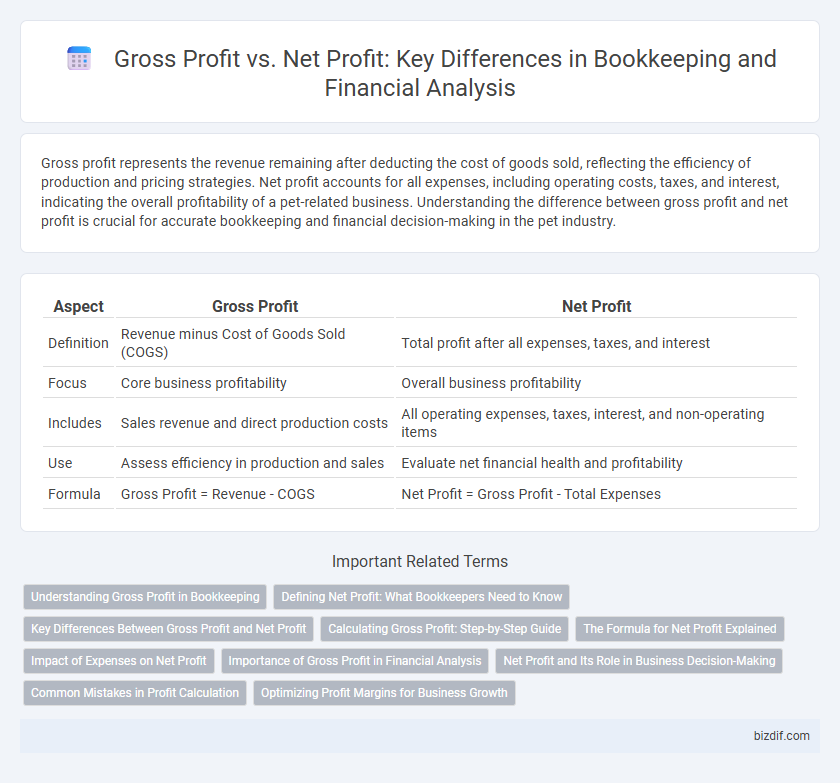

Gross profit represents the revenue remaining after deducting the cost of goods sold, reflecting the efficiency of production and pricing strategies. Net profit accounts for all expenses, including operating costs, taxes, and interest, indicating the overall profitability of a pet-related business. Understanding the difference between gross profit and net profit is crucial for accurate bookkeeping and financial decision-making in the pet industry.

Table of Comparison

| Aspect | Gross Profit | Net Profit |

|---|---|---|

| Definition | Revenue minus Cost of Goods Sold (COGS) | Total profit after all expenses, taxes, and interest |

| Focus | Core business profitability | Overall business profitability |

| Includes | Sales revenue and direct production costs | All operating expenses, taxes, interest, and non-operating items |

| Use | Assess efficiency in production and sales | Evaluate net financial health and profitability |

| Formula | Gross Profit = Revenue - COGS | Net Profit = Gross Profit - Total Expenses |

Understanding Gross Profit in Bookkeeping

Gross profit in bookkeeping represents the difference between revenue and the cost of goods sold (COGS), highlighting the efficiency of production and sales processes. It excludes operating expenses, taxes, and interest, providing a clear view of core profitability related to product or service delivery. Understanding gross profit is essential for accurate financial analysis, inventory management, and pricing strategies.

Defining Net Profit: What Bookkeepers Need to Know

Net profit represents the actual earnings remaining after all business expenses, including operating costs, taxes, and interest, have been deducted from gross profit. Bookkeepers must accurately track revenue streams and expense categories to calculate net profit precisely, ensuring the financial health and profitability of the business are clearly understood. Understanding net profit helps bookkeepers provide valuable insights for budgeting, forecasting, and strategic decision-making.

Key Differences Between Gross Profit and Net Profit

Gross profit represents a company's total revenue minus the cost of goods sold (COGS), reflecting the efficiency of production and core business activities. Net profit accounts for all expenses, including operating costs, taxes, interest, and other indirect costs, providing a comprehensive view of overall profitability. Understanding the key differences between gross profit and net profit is essential for accurate financial analysis and strategic decision-making in bookkeeping.

Calculating Gross Profit: Step-by-Step Guide

Calculating gross profit involves subtracting the cost of goods sold (COGS) from total revenue, a fundamental step in bookkeeping to assess a company's core profitability. To compute gross profit accurately, first gather total sales revenue and then itemize all direct costs related to production or purchase of goods sold within the accounting period. This step-by-step calculation provides clear insight into operational efficiency, essential for financial analysis and strategic decision-making.

The Formula for Net Profit Explained

Net profit is calculated by subtracting total expenses, including operating costs, taxes, and interest, from gross profit. The formula for net profit is Net Profit = Gross Profit - Total Expenses, highlighting that it accounts for all financial outflows beyond the cost of goods sold. Understanding net profit provides a clearer insight into a business's actual profitability after all costs are deducted.

Impact of Expenses on Net Profit

Gross profit represents total revenue minus the cost of goods sold, while net profit accounts for all expenses, including operating costs, interest, and taxes. Expenses beyond production directly reduce net profit, affecting overall business profitability and cash flow. Accurate bookkeeping of all expenses is essential to understand the true financial health reflected in net profit.

Importance of Gross Profit in Financial Analysis

Gross profit represents the revenue remaining after deducting the cost of goods sold, serving as a crucial indicator of a company's production efficiency and pricing strategy. Analyzing gross profit allows businesses to assess their core operational performance before accounting for overhead expenses and taxes. This metric is vital for making informed decisions about inventory management, cost control, and profitability optimization in financial analysis.

Net Profit and Its Role in Business Decision-Making

Net profit represents the actual earnings remaining after all operating expenses, taxes, and interest are deducted from total revenue, serving as a crucial indicator of business profitability and financial health. It enables business owners and managers to make informed decisions regarding budgeting, investment opportunities, and operational efficiency by providing a clear picture of sustainable earnings. Analyzing net profit trends over time assists in identifying cost control issues and profitability improvements, guiding strategic planning and resource allocation.

Common Mistakes in Profit Calculation

Common mistakes in profit calculation often involve confusing gross profit with net profit, leading to inaccurate financial analysis. Gross profit measures revenue minus the cost of goods sold, excluding operating expenses, taxes, and interest, whereas net profit accounts for all expenses, providing a true picture of business profitability. Misclassifying expenses or neglecting indirect costs can result in overstated profit margins, impacting budgeting and decision-making accuracy.

Optimizing Profit Margins for Business Growth

Gross profit represents total revenue minus the cost of goods sold, highlighting core business profitability before operating expenses. Net profit accounts for all expenses, taxes, and interest, providing a clear picture of actual earnings and financial health. Optimizing profit margins involves reducing costs and improving operational efficiency, which drives sustainable business growth and maximizes shareholder value.

Gross Profit vs Net Profit Infographic

bizdif.com

bizdif.com