Depreciation expense allocates the cost of tangible fixed assets like machinery and equipment over their useful lives, reflecting wear and tear or obsolescence. Amortization expense systematically reduces the value of intangible assets such as patents, trademarks, or goodwill, spreading the cost over their estimated useful life. Both methods ensure accurate matching of expenses to revenues, enhancing financial reporting and asset valuation.

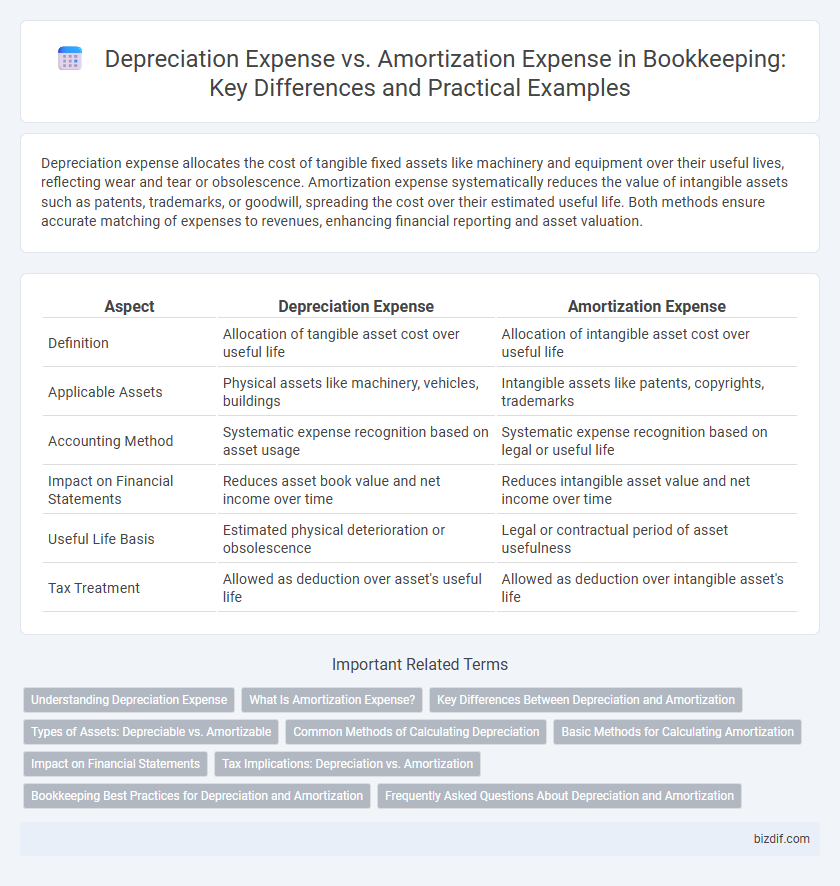

Table of Comparison

| Aspect | Depreciation Expense | Amortization Expense |

|---|---|---|

| Definition | Allocation of tangible asset cost over useful life | Allocation of intangible asset cost over useful life |

| Applicable Assets | Physical assets like machinery, vehicles, buildings | Intangible assets like patents, copyrights, trademarks |

| Accounting Method | Systematic expense recognition based on asset usage | Systematic expense recognition based on legal or useful life |

| Impact on Financial Statements | Reduces asset book value and net income over time | Reduces intangible asset value and net income over time |

| Useful Life Basis | Estimated physical deterioration or obsolescence | Legal or contractual period of asset usefulness |

| Tax Treatment | Allowed as deduction over asset's useful life | Allowed as deduction over intangible asset's life |

Understanding Depreciation Expense

Depreciation expense represents the systematic allocation of the cost of tangible fixed assets, such as machinery, vehicles, and buildings, over their useful lives to reflect wear and tear or obsolescence. This expense is recorded on the income statement to match the asset's cost with the revenue it helps generate, ensuring accurate profit measurement and compliance with accounting standards like GAAP or IFRS. Understanding depreciation methods--such as straight-line or declining balance--is critical for precise financial reporting and tax deduction calculations.

