Internal audits focus on evaluating a company's internal controls, risk management, and compliance processes to ensure accuracy and efficiency in financial reporting. External audits are conducted by independent auditors who examine the financial statements to provide an objective opinion on their fairness and adherence to accounting standards. Both audits play crucial roles in maintaining transparency and accountability within bookkeeping practices.

Table of Comparison

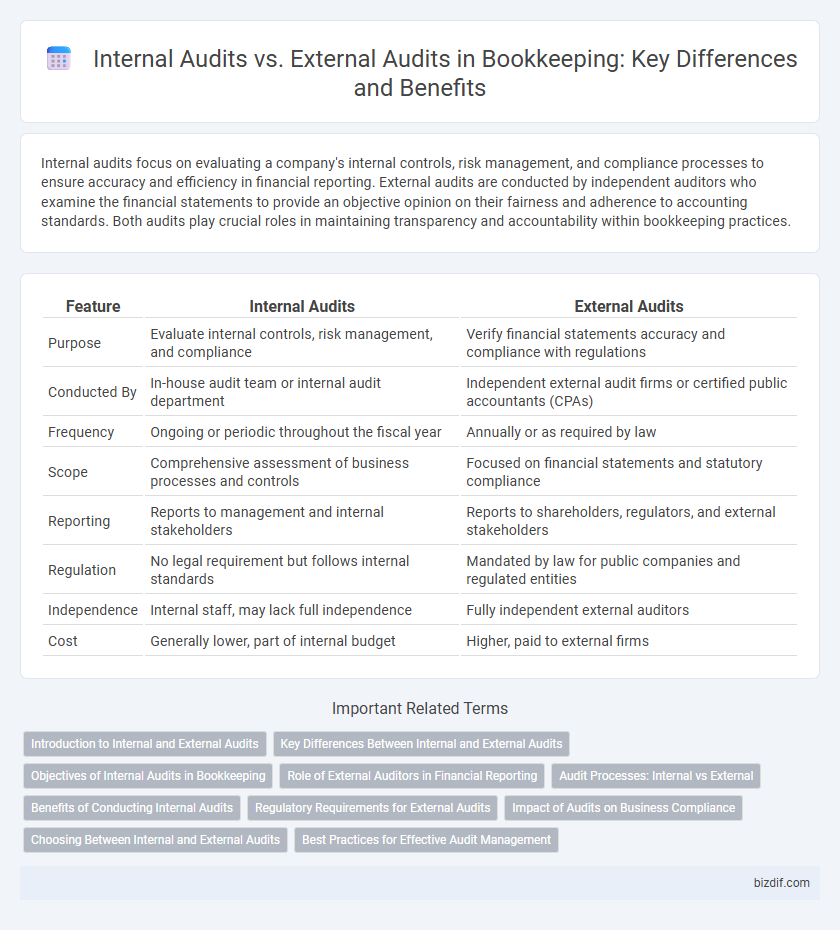

| Feature | Internal Audits | External Audits |

|---|---|---|

| Purpose | Evaluate internal controls, risk management, and compliance | Verify financial statements accuracy and compliance with regulations |

| Conducted By | In-house audit team or internal audit department | Independent external audit firms or certified public accountants (CPAs) |

| Frequency | Ongoing or periodic throughout the fiscal year | Annually or as required by law |

| Scope | Comprehensive assessment of business processes and controls | Focused on financial statements and statutory compliance |

| Reporting | Reports to management and internal stakeholders | Reports to shareholders, regulators, and external stakeholders |

| Regulation | No legal requirement but follows internal standards | Mandated by law for public companies and regulated entities |

| Independence | Internal staff, may lack full independence | Fully independent external auditors |

| Cost | Generally lower, part of internal budget | Higher, paid to external firms |

Introduction to Internal and External Audits

Internal audits are conducted by a company's own employees to assess and improve internal controls, risk management, and governance processes, ensuring operational efficiency and compliance. External audits are performed by independent third-party auditors who provide an unbiased evaluation of the financial statements' accuracy and adherence to accounting standards. Both audits play crucial roles in enhancing transparency, accountability, and stakeholder confidence within an organization.

