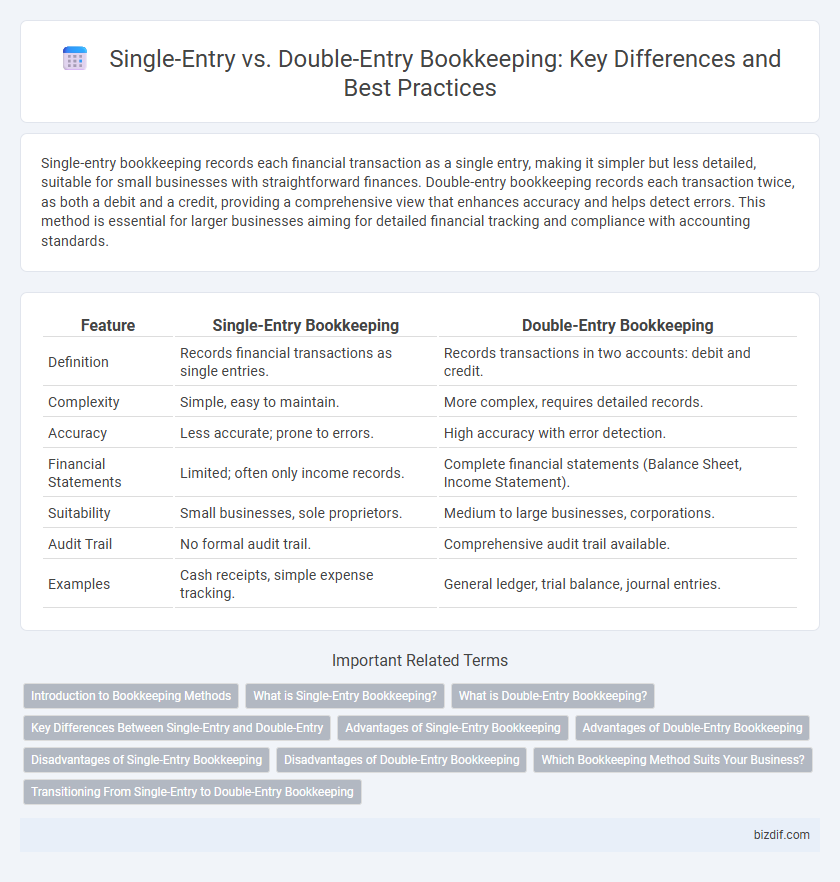

Single-entry bookkeeping records each financial transaction as a single entry, making it simpler but less detailed, suitable for small businesses with straightforward finances. Double-entry bookkeeping records each transaction twice, as both a debit and a credit, providing a comprehensive view that enhances accuracy and helps detect errors. This method is essential for larger businesses aiming for detailed financial tracking and compliance with accounting standards.

Table of Comparison

| Feature | Single-Entry Bookkeeping | Double-Entry Bookkeeping |

|---|---|---|

| Definition | Records financial transactions as single entries. | Records transactions in two accounts: debit and credit. |

| Complexity | Simple, easy to maintain. | More complex, requires detailed records. |

| Accuracy | Less accurate; prone to errors. | High accuracy with error detection. |

| Financial Statements | Limited; often only income records. | Complete financial statements (Balance Sheet, Income Statement). |

| Suitability | Small businesses, sole proprietors. | Medium to large businesses, corporations. |

| Audit Trail | No formal audit trail. | Comprehensive audit trail available. |

| Examples | Cash receipts, simple expense tracking. | General ledger, trial balance, journal entries. |

Introduction to Bookkeeping Methods

Single-entry bookkeeping records each financial transaction once, typically in a cash book, making it simple but less comprehensive for tracking assets and liabilities. Double-entry bookkeeping involves recording every transaction in at least two accounts, with debits and credits maintaining accounting equation balance and enhancing accuracy. This method provides a complete financial view, supports error detection, and is essential for producing financial statements compliant with accounting standards.

What is Single-Entry Bookkeeping?

Single-entry bookkeeping is a simplified accounting method where each financial transaction is recorded only once as either income or expense, similar to maintaining a checkbook. This system is primarily used by small businesses or sole proprietors with straightforward financial activities, lacking the complexity of tracking assets and liabilities. While easy to maintain, single-entry bookkeeping does not provide a complete financial picture or error-detection like double-entry bookkeeping does.

What is Double-Entry Bookkeeping?

Double-entry bookkeeping is an accounting method that records each financial transaction in two accounts, debit and credit, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced. This system provides a comprehensive view of a company's financial health by tracking both the sources and uses of funds, reducing errors and facilitating accurate financial statements. Widely used by businesses for its reliability, double-entry bookkeeping supports complex financial analysis and regulatory compliance.

Key Differences Between Single-Entry and Double-Entry

Single-entry bookkeeping records each financial transaction once, focusing primarily on cash inflows and outflows, making it simpler but less comprehensive. Double-entry bookkeeping requires every transaction to be entered twice, once as a debit and once as a credit, ensuring balanced accounts and greater accuracy. This system provides detailed financial statements and is essential for larger businesses, while single-entry suits small businesses with straightforward transactions.

Advantages of Single-Entry Bookkeeping

Single-entry bookkeeping offers simplicity and ease of use, making it ideal for small businesses with straightforward financial transactions. It requires less time and fewer accounting skills, reducing the need for professional assistance and lowering costs. This method efficiently tracks income and expenses, providing a clear snapshot of cash flow without the complexity of balancing debits and credits.

Advantages of Double-Entry Bookkeeping

Double-entry bookkeeping provides a comprehensive and accurate financial record by recording each transaction in two accounts, ensuring the accounting equation remains balanced. This system enhances error detection, reducing the risk of fraud and financial discrepancies. It also facilitates detailed financial reporting, enabling better decision-making and compliance with accounting standards.

Disadvantages of Single-Entry Bookkeeping

Single-entry bookkeeping often leads to incomplete financial records, increasing the risk of errors and fraud due to the lack of internal checks. It provides limited insight into company assets and liabilities, making it difficult to prepare accurate financial statements or track financial performance comprehensively. This system is less suitable for businesses requiring detailed accountability, complex transaction tracking, or audit readiness.

Disadvantages of Double-Entry Bookkeeping

Double-entry bookkeeping requires more time and expertise due to its complexity compared to single-entry systems. The increased record-keeping demands lead to higher costs for software, training, and potential accounting errors if not properly managed. Small businesses may find the system overwhelming, causing delays in financial reporting and decision-making.

Which Bookkeeping Method Suits Your Business?

Single-entry bookkeeping offers simplicity and is ideal for small businesses with limited transactions, tracking income and expenses through a single ledger. Double-entry bookkeeping provides a comprehensive financial overview by recording each transaction in two accounts, suitable for larger businesses requiring accuracy and detailed financial reporting. Choosing the right method depends on business complexity, financial needs, and regulatory requirements.

Transitioning From Single-Entry to Double-Entry Bookkeeping

Transitioning from single-entry to double-entry bookkeeping enhances financial accuracy by recording each transaction in two accounts, ensuring balanced ledgers. This shift provides comprehensive insights into assets, liabilities, income, and expenses, improving financial reporting and decision-making. Businesses adopting double-entry bookkeeping benefit from reduced errors and better compliance with accounting standards.

Single-Entry vs Double-Entry Infographic

bizdif.com

bizdif.com