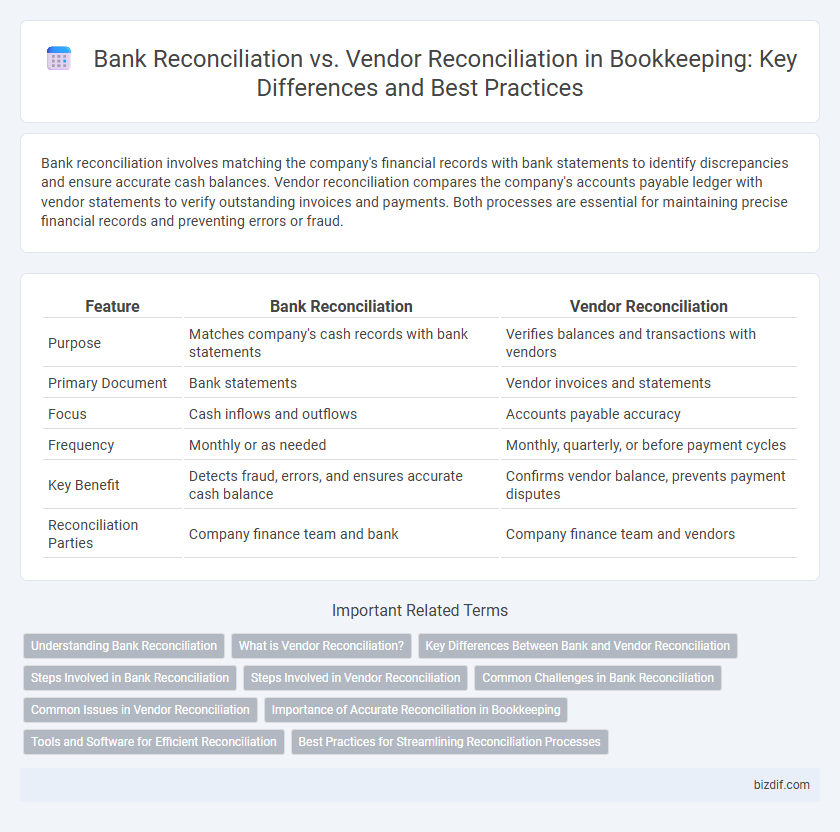

Bank reconciliation involves matching the company's financial records with bank statements to identify discrepancies and ensure accurate cash balances. Vendor reconciliation compares the company's accounts payable ledger with vendor statements to verify outstanding invoices and payments. Both processes are essential for maintaining precise financial records and preventing errors or fraud.

Table of Comparison

| Feature | Bank Reconciliation | Vendor Reconciliation |

|---|---|---|

| Purpose | Matches company's cash records with bank statements | Verifies balances and transactions with vendors |

| Primary Document | Bank statements | Vendor invoices and statements |

| Focus | Cash inflows and outflows | Accounts payable accuracy |

| Frequency | Monthly or as needed | Monthly, quarterly, or before payment cycles |

| Key Benefit | Detects fraud, errors, and ensures accurate cash balance | Confirms vendor balance, prevents payment disputes |

| Reconciliation Parties | Company finance team and bank | Company finance team and vendors |

Understanding Bank Reconciliation

Bank reconciliation involves comparing a company's internal financial records with the bank statement to identify and resolve discrepancies, ensuring accurate cash balances. It detects errors such as outstanding checks, deposits in transit, or bank fees, maintaining the integrity of financial reporting. Understanding bank reconciliation is essential for preventing fraud and managing cash flow effectively in bookkeeping.

What is Vendor Reconciliation?

Vendor reconciliation is the process of comparing a company's accounts payable records with the vendor's statements to ensure both parties agree on the outstanding balances. It helps identify discrepancies such as unrecorded invoices, payment errors, or unauthorized charges, ensuring accurate financial reporting. Regular vendor reconciliation improves cash flow management and strengthens supplier relationships by maintaining transparent and accurate accounts.

Key Differences Between Bank and Vendor Reconciliation

Bank reconciliation involves matching a company's cash records with the bank statement to identify discrepancies in transactions such as deposits, withdrawals, and fees. Vendor reconciliation focuses on verifying the accuracy of accounts payable by comparing internal records with vendors' statements to ensure all invoices and payments are accounted for. Key differences include the primary parties involved--financial institutions for bank reconciliation versus suppliers for vendor reconciliation--and the nature of transactions reconciled, where bank reconciliation deals with cash flow accuracy and vendor reconciliation ensures correct outstanding payables.

Steps Involved in Bank Reconciliation

Bank reconciliation involves systematically comparing the company's bank statement with its internal cash records to identify discrepancies and ensure accuracy. Key steps include collecting the bank statement, matching deposits and withdrawals with recorded transactions, adjusting for any outstanding checks or deposits in transit, and correcting errors or omissions. Completing this process regularly helps maintain accurate financial records and prevents fraud or accounting mistakes.

Steps Involved in Vendor Reconciliation

Vendor reconciliation involves verifying and matching the company's purchase records with the vendor's statements to identify discrepancies and resolve payment issues. Key steps include collecting purchase invoices and payment records, comparing these against vendor statements, and investigating any differences such as outstanding invoices or unapplied payments. Completing vendor reconciliation helps ensure accurate accounts payable balances and maintains strong vendor relationships.

Common Challenges in Bank Reconciliation

Bank reconciliation often faces challenges such as matching timely bank statement entries with internal records, identifying discrepancies caused by timing differences or errors, and managing incomplete or missing transaction information. Complexities arise from handling outstanding checks, deposits in transit, and bank fees that are not yet recorded in the books. These issues demand thorough review and precise adjustments to ensure accurate financial reporting and maintain reconciled accounts.

Common Issues in Vendor Reconciliation

Common issues in vendor reconciliation often include discrepancies in invoice amounts, missing payment records, and timing differences between recorded transactions and actual payments. Errors in data entry, such as incorrect invoice numbers or amounts, can lead to unmatched records that complicate the reconciliation process. Addressing these issues requires thorough cross-checking of vendor statements against company ledger entries to ensure accuracy and prevent payment disputes.

Importance of Accurate Reconciliation in Bookkeeping

Accurate bank reconciliation ensures that a company's financial records align with its bank statements, preventing discrepancies and detecting potential fraud. Vendor reconciliation verifies that the balances with suppliers match the company's accounts payable, maintaining trust and avoiding payment errors. Both processes are essential for reliable bookkeeping, supporting financial accuracy, cash flow management, and informed business decisions.

Tools and Software for Efficient Reconciliation

Bank reconciliation and vendor reconciliation rely heavily on advanced accounting software like QuickBooks, Xero, and Sage Intacct to automate transaction matching and discrepancy detection. Tools with AI-driven features enhance accuracy by quickly comparing bank statements against ledger entries or vendor invoices, reducing manual errors and saving time. Integration capabilities with banking APIs and vendor portals are essential for streamlined, real-time reconciliation processes that improve financial accuracy and reporting efficiency.

Best Practices for Streamlining Reconciliation Processes

Bank reconciliation ensures the accuracy of cash records by matching bank statements with internal records, while vendor reconciliation verifies outstanding balances and payment details with suppliers to maintain accurate accounts payable. Best practices include automating data entry through integrated accounting software, conducting regular reconciliation cycles to identify discrepancies early, and maintaining clear communication channels with banks and vendors to promptly resolve issues. Leveraging cloud-based solutions and standardized templates further streamlines processes, reducing errors and enhancing financial accuracy.

Bank Reconciliation vs Vendor Reconciliation Infographic

bizdif.com

bizdif.com