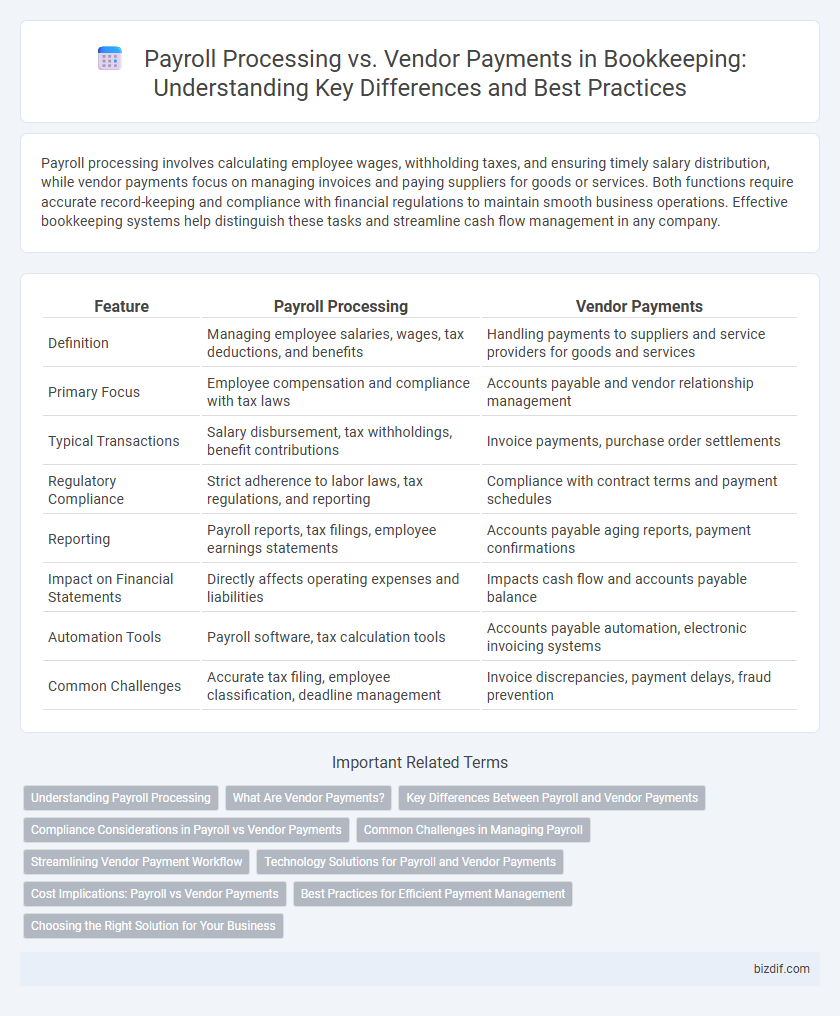

Payroll processing involves calculating employee wages, withholding taxes, and ensuring timely salary distribution, while vendor payments focus on managing invoices and paying suppliers for goods or services. Both functions require accurate record-keeping and compliance with financial regulations to maintain smooth business operations. Effective bookkeeping systems help distinguish these tasks and streamline cash flow management in any company.

Table of Comparison

| Feature | Payroll Processing | Vendor Payments |

|---|---|---|

| Definition | Managing employee salaries, wages, tax deductions, and benefits | Handling payments to suppliers and service providers for goods and services |

| Primary Focus | Employee compensation and compliance with tax laws | Accounts payable and vendor relationship management |

| Typical Transactions | Salary disbursement, tax withholdings, benefit contributions | Invoice payments, purchase order settlements |

| Regulatory Compliance | Strict adherence to labor laws, tax regulations, and reporting | Compliance with contract terms and payment schedules |

| Reporting | Payroll reports, tax filings, employee earnings statements | Accounts payable aging reports, payment confirmations |

| Impact on Financial Statements | Directly affects operating expenses and liabilities | Impacts cash flow and accounts payable balance |

| Automation Tools | Payroll software, tax calculation tools | Accounts payable automation, electronic invoicing systems |

| Common Challenges | Accurate tax filing, employee classification, deadline management | Invoice discrepancies, payment delays, fraud prevention |

Understanding Payroll Processing

Payroll processing involves calculating employee wages, withholding taxes, and ensuring timely salary disbursements in compliance with labor laws and tax regulations. It requires accurate record-keeping of hours worked, benefits, deductions, and tax filings to avoid penalties and ensure financial accuracy. Understanding payroll processing enhances cash flow management and maintains employee satisfaction by guaranteeing correct payment schedules.

