Depreciation refers to the gradual reduction in the value of tangible assets like equipment and vehicles used in a pet grooming or veterinary business, while amortization applies to intangible assets such as patents or franchise fees. Both methods allocate the cost of an asset over its useful life, impacting the bookkeeping records for pet-related businesses by spreading expenses, aiding in accurate profit calculation and tax reporting. Proper distinction between these concepts ensures precise financial management and compliance in the pet care industry.

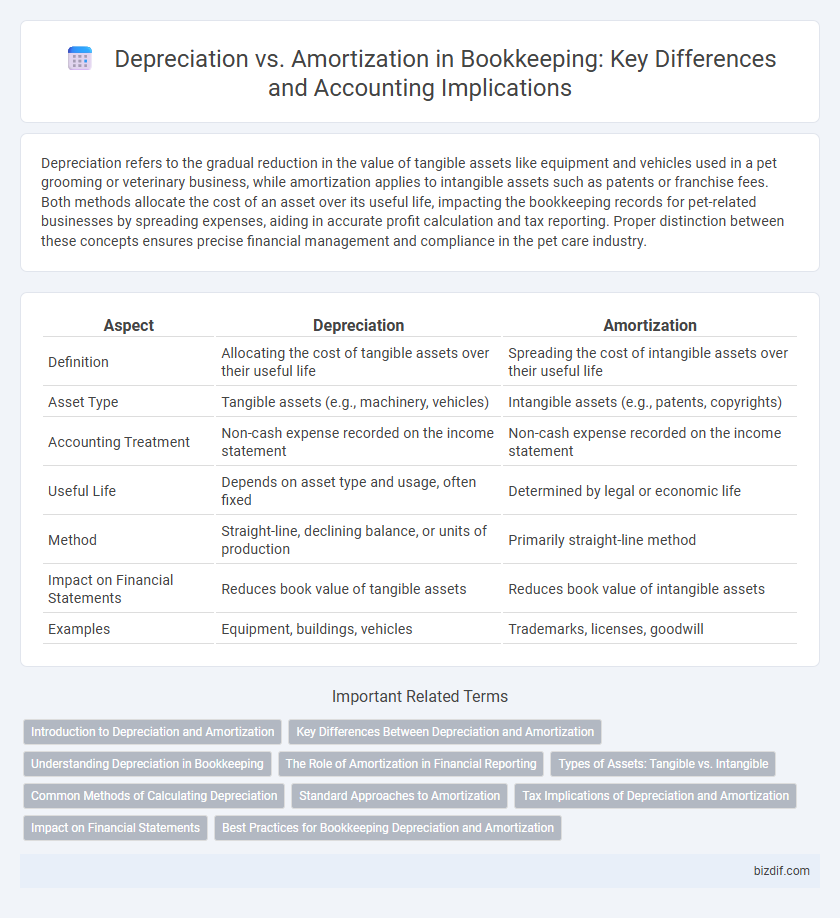

Table of Comparison

| Aspect | Depreciation | Amortization |

|---|---|---|

| Definition | Allocating the cost of tangible assets over their useful life | Spreading the cost of intangible assets over their useful life |

| Asset Type | Tangible assets (e.g., machinery, vehicles) | Intangible assets (e.g., patents, copyrights) |

| Accounting Treatment | Non-cash expense recorded on the income statement | Non-cash expense recorded on the income statement |

| Useful Life | Depends on asset type and usage, often fixed | Determined by legal or economic life |

| Method | Straight-line, declining balance, or units of production | Primarily straight-line method |

| Impact on Financial Statements | Reduces book value of tangible assets | Reduces book value of intangible assets |

| Examples | Equipment, buildings, vehicles | Trademarks, licenses, goodwill |

Introduction to Depreciation and Amortization

Depreciation and amortization are accounting methods that allocate the cost of tangible and intangible assets over their useful lives, respectively. Depreciation applies to physical assets like machinery and buildings, while amortization is used for intangible assets such as patents and trademarks. Understanding these processes helps businesses accurately reflect asset value and expenses on financial statements.

