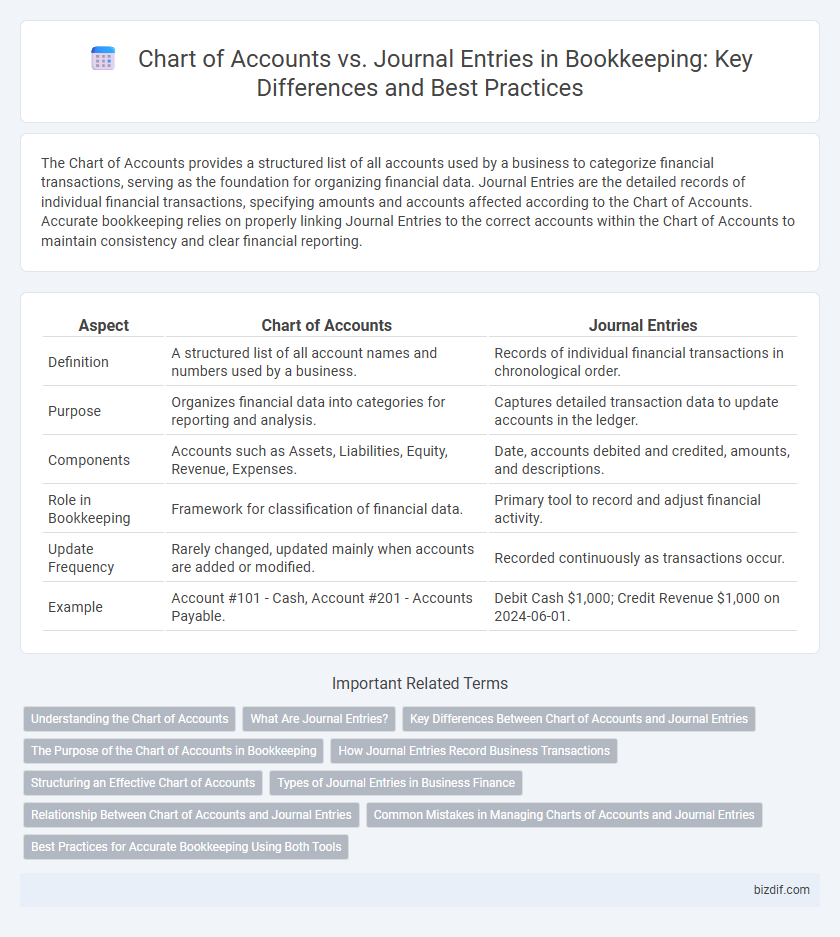

The Chart of Accounts provides a structured list of all accounts used by a business to categorize financial transactions, serving as the foundation for organizing financial data. Journal Entries are the detailed records of individual financial transactions, specifying amounts and accounts affected according to the Chart of Accounts. Accurate bookkeeping relies on properly linking Journal Entries to the correct accounts within the Chart of Accounts to maintain consistency and clear financial reporting.

Table of Comparison

| Aspect | Chart of Accounts | Journal Entries |

|---|---|---|

| Definition | A structured list of all account names and numbers used by a business. | Records of individual financial transactions in chronological order. |

| Purpose | Organizes financial data into categories for reporting and analysis. | Captures detailed transaction data to update accounts in the ledger. |

| Components | Accounts such as Assets, Liabilities, Equity, Revenue, Expenses. | Date, accounts debited and credited, amounts, and descriptions. |

| Role in Bookkeeping | Framework for classification of financial data. | Primary tool to record and adjust financial activity. |

| Update Frequency | Rarely changed, updated mainly when accounts are added or modified. | Recorded continuously as transactions occur. |

| Example | Account #101 - Cash, Account #201 - Accounts Payable. | Debit Cash $1,000; Credit Revenue $1,000 on 2024-06-01. |

Understanding the Chart of Accounts

The Chart of Accounts is a structured list of all financial accounts used by a business, categorized to facilitate accurate recording and reporting of transactions. It serves as the foundational framework for organizing journal entries, ensuring each transaction is assigned to the appropriate account for precise bookkeeping. Proper understanding of the Chart of Accounts enhances financial clarity, helping businesses track assets, liabilities, equity, revenues, and expenses efficiently.

