Periodic bookkeeping involves recording financial transactions at specific intervals, typically monthly or quarterly, which simplifies the process but may delay real-time insights. Perpetual bookkeeping updates records continuously with each transaction, providing accurate and up-to-date financial data essential for timely decision-making. Businesses seeking immediate inventory and financial status often prefer perpetual bookkeeping over the traditional periodic approach.

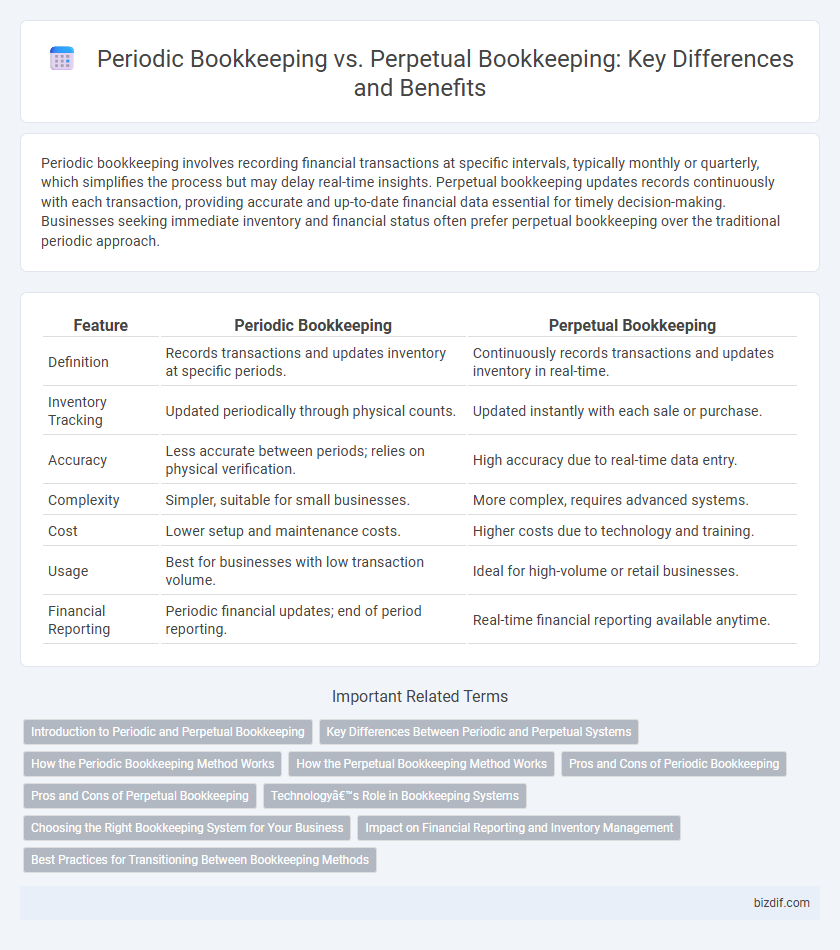

Table of Comparison

| Feature | Periodic Bookkeeping | Perpetual Bookkeeping |

|---|---|---|

| Definition | Records transactions and updates inventory at specific periods. | Continuously records transactions and updates inventory in real-time. |

| Inventory Tracking | Updated periodically through physical counts. | Updated instantly with each sale or purchase. |

| Accuracy | Less accurate between periods; relies on physical verification. | High accuracy due to real-time data entry. |

| Complexity | Simpler, suitable for small businesses. | More complex, requires advanced systems. |

| Cost | Lower setup and maintenance costs. | Higher costs due to technology and training. |

| Usage | Best for businesses with low transaction volume. | Ideal for high-volume or retail businesses. |

| Financial Reporting | Periodic financial updates; end of period reporting. | Real-time financial reporting available anytime. |

Introduction to Periodic and Perpetual Bookkeeping

Periodic bookkeeping updates inventory and financial records at specific intervals, such as monthly or annually, simplifying the tracking process for small businesses with less frequent transactions. Perpetual bookkeeping continuously records sales, purchases, and inventory changes in real-time, providing accurate and up-to-date financial data essential for businesses with high transaction volumes. Both methods serve distinct operational needs, with periodic bookkeeping offering ease of use and perpetual bookkeeping ensuring precise inventory management.

