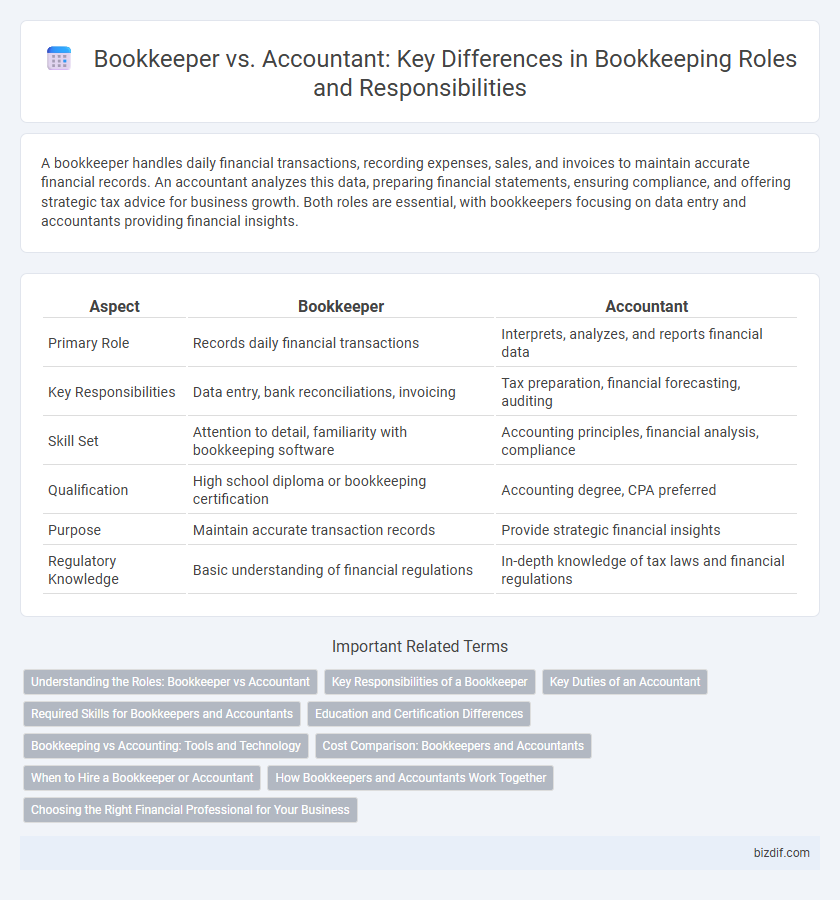

A bookkeeper handles daily financial transactions, recording expenses, sales, and invoices to maintain accurate financial records. An accountant analyzes this data, preparing financial statements, ensuring compliance, and offering strategic tax advice for business growth. Both roles are essential, with bookkeepers focusing on data entry and accountants providing financial insights.

Table of Comparison

| Aspect | Bookkeeper | Accountant |

|---|---|---|

| Primary Role | Records daily financial transactions | Interprets, analyzes, and reports financial data |

| Key Responsibilities | Data entry, bank reconciliations, invoicing | Tax preparation, financial forecasting, auditing |

| Skill Set | Attention to detail, familiarity with bookkeeping software | Accounting principles, financial analysis, compliance |

| Qualification | High school diploma or bookkeeping certification | Accounting degree, CPA preferred |

| Purpose | Maintain accurate transaction records | Provide strategic financial insights |

| Regulatory Knowledge | Basic understanding of financial regulations | In-depth knowledge of tax laws and financial regulations |

Understanding the Roles: Bookkeeper vs Accountant

A bookkeeper maintains accurate and organized financial records by recording daily transactions and managing ledgers, ensuring all financial data is up to date. An accountant analyzes these records, prepares financial reports, offers tax advice, and assists in strategic financial planning. Understanding the distinct roles of bookkeepers and accountants helps businesses optimize financial management and compliance.

Key Responsibilities of a Bookkeeper

Bookkeepers manage daily financial transactions, including recording sales, purchases, receipts, and payments, ensuring accurate and up-to-date ledgers. They reconcile bank statements and maintain payroll records to support financial integrity. Their precise data entry and record-keeping provide the foundation for accountants to prepare financial reports and tax returns.

Key Duties of an Accountant

Accountants analyze financial data, prepare detailed financial statements, and ensure compliance with tax regulations and accounting standards. They perform audits, manage budgeting and forecasting, and offer strategic financial advice to improve business performance. Their role extends beyond record-keeping to include interpreting financial information and guiding decision-making processes.

Required Skills for Bookkeepers and Accountants

Bookkeepers require strong attention to detail, proficiency in data entry, and familiarity with accounting software like QuickBooks for accurate financial record maintenance. Accountants must possess advanced analytical skills, expertise in financial reporting, tax regulations, and the ability to interpret complex financial data for strategic decision-making. Both professionals need a solid understanding of basic accounting principles, but accountants typically require higher education credentials such as a CPA certification.

Education and Certification Differences

Bookkeepers typically require a high school diploma or equivalent, while accountants often hold a bachelor's degree in accounting or finance. Certification for bookkeepers includes options like the Certified Bookkeeper (CB) credential offered by the American Institute of Professional Bookkeepers (AIPB), whereas accountants pursue certifications such as Certified Public Accountant (CPA) or Chartered Accountant (CA). These education and certification disparities reflect the differing responsibilities and expertise levels between bookkeeping and accounting roles.

Bookkeeping vs Accounting: Tools and Technology

Bookkeeping primarily utilizes software such as QuickBooks, Xero, and Wave to record daily financial transactions with accuracy and efficiency. Accounting involves more advanced tools like SAP, Oracle Financials, and Sage Intacct that support comprehensive financial analysis, reporting, and compliance management. Both professions increasingly rely on cloud technology and automation to streamline workflows and improve data accuracy.

Cost Comparison: Bookkeepers and Accountants

Bookkeepers generally charge lower fees, averaging $20 to $50 per hour, while accountants typically cost between $70 and $150 per hour due to their advanced qualifications and expertise. Small businesses often opt for bookkeepers to manage routine financial tasks such as data entry and bank reconciliations to save on expenses. Accountants provide comprehensive services including tax preparation and financial analysis, justifying their higher rates for complex business needs.

When to Hire a Bookkeeper or Accountant

Hire a bookkeeper when your business needs accurate recording and organization of daily financial transactions, ensuring up-to-date ledgers and expense tracking. An accountant is essential when you require financial analysis, tax preparation, compliance reporting, and strategic financial planning for growth or audit purposes. Small businesses typically start with a bookkeeper and consult an accountant for complex tax filings or year-end financial statements.

How Bookkeepers and Accountants Work Together

Bookkeepers maintain accurate day-to-day financial records, ensuring transactions are correctly documented and categorized. Accountants use this detailed data from bookkeepers to prepare financial statements, conduct audits, and provide strategic financial analysis. Their collaboration ensures seamless financial management, compliance with regulations, and informed business decision-making.

Choosing the Right Financial Professional for Your Business

Bookkeepers handle daily financial transactions and maintain accurate records, ensuring your business's books are up to date. Accountants analyze financial data, prepare reports, and provide strategic advice for tax planning and compliance. Choosing the right financial professional depends on your business needs--bookkeepers suit routine recordkeeping, while accountants are essential for complex financial analysis and decision-making.

Bookkeeper vs Accountant Infographic

bizdif.com

bizdif.com