Key Differences Between Depreciation and Amortization

Depreciation applies to the allocation of tangible asset costs, such as machinery, vehicles, and buildings, over their useful lives, reflecting wear and tear. Amortization, on the other hand, involves expensing intangible assets like patents, trademarks, and goodwill, systematically spreading their acquisition cost over time. The key difference lies in asset type: depreciation addresses physical assets, while amortization concerns intangible assets, both crucial for accurate financial reporting and tax compliance.

Understanding Depreciation in Bookkeeping

Depreciation in bookkeeping systematically allocates the cost of tangible fixed assets like machinery, vehicles, and buildings over their useful lives, reflecting asset wear and tear or obsolescence. It follows accounting standards such as GAAP or IFRS, using methods like straight-line or declining balance to match expenses with revenue periods accurately. Proper depreciation recording ensures financial statements reflect true asset values and impacts tax calculations by reducing taxable income through expense recognition.

The Role of Amortization in Financial Reporting

Amortization plays a crucial role in financial reporting by systematically allocating the cost of intangible assets, such as patents and trademarks, over their useful lives. This process ensures that expenses are matched with the revenue generated, providing a more accurate representation of a company's financial position. Proper amortization enhances transparency and aids stakeholders in assessing long-term asset value and profitability.

Types of Assets: Tangible vs. Intangible

Depreciation applies to tangible assets like machinery, vehicles, and buildings, spreading their cost over the useful life to reflect wear and tear. Amortization is used for intangible assets such as patents, copyrights, and trademarks, allocating their expense over a fixed period. Understanding the distinction between these methods is essential for accurate financial reporting and asset management in bookkeeping.

Common Methods of Calculating Depreciation

Common methods of calculating depreciation include the straight-line method, which allocates an equal expense amount over an asset's useful life, and the declining balance method, which applies a fixed depreciation rate to the reducing book value each year. The units of production method bases depreciation on actual usage or output, linking expense recognition directly to operational activity. These approaches help businesses accurately match asset costs with revenues, ensuring precise financial reporting and tax compliance.

Standard Approaches to Amortization

Standard approaches to amortization in bookkeeping involve systematically allocating the cost of intangible assets, such as patents and copyrights, over their useful life. This process follows methods like the straight-line approach, where the asset's value is evenly expensed each accounting period, ensuring accurate financial reporting. Unlike depreciation, amortization typically excludes residual value and applies specifically to intangible assets.

Tax Implications of Depreciation and Amortization

Depreciation and amortization both reduce taxable income by spreading asset costs over time, but depreciation applies to tangible assets while amortization applies to intangible assets. Tax regulations often allow accelerated depreciation methods, such as Modified Accelerated Cost Recovery System (MACRS), resulting in higher initial tax deductions compared to amortization, which usually follows a straight-line method over the asset's useful life. Understanding these distinctions helps businesses optimize tax savings and comply with IRS guidelines for asset expense reporting.

Impact on Financial Statements

Depreciation reduces the book value of tangible assets, such as machinery and vehicles, thus decreasing net income and total assets on the balance sheet over time. Amortization applies to intangible assets like patents or goodwill, allocating their cost systematically and impacting net income and intangible asset values similarly. Both methods improve financial accuracy by matching expenses with revenues, enhancing the reliability of financial statements.

Best Practices for Bookkeeping Depreciation and Amortization

Accurate bookkeeping for depreciation and amortization requires categorizing tangible assets under depreciation and intangible assets under amortization to ensure compliance with accounting standards. Maintaining detailed records of asset acquisition costs, useful life estimates, and residual values supports precise periodic expense calculations. Consistently applying appropriate methods, such as straight-line or declining balance, enhances financial reporting accuracy and asset management efficiency.

Depreciation vs Amortization Infographic

bizdif.com

bizdif.com