What Are Vendor Payments?

Vendor payments refer to the disbursements made by a business to its suppliers or service providers for goods and services received. These transactions are recorded in bookkeeping to ensure accurate accounts payable management and maintain strong vendor relationships. Proper vendor payment processing is essential for cash flow control and financial reporting accuracy.

Key Differences Between Payroll and Vendor Payments

Payroll processing involves calculating employee wages, withholding taxes, and ensuring timely salary disbursements, while vendor payments focus on managing invoices and settling accounts payable with suppliers. Payroll requires compliance with employment laws and tax regulations, whereas vendor payments prioritize contract terms and payment schedules. The key difference lies in the recipient type--employees versus vendors--and the regulatory requirements governing each process.

Compliance Considerations in Payroll vs Vendor Payments

Payroll processing requires strict adherence to labor laws, tax withholdings, and employee benefits regulations to ensure compliance and avoid penalties. Vendor payments must comply with contractual agreements, tax reporting requirements such as 1099 forms for independent contractors, and timely remittance to prevent interest or late fees. Both processes demand accurate record-keeping and audit trails to satisfy regulatory scrutiny and maintain financial transparency.

Common Challenges in Managing Payroll

Managing payroll involves complex compliance with tax regulations and accurate calculation of employee wages, often complicated by varying work hours and benefits administration. Common challenges include timely processing to avoid penalties, ensuring data security, and integrating payroll systems with accounting software. Inefficient payroll management can lead to errors, employee dissatisfaction, and increased administrative costs, contrasting with vendor payments that primarily focus on invoice accuracy and timely disbursement.

Streamlining Vendor Payment Workflow

Streamlining vendor payment workflow enhances cash flow management and reduces processing errors by automating invoice approvals and scheduling payments. Integrating accounts payable software with existing bookkeeping systems centralizes vendor data, enabling timely payments and improved vendor relationships. Efficient vendor payment processes free up resources for other payroll processing tasks, ensuring overall financial accuracy and compliance.

Technology Solutions for Payroll and Vendor Payments

Technology solutions for payroll processing automate employee wage calculations, tax withholdings, and direct deposits, improving accuracy and compliance. Vendor payment platforms streamline invoice approvals, scheduling, and payment methods, enhancing cash flow management and supplier relationships. Integrating payroll and vendor payment systems within cloud-based accounting software boosts operational efficiency and financial reporting accuracy.

Cost Implications: Payroll vs Vendor Payments

Payroll processing involves regular, often fixed costs related to employee salaries, taxes, and benefits, requiring precise calculations to avoid costly errors or penalties. Vendor payments incur variable costs tied to invoice amounts, payment methods, and potential late fees, influencing cash flow management and operational expenses. Understanding these cost implications helps businesses optimize budgeting by balancing predictable payroll expenses against fluctuating vendor payment outflows.

Best Practices for Efficient Payment Management

Streamlining payroll processing requires accurate employee data management, timely tax withholdings, and automated salary disbursements to ensure compliance and employee satisfaction. Vendor payments demand precise invoice verification, scheduled payment cycles, and maintaining transparent communication to avoid late fees and preserve supplier relationships. Leveraging integrated bookkeeping software enhances efficiency by consolidating payroll and vendor payments into a unified platform for real-time tracking and reporting.

Choosing the Right Solution for Your Business

Effective payroll processing ensures timely and accurate employee compensation, while vendor payments focus on managing supplier invoices and cash flow. Selecting the right solution depends on your business size, complexity of payroll cycles, and frequency of vendor transactions. Integrating automated payroll software with accounts payable systems enhances financial accuracy and operational efficiency.

Payroll Processing vs Vendor Payments Infographic

bizdif.com

bizdif.com