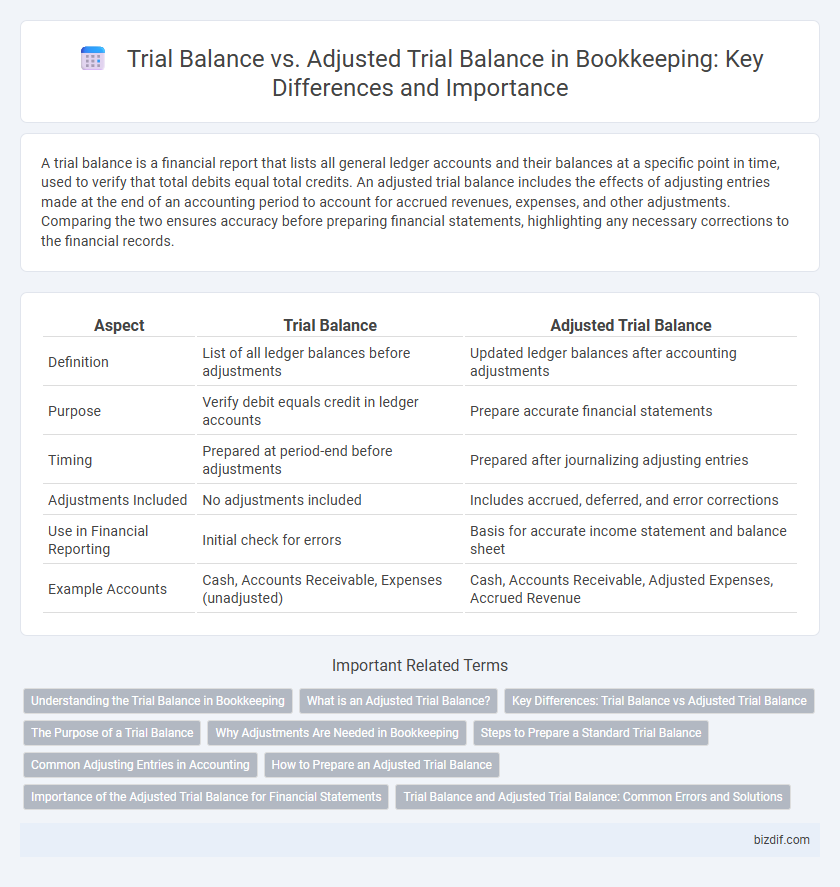

A trial balance is a financial report that lists all general ledger accounts and their balances at a specific point in time, used to verify that total debits equal total credits. An adjusted trial balance includes the effects of adjusting entries made at the end of an accounting period to account for accrued revenues, expenses, and other adjustments. Comparing the two ensures accuracy before preparing financial statements, highlighting any necessary corrections to the financial records.

Table of Comparison

| Aspect | Trial Balance | Adjusted Trial Balance |

|---|---|---|

| Definition | List of all ledger balances before adjustments | Updated ledger balances after accounting adjustments |

| Purpose | Verify debit equals credit in ledger accounts | Prepare accurate financial statements |

| Timing | Prepared at period-end before adjustments | Prepared after journalizing adjusting entries |

| Adjustments Included | No adjustments included | Includes accrued, deferred, and error corrections |

| Use in Financial Reporting | Initial check for errors | Basis for accurate income statement and balance sheet |

| Example Accounts | Cash, Accounts Receivable, Expenses (unadjusted) | Cash, Accounts Receivable, Adjusted Expenses, Accrued Revenue |

Understanding the Trial Balance in Bookkeeping

The trial balance in bookkeeping is a fundamental report that lists all general ledger accounts and their balances at a specific point in time, ensuring that total debits equal total credits. It serves as a preliminary check for accuracy before preparing financial statements, but it may not include necessary adjustments for accrued expenses or depreciation. The adjusted trial balance incorporates these corrections, providing a more accurate foundation for finalizing the company's financial position.

What is an Adjusted Trial Balance?

An adjusted trial balance is a financial report that lists all account balances after adjusting entries have been recorded at the end of an accounting period. It reflects updated figures, including accrued revenues, expenses, and corrections, ensuring accuracy before preparing financial statements. This document helps verify that total debits equal total credits post-adjustments, maintaining the integrity of the ledger.

Key Differences: Trial Balance vs Adjusted Trial Balance

The trial balance is an initial report listing all ledger account balances to check the arithmetic accuracy of bookkeeping entries. The adjusted trial balance includes updates from adjusting entries made at period-end, reflecting accruals, deferrals, and corrections ensuring financial statements' accuracy. Key differences lie in timing--trial balance is pre-adjustment, while adjusted trial balance provides the finalized figures for financial reporting.

The Purpose of a Trial Balance

A trial balance serves as an initial step to verify the accuracy of ledger entries by ensuring that total debits equal total credits. It helps detect arithmetic errors but does not identify all types of accounting mistakes. Adjusted trial balances incorporate necessary corrections and adjustments, providing a more accurate financial position before preparing financial statements.

Why Adjustments Are Needed in Bookkeeping

Adjustments in bookkeeping are essential to ensure that financial records accurately reflect the true financial position of a business at the end of an accounting period. The adjusted trial balance incorporates these necessary corrections, such as accrued expenses, prepaid assets, and unearned revenues, which are not captured in the initial trial balance. Without these adjustments, financial statements may present misleading data, impacting decision-making and compliance with accounting standards.

Steps to Prepare a Standard Trial Balance

To prepare a standard trial balance, first list all ledger accounts with their respective debit or credit balances as of the reporting date. Verify that the total debits equal total credits to ensure ledger accuracy before moving to adjustments. This foundational step safeguards the integrity of financial data prior to creating the adjusted trial balance.

Common Adjusting Entries in Accounting

Trial balance lists all ledger accounts and their balances before adjustments, while adjusted trial balance reflects updated balances after common adjusting entries such as accrued revenues, accrued expenses, depreciation, and unearned revenues are recorded. Accrued revenues recognize income earned but not yet received, accrued expenses account for costs incurred but unpaid, depreciation allocates the cost of fixed assets over time, and unearned revenues adjust liabilities for advance payments earned. These adjustments ensure financial statements reflect accurate financial positions in accordance with the matching principle and GAAP compliance.

How to Prepare an Adjusted Trial Balance

An adjusted trial balance is prepared by first posting all adjusting entries to the ledger accounts, ensuring that revenues and expenses reflect the correct amounts for the accounting period. