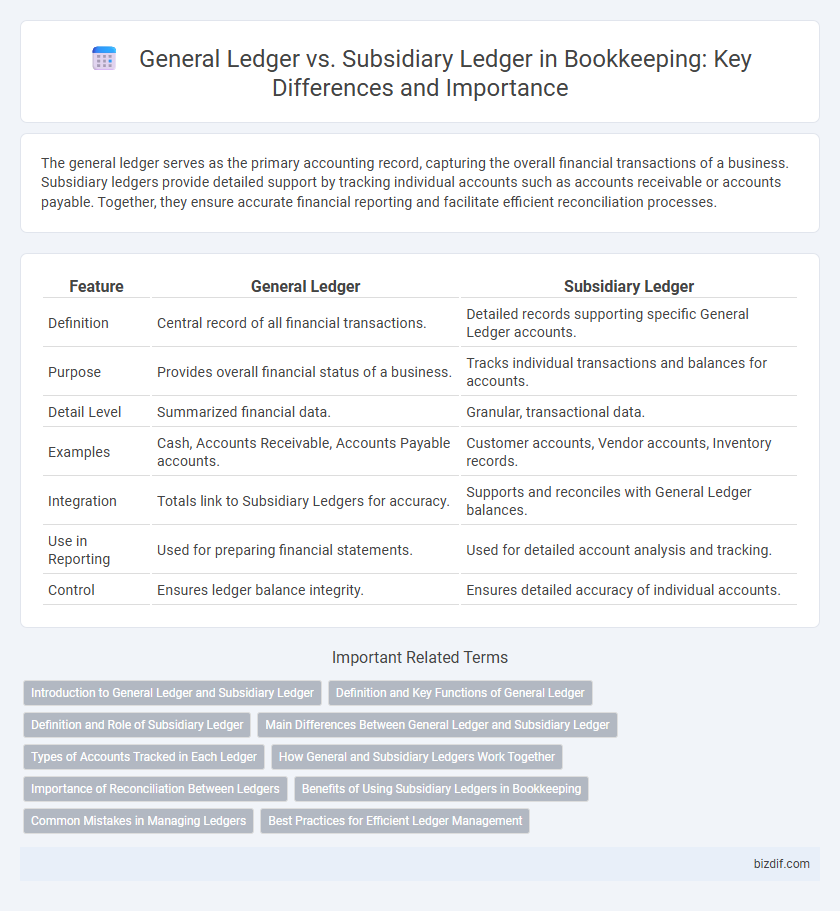

The general ledger serves as the primary accounting record, capturing the overall financial transactions of a business. Subsidiary ledgers provide detailed support by tracking individual accounts such as accounts receivable or accounts payable. Together, they ensure accurate financial reporting and facilitate efficient reconciliation processes.

Table of Comparison

| Feature | General Ledger | Subsidiary Ledger |

|---|---|---|

| Definition | Central record of all financial transactions. | Detailed records supporting specific General Ledger accounts. |

| Purpose | Provides overall financial status of a business. | Tracks individual transactions and balances for accounts. |

| Detail Level | Summarized financial data. | Granular, transactional data. |

| Examples | Cash, Accounts Receivable, Accounts Payable accounts. | Customer accounts, Vendor accounts, Inventory records. |

| Integration | Totals link to Subsidiary Ledgers for accuracy. | Supports and reconciles with General Ledger balances. |

| Use in Reporting | Used for preparing financial statements. | Used for detailed account analysis and tracking. |

| Control | Ensures ledger balance integrity. | Ensures detailed accuracy of individual accounts. |

Introduction to General Ledger and Subsidiary Ledger

The General Ledger serves as the primary accounting record, consolidating all financial transactions into comprehensive accounts such as assets, liabilities, equity, revenues, and expenses. Subsidiary Ledgers provide detailed information supporting specific General Ledger accounts, like accounts receivable or accounts payable, enabling granular tracking of individual transactions or customer balances. Together, these ledgers ensure accurate financial reporting and efficient transaction management by linking summary-level data with itemized details.