What Is Amortization Expense?

Amortization expense refers to the systematic allocation of the cost of an intangible asset over its useful life, reflecting the gradual consumption of its economic benefits. Unlike depreciation, which applies to tangible fixed assets like machinery or vehicles, amortization targets intangible assets such as patents, trademarks, and copyrights. Tracking amortization expense is essential for accurately representing asset value and expense recognition in financial statements.

Key Differences Between Depreciation and Amortization

Depreciation expense allocates the cost of tangible fixed assets like machinery or buildings over their useful lives, while amortization expense applies to intangible assets such as patents or copyrights. Depreciation typically involves methods like straight-line or declining balance, focusing on physical asset wear and tear, whereas amortization usually uses the straight-line method reflecting intangible asset consumption. The distinction lies in asset type and accounting treatment, crucial for accurate financial reporting and tax compliance.

Types of Assets: Depreciable vs. Amortizable

Depreciation expense applies to tangible fixed assets such as machinery, buildings, and vehicles, reflecting the wear and tear over their useful lives. Amortization expense pertains to intangible assets like patents, copyrights, and trademarks, spreading their cost over the legal or useful life. Understanding the distinction between depreciable (physical) and amortizable (intangible) assets ensures accurate financial reporting and compliance with accounting standards.

Common Methods of Calculating Depreciation

Depreciation expense is commonly calculated using methods such as the straight-line method, declining balance method, and units of production method, each allocating the cost of tangible assets over their useful lives. The straight-line method spreads the expense evenly, while the declining balance accelerates expense recognition, and units of production bases depreciation on actual usage. These approaches help businesses systematically reduce asset value on financial statements, contrasting with amortization expense, which applies to intangible assets.

Basic Methods for Calculating Amortization

Basic methods for calculating amortization include the straight-line method, which allocates equal expense amounts over the asset's useful life, and the declining balance method, which applies a fixed percentage to the asset's remaining book value each period. Unlike depreciation expense that applies to tangible assets, amortization expense pertains to intangible assets such as patents, copyrights, and trademarks. Accurate calculation of amortization expense ensures proper expense recognition and compliance with accounting standards like GAAP or IFRS.

Impact on Financial Statements

Depreciation expense reduces the carrying value of tangible fixed assets on the balance sheet and lowers net income on the income statement over an asset's useful life. Amortization expense similarly decreases the value of intangible assets and impacts net income, reflecting asset consumption or expiration. Both expenses enhance accuracy in financial reporting by systematically allocating asset costs, influencing asset valuation, profitability metrics, and tax obligations.

Tax Implications: Depreciation vs. Amortization

Depreciation expense allows businesses to deduct the cost of tangible assets like machinery and vehicles over their useful lives, reducing taxable income annually. Amortization expense applies to intangible assets such as patents or trademarks, enabling gradual tax deductions based on the asset's amortizable period. Understanding the differences in tax treatment between depreciation and amortization is crucial for optimizing tax liability and maintaining accurate financial records.

Bookkeeping Best Practices for Depreciation and Amortization

Accurately recording depreciation expense involves systematically allocating the cost of tangible fixed assets over their useful lives, while amortization expense applies to intangible assets such as patents or trademarks. Best bookkeeping practices include maintaining detailed asset registers, using consistent depreciation and amortization methods aligned with Generally Accepted Accounting Principles (GAAP), and regularly reviewing asset useful lives and residual values. Proper documentation and use of accounting software for automatic calculations ensure precise financial reporting and compliance.

Frequently Asked Questions About Depreciation and Amortization

Depreciation expense allocates the cost of tangible fixed assets like machinery or buildings over their useful lives, while amortization expense spreads the cost of intangible assets such as patents or trademarks. Frequently asked questions often address the differences in asset types, the methods used for calculation, and their impacts on financial statements and tax reporting. Understanding the distinctions helps ensure accurate bookkeeping, compliance with accounting standards, and proper financial analysis.

Depreciation Expense vs Amortization Expense Infographic

bizdif.com

bizdif.com