Deferred revenue represents payments received in advance for goods or services yet to be delivered, recording a liability until fulfillment occurs. Accrued revenue, on the other hand, represents revenue earned but not yet received or recorded, reflecting an asset on the balance sheet. Understanding the distinction between deferred and accrued revenue is crucial for accurate financial reporting and compliance with revenue recognition principles.

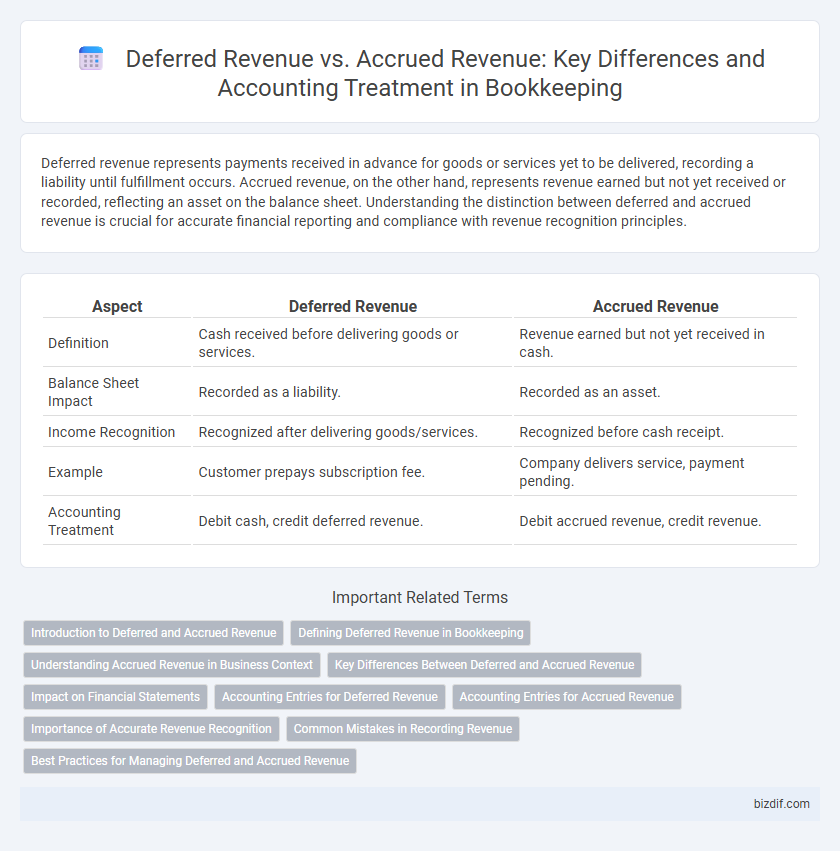

Table of Comparison

| Aspect | Deferred Revenue | Accrued Revenue |

|---|---|---|

| Definition | Cash received before delivering goods or services. | Revenue earned but not yet received in cash. |

| Balance Sheet Impact | Recorded as a liability. | Recorded as an asset. |

| Income Recognition | Recognized after delivering goods/services. | Recognized before cash receipt. |

| Example | Customer prepays subscription fee. | Company delivers service, payment pending. |

| Accounting Treatment | Debit cash, credit deferred revenue. | Debit accrued revenue, credit revenue. |

Introduction to Deferred and Accrued Revenue

Deferred revenue represents payments received by a business for goods or services yet to be delivered, creating a liability on the balance sheet until the revenue is earned. Accrued revenue, conversely, refers to income that has been earned but not yet invoiced or received, reflecting an asset as accounts receivable. Understanding these key revenue recognition concepts ensures accurate financial reporting and compliance with accounting standards.

Defining Deferred Revenue in Bookkeeping

Deferred revenue in bookkeeping represents payments received by a business for goods or services not yet delivered or performed, creating a liability on the balance sheet. This revenue is recorded as a liability until the company fulfills its obligation, at which point it is recognized as earned revenue. Proper management of deferred revenue ensures accurate financial reporting and compliance with revenue recognition principles under accounting standards like GAAP and IFRS.

Understanding Accrued Revenue in Business Context

Accrued revenue represents income earned by a business for goods or services delivered but not yet invoiced or received in cash, reflecting increased accounts receivable. This revenue recognition aligns with the accrual accounting principle where revenue is recorded when earned, not when payment is received. Accrued revenue improves financial accuracy, enabling businesses to better track earned income and predict future cash flows.

Key Differences Between Deferred and Accrued Revenue

Deferred revenue represents cash received in advance for goods or services yet to be delivered, classified as a liability on the balance sheet. Accrued revenue, however, refers to earnings recognized when goods or services are delivered but payment is not yet received, recorded as a receivable. The key difference lies in timing: deferred revenue involves cash first with future delivery obligations, while accrued revenue entails earned revenue awaiting cash collection.

Impact on Financial Statements

Deferred revenue appears as a liability on the balance sheet until the goods or services are delivered, which postpones revenue recognition and affects the timing of income statement reporting. Accrued revenue is recorded as an asset (accounts receivable) on the balance sheet and reflects earned revenue not yet received, impacting the income statement by increasing reported revenue in the current period. Properly distinguishing deferred revenue from accrued revenue ensures accurate matching of revenues and expenses, enhancing financial statement reliability and compliance with accrual accounting principles.

Accounting Entries for Deferred Revenue

Deferred revenue involves cash received before goods or services are delivered, recorded as a liability on the balance sheet. The accounting entry debits cash or bank and credits deferred revenue, reflecting the obligation to provide future services or products. Once earned, deferred revenue is recognized as revenue by debiting deferred revenue and crediting sales or service revenue accounts.

Accounting Entries for Accrued Revenue

Accrued revenue accounting entries involve debiting accrued revenue (an asset account) and crediting revenue to recognize income earned but not yet received in cash, ensuring compliance with the revenue recognition principle. These entries increase accounts receivable, reflecting the company's right to receive payment for goods or services delivered. Accurate recording of accrued revenue improves financial statement accuracy and provides a clear picture of earned income before cash collection.

Importance of Accurate Revenue Recognition

Accurate revenue recognition ensures that deferred revenue and accrued revenue are recorded in the correct accounting periods, providing a true financial position of the business. Misstating deferred revenue can overstate liabilities, while improper accruals may distort income, impacting financial statements and tax obligations. Precise handling of these revenue types supports compliance with GAAP and enhances decision-making for stakeholders.

Common Mistakes in Recording Revenue

Common mistakes in recording deferred revenue include recognizing it prematurely before the service is delivered or the product is shipped, leading to overstated income. Inaccurate timing of accrued revenue recognition occurs when revenue is recorded without sufficient evidence that the earning process is substantially complete, causing misstated earnings. Failure to distinguish these types of revenue can result in distorted financial statements and non-compliance with GAAP or IFRS standards.

Best Practices for Managing Deferred and Accrued Revenue

Effective management of deferred and accrued revenue requires precise tracking of payment timings and service delivery to ensure accurate financial reporting and compliance with accounting standards like GAAP or IFRS. Implementing automated accounting software facilitates real-time recognition of revenue by matching cash received with earned income, reducing errors in revenue recognition. Regular reconciliation and clear documentation of deferred revenue liabilities and accrued revenue assets enhance transparency and support informed decision-making during audits.

Deferred Revenue vs Accrued Revenue Infographic

bizdif.com

bizdif.com