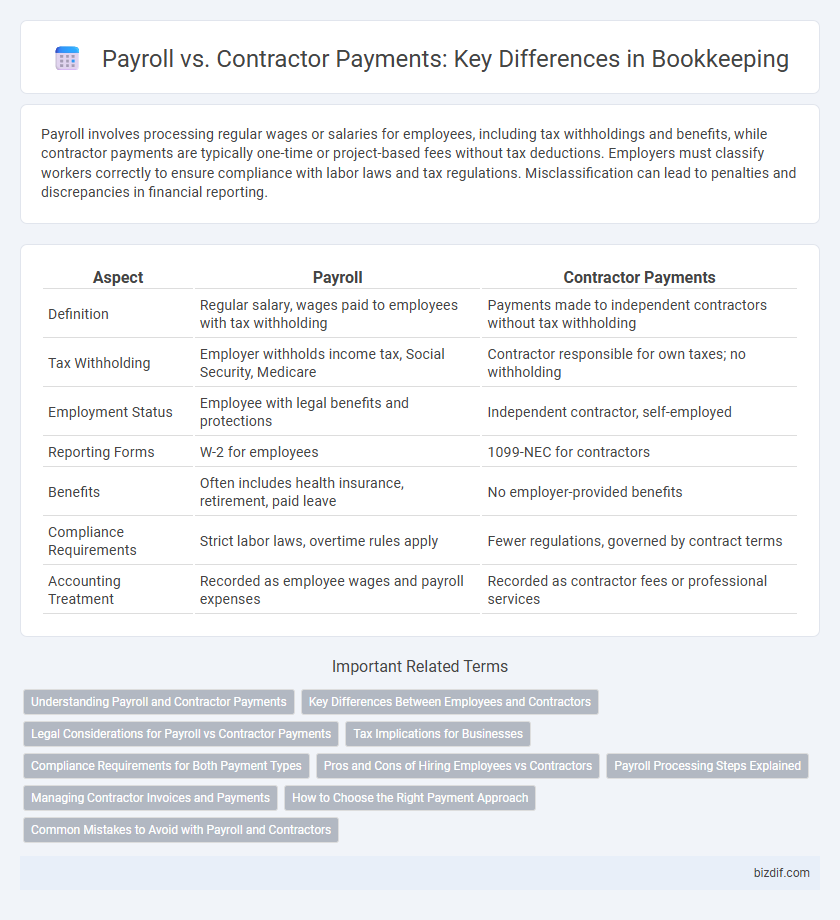

Payroll involves processing regular wages or salaries for employees, including tax withholdings and benefits, while contractor payments are typically one-time or project-based fees without tax deductions. Employers must classify workers correctly to ensure compliance with labor laws and tax regulations. Misclassification can lead to penalties and discrepancies in financial reporting.

Table of Comparison

| Aspect | Payroll | Contractor Payments |

|---|---|---|

| Definition | Regular salary, wages paid to employees with tax withholding | Payments made to independent contractors without tax withholding |

| Tax Withholding | Employer withholds income tax, Social Security, Medicare | Contractor responsible for own taxes; no withholding |

| Employment Status | Employee with legal benefits and protections | Independent contractor, self-employed |

| Reporting Forms | W-2 for employees | 1099-NEC for contractors |

| Benefits | Often includes health insurance, retirement, paid leave | No employer-provided benefits |

| Compliance Requirements | Strict labor laws, overtime rules apply | Fewer regulations, governed by contract terms |

| Accounting Treatment | Recorded as employee wages and payroll expenses | Recorded as contractor fees or professional services |

Understanding Payroll and Contractor Payments

Payroll involves processing regular employee salaries, including tax withholdings, benefits, and compliance with labor laws, while contractor payments pertain to compensations made to independent workers without tax deductions. Understanding the distinctions ensures accurate financial records, proper tax reporting, and adherence to legal requirements. Accurate classification between payroll and contractor payments is critical for bookkeeping to avoid penalties and maintain transparent financial statements.