Key Differences Between Internal and External Audits

Internal audits are conducted by employees within an organization to evaluate and improve internal controls, risk management, and governance processes. External audits are performed by independent third parties to provide an unbiased opinion on the accuracy of financial statements and compliance with accounting standards. Key differences include the scope of work, reporting objectives, and the auditors' relationship to the organization, with internal audits focusing on operational efficiency and external audits emphasizing financial statement reliability.

Objectives of Internal Audits in Bookkeeping

Internal audits in bookkeeping primarily aim to evaluate the effectiveness of internal controls, ensure accuracy in financial records, and identify potential risks or fraud within an organization. These audits focus on enhancing operational efficiency, compliance with company policies, and safeguarding assets by verifying transaction details and accounting processes. Internal auditors provide management with insights for continuous improvement, supporting decision-making and maintaining financial integrity.

Role of External Auditors in Financial Reporting

External auditors play a critical role in financial reporting by providing an independent assessment of a company's financial statements to ensure accuracy, completeness, and compliance with accounting standards and regulations. Their objective evaluation increases stakeholders' confidence by detecting material misstatements or fraud, thereby enhancing the integrity of financial disclosures. Relying on external audits supports transparency and accountability, which are essential for investor trust and regulatory compliance.

Audit Processes: Internal vs External

Internal audits focus on continuous evaluation of financial records and operational processes within an organization, emphasizing risk management and compliance with internal policies. External audits involve an independent third-party review of financial statements to ensure accuracy, regulatory compliance, and provide assurance to stakeholders. Both audit processes use systematic procedures but differ in scope, frequency, and objectives, with internal audits being more frequent and operational, while external audits are periodic and certification-driven.

Benefits of Conducting Internal Audits

Internal audits enhance financial accuracy and operational efficiency by regularly assessing internal controls and identifying risks early. They support compliance with regulatory standards and prepare the organization for external audits, reducing potential discrepancies. Continuous internal audits enable proactive decision-making and improve overall governance within the company.

Regulatory Requirements for External Audits

External audits are mandated by regulatory bodies to ensure compliance with financial reporting standards and legal requirements, providing an objective evaluation of a company's financial statements. Internal audits focus on evaluating internal controls and operational efficiency but are not always legally required. Regulatory requirements for external audits include adherence to guidelines set by organizations such as the Public Company Accounting Oversight Board (PCAOB) or International Auditing and Assurance Standards Board (IAASB).

Impact of Audits on Business Compliance

Internal audits enhance business compliance by providing continuous monitoring of financial processes and identifying risks early, which helps organizations maintain regulatory standards and improve internal controls. External audits offer an independent evaluation of financial statements, ensuring transparency and trust among stakeholders, including investors, regulators, and customers. The combined impact of both audits strengthens overall compliance, reduces the risk of fraud, and supports organizational accountability.

Choosing Between Internal and External Audits

Choosing between internal and external audits depends on the organization's objectives, with internal audits providing continuous, in-depth evaluation of internal controls and risk management, while external audits offer independent verification of financial statements for stakeholders. Internal audits are conducted by employees familiar with company operations, enhancing ongoing compliance and operational efficiency, whereas external audits involve independent auditors ensuring credibility and regulatory compliance. Companies aiming for robust internal improvements may prioritize internal audits, whereas those seeking assurance for investors and regulators typically opt for external audits.

Best Practices for Effective Audit Management

Effective audit management requires clear distinction between internal and external audits, ensuring comprehensive financial oversight. Internal audits focus on evaluating internal controls and processes for risk management and operational efficiency, while external audits provide independent verification of financial statements for regulatory compliance. Best practices include regular audit planning, transparent communication between auditors and management, and prompt resolution of identified issues to strengthen organizational accountability.

Internal audits vs External audits Infographic

bizdif.com

bizdif.com