Key Differences Between Periodic and Perpetual Systems

Periodic bookkeeping records inventory and cost of goods sold at the end of an accounting period, resulting in less real-time inventory tracking but simpler recordkeeping. Perpetual bookkeeping updates inventory and cost of goods sold continuously with each transaction, providing accurate and timely financial data for decision-making. The key differences include inventory update frequency, accuracy of financial information, and complexity of implementation.

How the Periodic Bookkeeping Method Works

The Periodic Bookkeeping method records financial transactions at specific intervals, such as monthly or quarterly, rather than continuously. Inventory and revenue accounts are updated only after a physical count or at the end of the period, which can simplify record-keeping but may delay accurate financial insights. This approach contrasts with Perpetual Bookkeeping, where transactions are recorded in real-time, providing immediate data accuracy.

How the Perpetual Bookkeeping Method Works

The perpetual bookkeeping method continuously updates financial records by recording transactions in real-time, ensuring that the inventory and account balances reflect current data without the need for periodic adjustments. Each sale, purchase, or return is immediately entered into the system, allowing businesses to have up-to-date financial information and inventory levels at any given moment. This approach relies heavily on sophisticated accounting software and point-of-sale systems to maintain accurate and instant transaction records.

Pros and Cons of Periodic Bookkeeping

Periodic bookkeeping simplifies record-keeping by updating accounts at specific intervals, reducing day-to-day administrative work and minimizing immediate data entry errors. However, it can lead to less timely financial information, making it difficult to monitor cash flow and inventory levels accurately between periods. This delay increases the risk of undetected discrepancies and less effective decision-making compared to perpetual bookkeeping systems.

Pros and Cons of Perpetual Bookkeeping

Perpetual bookkeeping continuously updates financial records after each transaction, providing real-time inventory and financial data that enhances accuracy and decision-making efficiency. This method reduces discrepancies and the need for frequent physical counts but requires significant investment in technology and ongoing data management. However, perpetual bookkeeping can be complex to maintain, especially for small businesses lacking the resources for sophisticated software and training.

Technology’s Role in Bookkeeping Systems

Technology's role in bookkeeping systems has revolutionized both periodic and perpetual bookkeeping by enhancing accuracy and efficiency through automated data entry and real-time transaction tracking. Cloud-based software integrates continuously updated financial records in perpetual bookkeeping, allowing instant access to current data, while periodic bookkeeping leverages digital tools to simplify end-of-period reconciliations and reporting. Advanced analytics and AI-powered features further optimize decision-making processes, reducing manual errors and improving financial transparency in both bookkeeping approaches.

Choosing the Right Bookkeeping System for Your Business

Choosing the right bookkeeping system depends on your business's transaction volume and inventory management needs. Periodic bookkeeping suits small businesses with fewer transactions, updating accounts at set intervals, while perpetual bookkeeping offers real-time tracking, ideal for businesses requiring accurate, up-to-date financial data. Evaluate factors like accuracy requirements, resource availability, and financial reporting frequency to determine the best fit for efficient bookkeeping and informed decision-making.

Impact on Financial Reporting and Inventory Management

Periodic bookkeeping updates inventory and financial records at specific intervals, often leading to less timely financial reporting and potential discrepancies in inventory accuracy. Perpetual bookkeeping continuously records transactions, providing real-time financial data and precise inventory management, enhancing decision-making and reducing stockouts or overstock situations. Businesses relying on accurate and up-to-date inventory levels typically benefit from the perpetual system's immediate impact on financial reporting and operational efficiency.

Best Practices for Transitioning Between Bookkeeping Methods

Transitioning from periodic to perpetual bookkeeping requires accurate real-time data integration and consistent inventory tracking to maintain financial accuracy. Implementing automated accounting software ensures seamless updates and reduces discrepancies commonly found in periodic systems. Training staff on new procedures and regularly reconciling accounts supports a smooth transition and ongoing compliance with accounting standards.

Periodic bookkeeping vs Perpetual bookkeeping Infographic

bizdif.com

bizdif.com