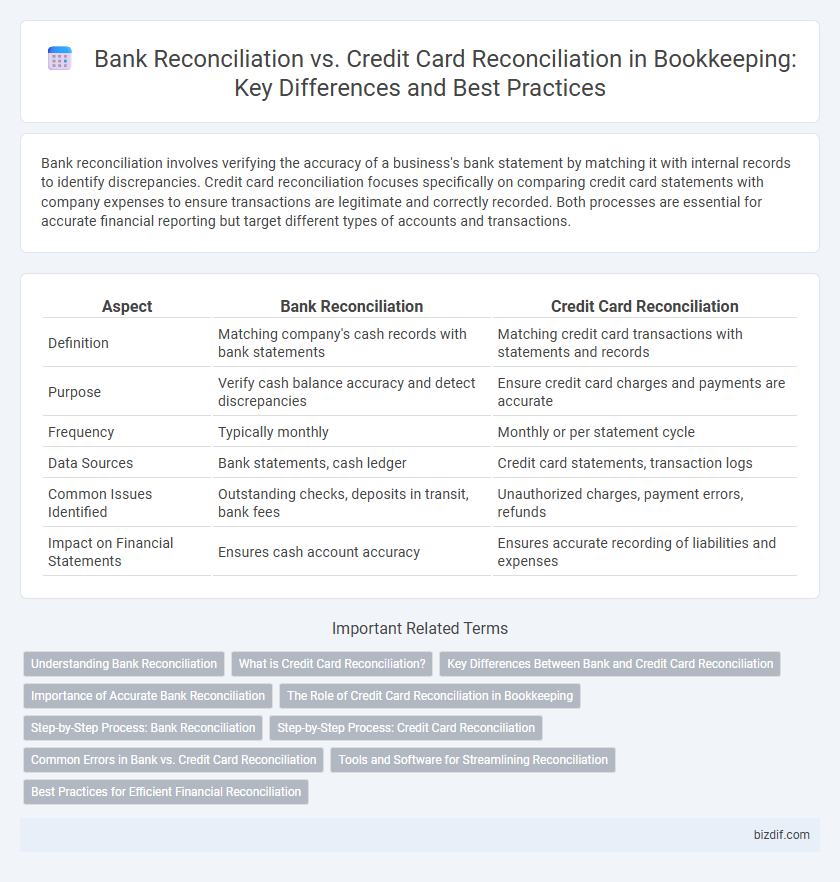

Bank reconciliation involves verifying the accuracy of a business's bank statement by matching it with internal records to identify discrepancies. Credit card reconciliation focuses specifically on comparing credit card statements with company expenses to ensure transactions are legitimate and correctly recorded. Both processes are essential for accurate financial reporting but target different types of accounts and transactions.

Table of Comparison

| Aspect | Bank Reconciliation | Credit Card Reconciliation |

|---|---|---|

| Definition | Matching company's cash records with bank statements | Matching credit card transactions with statements and records |

| Purpose | Verify cash balance accuracy and detect discrepancies | Ensure credit card charges and payments are accurate |

| Frequency | Typically monthly | Monthly or per statement cycle |

| Data Sources | Bank statements, cash ledger | Credit card statements, transaction logs |

| Common Issues Identified | Outstanding checks, deposits in transit, bank fees | Unauthorized charges, payment errors, refunds |

| Impact on Financial Statements | Ensures cash account accuracy | Ensures accurate recording of liabilities and expenses |

Understanding Bank Reconciliation

Bank reconciliation involves matching the bank statement with the company's ledger to identify discrepancies and ensure accurate cash records. It detects errors, unauthorized transactions, and timing differences that affect cash flow accuracy. Mastering bank reconciliation enhances financial integrity and supports effective cash management.

What is Credit Card Reconciliation?

Credit card reconciliation is the process of comparing and verifying credit card statements against internal accounting records to ensure all transactions are accurately recorded and authorized. This practice helps identify discrepancies such as unauthorized charges, duplicate entries, or accounting errors, ensuring the financial statements reflect true credit card expenses. Regular credit card reconciliation supports effective expense management and accurate financial reporting in bookkeeping.

Key Differences Between Bank and Credit Card Reconciliation

Bank reconciliation involves verifying transactions between a business's bank statement and its own accounting records to ensure accuracy and identify discrepancies. Credit card reconciliation focuses on matching credit card statements with internal expense records to track spending and detect unauthorized charges. Key differences include the types of accounts reconciled, the nature of transactions handled, and the timing of statement cycles unique to bank and credit card accounts.

Importance of Accurate Bank Reconciliation

Accurate bank reconciliation ensures that recorded transactions match the bank statements, preventing errors and detecting fraudulent activity in bookkeeping. This process improves cash flow management by identifying discrepancies promptly and maintaining up-to-date financial records. Effective bank reconciliation safeguards business financial integrity, unlike credit card reconciliation, which primarily focuses on validating credit card transactions.

The Role of Credit Card Reconciliation in Bookkeeping

Credit card reconciliation plays a crucial role in bookkeeping by ensuring that all credit card transactions recorded in the accounting system match the statements provided by the credit card issuer, thereby preventing errors and detecting fraudulent activities. Unlike bank reconciliation, which verifies cash account transactions, credit card reconciliation focuses specifically on managing credit liabilities and expense tracking within the books. Accurate credit card reconciliation improves financial accuracy, supports cash flow management, and facilitates more precise expense categorization for tax and reporting purposes.

Step-by-Step Process: Bank Reconciliation

Bank reconciliation involves systematically comparing the bank statement with the company's ledger to identify discrepancies such as outstanding checks, deposits in transit, and bank fees. The process includes verifying each transaction, adjusting the books for errors or omissions, and ensuring the adjusted book balance matches the bank statement balance. This step-by-step method helps maintain accurate financial records and detect potential fraud or accounting errors early.

Step-by-Step Process: Credit Card Reconciliation

Credit card reconciliation begins with gathering monthly credit card statements and comparing each transaction against the company's accounting records to identify discrepancies. Next, verify all payments, fees, and interest charges, ensuring they are accurately recorded and categorized in the ledger. Finally, resolve unmatched transactions by investigating errors or omissions, adjusting the accounts, and confirming that the reconciled balance matches the credit card statement to maintain accurate financial records.

Common Errors in Bank vs. Credit Card Reconciliation

Common errors in bank reconciliation often include missed transactions, duplicate entries, and timing differences between the bank statement and the ledger. Credit card reconciliation mistakes frequently involve unrecorded fees, uncategorized purchases, and misclassification of payments. Both processes require careful matching of statements to internal records to ensure accuracy and avoid financial discrepancies.

Tools and Software for Streamlining Reconciliation

Bank reconciliation and credit card reconciliation both benefit significantly from specialized accounting tools like QuickBooks, Xero, and FreshBooks, which automate transaction matching and error detection. Advanced software features such as AI-driven auditing and real-time transaction syncing streamline the reconciliation process, reducing manual effort and increasing accuracy. Cloud-based platforms also provide secure access and seamless integration with bank and credit card accounts, enhancing overall financial management efficiency.

Best Practices for Efficient Financial Reconciliation

Bank reconciliation and credit card reconciliation are crucial processes in bookkeeping that ensure accuracy between financial records and statement balances. Best practices for efficient financial reconciliation include regularly cross-referencing transactions, promptly identifying discrepancies, and using automated tools to streamline matching processes. Maintaining detailed documentation and separating duties enhances accuracy and reduces the risk of errors or fraud in both bank and credit card reconciliations.

Bank Reconciliation vs Credit Card Reconciliation Infographic

bizdif.com

bizdif.com