What Are Journal Entries?

Journal entries are detailed records of financial transactions in bookkeeping, capturing debit and credit amounts along with descriptions and dates. They serve as the fundamental input for the ledger, reflecting every movement of money and financial activity within a business. Accurate journal entries ensure the integrity of financial statements and compliance with accounting standards.

Key Differences Between Chart of Accounts and Journal Entries

The Chart of Accounts is a structured list of all financial accounts used by a business to categorize transactions, while Journal Entries are the individual records of these transactions within those accounts. The Chart of Accounts provides the framework for organizing financial information, whereas Journal Entries capture the specific details of each financial event including date, amount, and accounts affected. Understanding these key differences is essential for accurate bookkeeping and financial reporting.

The Purpose of the Chart of Accounts in Bookkeeping

The Chart of Accounts serves as a structured framework that categorizes all financial transactions for accurate recording and reporting in bookkeeping. It organizes accounts into assets, liabilities, equity, revenues, and expenses, enabling consistent classification and easier financial analysis. This system ensures journal entries are recorded systematically, facilitating precise tracking and reconciliation of financial data.

How Journal Entries Record Business Transactions

Journal entries systematically record business transactions by documenting debits and credits in the company's general ledger, ensuring accurate financial tracking. Each entry captures transaction details such as date, accounts affected from the chart of accounts, amounts, and descriptions, providing a clear audit trail. This process enables real-time financial analysis and reconciles accounts, maintaining the integrity of the company's accounting records.

Structuring an Effective Chart of Accounts

A well-structured Chart of Accounts (CoA) categorizes all financial transactions for streamlined bookkeeping and accurate financial reporting. Organizing accounts into clear categories such as assets, liabilities, equity, revenues, and expenses enhances the efficiency of recording journal entries and simplifies account reconciliation. Properly defining account types and numbering sequenced within the CoA ensures consistency and aids in detailed financial analysis.

Types of Journal Entries in Business Finance

Journal entries in business finance include types such as adjusting entries, closing entries, and recurring entries, each serving to record transactions with precision. Adjusting entries update account balances before financial statements are prepared, while closing entries reset temporary accounts for the new accounting period. Recurring entries automate repetitive transactions, enhancing bookkeeping efficiency and accuracy.

Relationship Between Chart of Accounts and Journal Entries

The Chart of Accounts serves as a structured framework listing all financial accounts used by a business, providing the foundation for categorizing all financial transactions. Journal entries record these transactions in chronological order, referencing specific accounts from the Chart of Accounts to ensure accurate classification of debits and credits. This relationship between the Chart of Accounts and journal entries enables precise financial tracking and reporting.

Common Mistakes in Managing Charts of Accounts and Journal Entries

Common mistakes in managing charts of accounts include improper account categorization, creating redundant accounts, and failing to update the chart to reflect business changes, leading to inaccurate financial reporting. Journal entry errors often involve incorrect date entries, misclassification of expenses or revenues, and omission of supporting documentation, which can cause discrepancies in trial balances. Ensuring regular reviews and reconciliations helps maintain the integrity of both the chart of accounts and journal entries for accurate bookkeeping.

Best Practices for Accurate Bookkeeping Using Both Tools

Maintaining an organized Chart of Accounts tailored to your business structure simplifies categorizing financial transactions, ensuring precision in journal entries and overall bookkeeping accuracy. Regularly updating and reviewing the Chart of Accounts facilitates consistent classification, preventing errors and discrepancies in financial reporting. Accurate journal entries, recorded with supporting documentation and linked to the appropriate accounts, provide a reliable audit trail essential for compliance and informed financial analysis.

Chart of Accounts vs Journal Entries Infographic

bizdif.com

bizdif.com