consistency in reporting.

The Accrual Basis: Linking Revenue and Expense Recognition

The accrual basis of accounting aligns revenue recognition with the expenses incurred to generate that revenue, ensuring accurate matching within the same accounting period. Revenue is recorded when earned, regardless of cash receipt, while expenses are recognized when they are incurred, not necessarily when paid. This matching principle enhances financial statement accuracy by linking revenues to their directly related expenses, providing a clear view of a company's profitability.

Revenue Recognition: Common Methods and Examples

Revenue recognition involves recording income when it is earned, following specific criteria outlined by accounting standards such as GAAP and IFRS. Common methods include the completed-contract method for long-term projects, percentage-of-completion method for ongoing services, and point-of-sale recognition typical in retail transactions. Examples of revenue recognition practices are recognizing subscription fees over the service period and recording sales revenue at the time of product delivery.

Criteria for Proper Expense Recognition

Proper expense recognition requires that expenses be recorded when they are incurred and matched with the related revenues in the same accounting period, adhering to the matching principle. Key criteria include ensuring that the expense has been realized or incurred, the amount can be reliably measured, and there is a clear cause-and-effect relationship with the recognized revenue. Accurate expense recognition improves financial statement reliability and provides a true representation of profitability during a given period.

Differences Between Revenue and Expense Recognition

Revenue recognition records income when it is earned, regardless of when cash is received, following accrual accounting principles. Expense recognition matches costs to the period when related revenues are incurred, ensuring accurate financial performance measurement. The fundamental difference lies in timing: revenue is recognized upon earning, while expenses are recognized when incurred, aligning financial statements with economic activities.

Impact on Financial Statements

Revenue recognition affects the timing and amount of income reported on the income statement, directly influencing net profit and retained earnings on the balance sheet. Expense recognition determines when costs are recorded, impacting gross profit, operating income, and overall financial performance metrics. Accurate alignment of revenue and expense recognition ensures financial statements reflect a true and fair view of a company's financial health and operational efficiency.

Common Challenges in Revenue and Expense Recognition

Common challenges in revenue and expense recognition include accurately matching revenues and expenses to the correct accounting periods, which ensures compliance with the matching principle and GAAP standards. Businesses often struggle with timing discrepancies due to complex contracts, multi-element arrangements, or variable consideration, leading to potential misstatements in financial reporting. Proper documentation and robust accounting systems are essential to overcome challenges related to subjective judgments and ensure precise revenue and expense recognition.

Regulatory Standards: GAAP and IFRS Perspectives

Revenue recognition under GAAP follows the five-step model outlined in ASC 606, requiring identification of contracts and performance obligations, while IFRS uses IFRS 15 with similar principles but emphasizes more judgment in contract assessment. Expense recognition under GAAP adheres to the matching principle, ensuring expenses are recorded in the same period as related revenues, whereas IFRS provides broader guidance under IAS 1 and IAS 2, focusing on systematic allocation of costs. Both frameworks require transparency and consistency in financial reporting but differ slightly in application and interpretation of transaction timing and recognition criteria.

Best Practices for Accurate Revenue and Expense Tracking

Accurate revenue recognition requires recording income when earned, not when received, following GAAP or IFRS standards to ensure precise financial reporting. Expense recognition should align with the matching principle, recognizing expenses in the same period as related revenues for proper cost matching. Utilizing automated bookkeeping software with real-time data entry enhances accuracy and compliance in revenue and expense tracking.

Revenue Recognition vs Expense Recognition Infographic

bizdif.com

bizdif.com