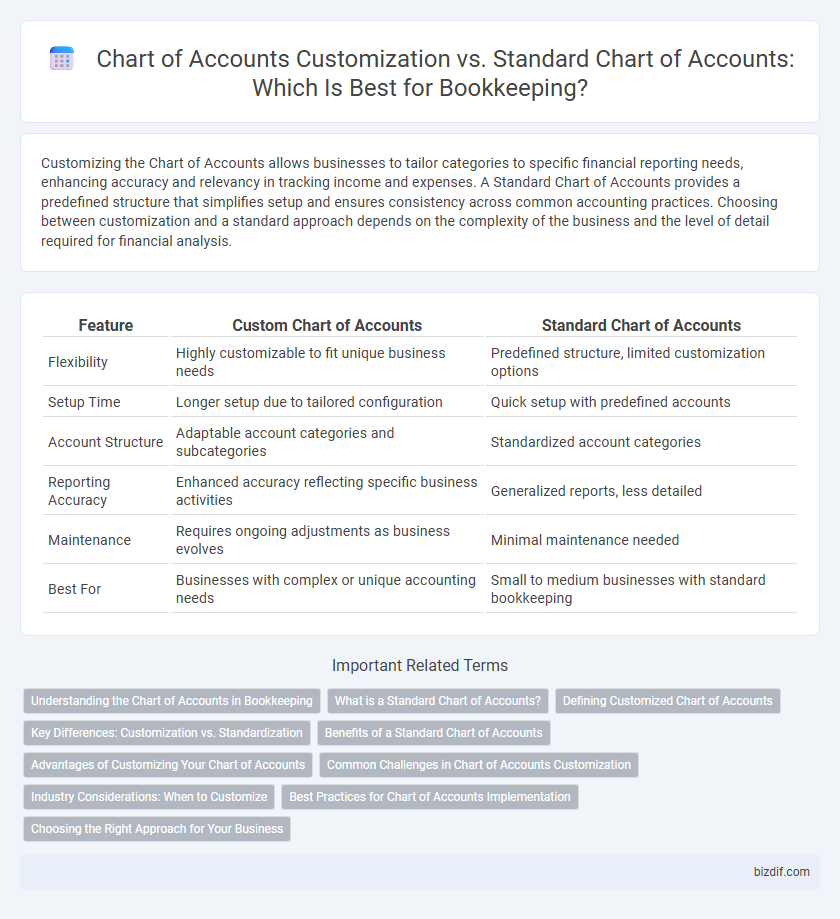

Customizing the Chart of Accounts allows businesses to tailor categories to specific financial reporting needs, enhancing accuracy and relevancy in tracking income and expenses. A Standard Chart of Accounts provides a predefined structure that simplifies setup and ensures consistency across common accounting practices. Choosing between customization and a standard approach depends on the complexity of the business and the level of detail required for financial analysis.

Table of Comparison

| Feature | Custom Chart of Accounts | Standard Chart of Accounts |

|---|---|---|

| Flexibility | Highly customizable to fit unique business needs | Predefined structure, limited customization options |

| Setup Time | Longer setup due to tailored configuration | Quick setup with predefined accounts |

| Account Structure | Adaptable account categories and subcategories | Standardized account categories |

| Reporting Accuracy | Enhanced accuracy reflecting specific business activities | Generalized reports, less detailed |

| Maintenance | Requires ongoing adjustments as business evolves | Minimal maintenance needed |

| Best For | Businesses with complex or unique accounting needs | Small to medium businesses with standard bookkeeping |

Understanding the Chart of Accounts in Bookkeeping

A customized Chart of Accounts in bookkeeping allows businesses to tailor account categories to match their specific financial activities, enhancing accuracy in tracking income, expenses, assets, and liabilities. In contrast, a standard Chart of Accounts offers predefined categories suitable for general use but may lack the specificity required for detailed financial analysis. Understanding the differences between these options helps accountants and business owners optimize financial reporting and ensure compliance with accounting standards.

What is a Standard Chart of Accounts?

A Standard Chart of Accounts (CoA) is a predefined list of account categories used to organize financial transactions uniformly across businesses within similar industries. It typically includes common account types such as assets, liabilities, equity, revenue, and expenses, ensuring consistent reporting and easier comparison. This standardized framework streamlines bookkeeping by providing a clear structure for recording and summarizing financial data.

Defining Customized Chart of Accounts

Defining a customized Chart of Accounts allows businesses to tailor account categories to their specific financial reporting and operational needs, enhancing accuracy and relevance in bookkeeping. Unlike the Standard Chart of Accounts, which provides a generic framework, customized charts enable the inclusion of unique account codes and classifications aligned with industry standards and company structure. This level of customization facilitates more detailed financial analysis, better expense tracking, and improved compliance with accounting principles.

Key Differences: Customization vs. Standardization

Chart of Accounts customization allows businesses to tailor account categories and subcategories to fit specific industry needs, fostering detailed financial reporting and improved decision-making. In contrast, the standard Chart of Accounts offers a fixed, uniform structure aimed at simplicity and compliance, which may limit flexibility but enhances consistency across organizations. Customization supports scalability and unique transaction tracking, while standardization ensures streamlined reporting and easier benchmarking against industry norms.

Benefits of a Standard Chart of Accounts

A Standard Chart of Accounts streamlines financial reporting by providing a uniform framework that enhances consistency across different periods and departments. It simplifies compliance with accounting regulations and facilitates easier comparison with industry benchmarks. Businesses benefit from reduced setup time and lower training costs due to its widespread acceptance and predefined structure.

Advantages of Customizing Your Chart of Accounts

Customizing your Chart of Accounts allows businesses to tailor account categories to reflect specific industry needs and unique financial activities, enhancing accuracy and relevance in financial reporting. This flexibility improves decision-making by providing more detailed insights into revenue streams and expenses, facilitating targeted budget management. Customized charts also streamline tax preparation and compliance by aligning accounts with regulatory requirements and business-specific transactions.

Common Challenges in Chart of Accounts Customization

Customizing the Chart of Accounts often leads to challenges such as maintaining consistency across financial reports, preventing account redundancy, and ensuring compliance with accounting standards. Business-specific needs may require frequent updates, increasing the complexity and risk of errors. Balancing flexibility with simplicity is essential to optimize bookkeeping accuracy and clarity.

Industry Considerations: When to Customize

Chart of Accounts customization becomes essential for industries with unique financial reporting requirements such as manufacturing, construction, or non-profits, where standard charts may lack specificity or compliance features. Tailoring accounts enables precise tracking of industry-specific expenses, revenue streams, and regulatory obligations, enhancing financial clarity and decision-making. Companies operating in regulated sectors often require customized accounts to meet audit standards and provide stakeholders with relevant, actionable financial insights.

Best Practices for Chart of Accounts Implementation

Customizing the Chart of Accounts (COA) allows businesses to tailor account categories specific to their industry and operational needs, enhancing financial reporting accuracy. Best practices for COA implementation include defining clear account hierarchies, maintaining consistency in account numbering, and aligning the structure with regulatory requirements and internal management goals. Regular reviews and updates ensure the COA remains relevant, supporting efficient bookkeeping and robust financial analysis.

Choosing the Right Approach for Your Business

Selecting the right approach between Chart of Accounts customization and using a standard chart depends on your business complexity and industry requirements. Customized charts provide tailored account structures that enhance financial clarity and reporting accuracy specific to unique business operations. Standard charts offer simplicity and quicker setup, ideal for small businesses or those seeking consistent, straightforward accounting frameworks.

Chart of Accounts Customization vs Standard Chart of Accounts Infographic

bizdif.com

bizdif.com