Key Differences Between Employees and Contractors

Employee payroll involves withholding taxes, providing benefits, and adhering to employment laws, whereas contractor payments are typically gross amounts without tax withholdings or benefits. Employees have wages reported on a W-2 form, while contractors receive a 1099 form for tax purposes. The classification affects compliance, tax obligations, and record-keeping in bookkeeping practices.

Legal Considerations for Payroll vs Contractor Payments

Payroll payments require strict adherence to employment laws, including tax withholdings, social security contributions, and overtime regulations enforced by agencies such as the IRS and Department of Labor. Contractor payments, classified under independent contractors, necessitate clear contract agreements and compliance with IRS guidelines on worker classification to avoid misclassification penalties. Proper classification impacts tax liabilities, reporting obligations, and legal risks in bookkeeping, making it essential to distinguish payroll employees from contractors accurately.

Tax Implications for Businesses

Payroll involves withholding taxes such as income tax, Social Security, and Medicare from employee wages, requiring businesses to manage payroll tax filings and contributions. Contractor payments do not require tax withholdings, but businesses must issue Form 1099-NEC for contractors earning over $600 annually, shifting tax reporting responsibilities to the contractor. Misclassifying employees as contractors can lead to IRS penalties and unpaid payroll taxes, increasing financial liabilities for businesses.

Compliance Requirements for Both Payment Types

Payroll compliance requires strict adherence to tax withholding, reporting obligations, and employee benefits regulations as mandated by the IRS and Department of Labor. Contractor payments must comply with accurate 1099 reporting, proper classification to avoid misclassification penalties, and adherence to state-specific independent contractor laws. Maintaining detailed records and timely filings ensures legal compliance and minimizes audit risks for both payroll and contractor payment processes.

Pros and Cons of Hiring Employees vs Contractors

Hiring employees offers benefits like greater control over work processes, eligibility for company benefits, and increased loyalty, but involves higher costs due to taxes, insurance, and compliance with labor laws. Contractors provide flexibility, lower payroll taxes, and reduced administrative burdens, yet lack long-term commitment and may pose challenges in maintaining consistent quality. Choosing between payroll and contractor payments depends on balancing cost efficiency with control and operational needs specific to business goals.

Payroll Processing Steps Explained

Payroll processing involves verifying employee hours, calculating wages based on hours worked or salary, and withholding appropriate taxes and benefits before issuing payments. Employers must accurately record all payroll transactions to ensure compliance with tax regulations and maintain proper financial records. Efficient payroll systems streamline these steps, reducing errors and ensuring timely compensation for employees.

Managing Contractor Invoices and Payments

Managing contractor invoices requires precise tracking of payment terms, rates, and service delivery dates to ensure timely and accurate payments. Payroll systems typically do not cover contractor payments, so using dedicated bookkeeping software that integrates contractor invoice management enhances financial accuracy and compliance with tax regulations. Proper documentation and categorization of contractor expenses help differentiate them from employee payroll, optimizing accounting processes and reporting.

How to Choose the Right Payment Approach

Choosing between payroll and contractor payments hinges on legal classification, tax obligations, and the nature of work performed. Payroll requires employee status compliance, including tax withholdings and benefit provisions, while contractor payments demand independent contractor agreements, accurate 1099 reporting, and no withholding. Businesses must evaluate control over work, duration, and financial risk to select the appropriate payment method, ensuring compliance with IRS guidelines and avoiding misclassification penalties.

Common Mistakes to Avoid with Payroll and Contractors

Misclassifying employees as contractors leads to costly tax penalties and compliance issues in payroll management. Neglecting to withhold payroll taxes for employees while ignoring tax reporting requirements for contractors causes record-keeping errors and fines. Maintaining clear documentation and differentiating payment types ensures accurate tax filings and prevents audits.

Payroll vs Contractor Payments Infographic

bizdif.com

bizdif.com