Definition and Key Functions of General Ledger

The General Ledger is a central accounting record that aggregates all financial transactions for a company, serving as the main source for preparing financial statements. It summarizes data from subsidiary ledgers, which provide detailed information on specific accounts like accounts receivable or payable. Key functions of the General Ledger include ensuring accuracy in financial reporting, maintaining account balances, and facilitating the trial balance process.

Definition and Role of Subsidiary Ledger

A subsidiary ledger is a detailed subset of accounts that supports the general ledger by breaking down individual transactions for specific accounts such as accounts receivable, accounts payable, or inventory. It enables precise tracking and management of financial data at a granular level, improving accuracy and aiding in reconciliation processes. By maintaining detailed records in subsidiary ledgers, businesses streamline financial reporting and ensure the integrity of the summarized information presented in the general ledger.

Main Differences Between General Ledger and Subsidiary Ledger

The general ledger serves as the central repository for all financial transactions, consolidating data across accounts, whereas subsidiary ledgers provide detailed information on specific accounts such as accounts receivable or accounts payable. The main difference lies in their scope: the general ledger offers a comprehensive overview, while subsidiary ledgers focus on granular details to support accuracy and reconciliation. Subsidiary ledgers enhance the general ledger by breaking down summary totals into individual transaction records, facilitating better tracking and error detection.

Types of Accounts Tracked in Each Ledger

The general ledger tracks all primary accounts including assets, liabilities, equity, revenue, and expenses, providing a comprehensive overview of a company's financial status. Subsidiary ledgers focus on detailed transactions within specific account categories such as accounts receivable, accounts payable, or inventory, offering granular insight into individual components. This differentiation ensures accurate reconciliation and reporting by linking detailed subsidiary records to their corresponding control accounts in the general ledger.

How General and Subsidiary Ledgers Work Together

The General Ledger serves as the primary record of all financial transactions, while Subsidiary Ledgers provide detailed information supporting specific accounts within the General Ledger. Transactions recorded in Subsidiary Ledgers are periodically summarized and posted to the General Ledger to ensure accuracy and completeness. This coordinated process enhances financial reporting precision and aids in tracking individual account activities effectively.

Importance of Reconciliation Between Ledgers

Reconciliation between the general ledger and subsidiary ledger is crucial for ensuring accurate financial records and detecting discrepancies early. It helps maintain consistency by verifying that individual account details in subsidiary ledgers align with the control totals in the general ledger. Regular reconciliation enhances the reliability of financial statements and supports effective internal controls in bookkeeping.

Benefits of Using Subsidiary Ledgers in Bookkeeping

Subsidiary ledgers enhance bookkeeping accuracy by breaking down detailed transactions for individual accounts, reducing errors in the general ledger. They improve financial reporting by providing clear, organized data that simplifies audit processes and reconciliations. Using subsidiary ledgers also increases efficiency in managing high-volume accounts like accounts receivable or payable, enabling faster access to specific transaction details.

Common Mistakes in Managing Ledgers

Common mistakes in managing general ledgers and subsidiary ledgers include improper reconciliation, leading to discrepancies in financial records. Failing to maintain detailed entries in subsidiary ledgers can cause inaccuracies in accounts payable or receivable. Overlooking the segregation of duties between the two ledgers often results in errors and potential fraud risks.

Best Practices for Efficient Ledger Management

Maintaining separate General Ledger and Subsidiary Ledger accounts enhances accuracy by ensuring detailed transaction tracking while providing a summarized financial overview. Implementing regular reconciliation between the ledgers helps identify discrepancies early, reducing errors and improving audit readiness. Utilizing accounting software with automated ledger management features streamlines data entry and supports efficient, real-time financial reporting.

General Ledger vs Subsidiary Ledger Infographic

bizdif.com

bizdif.com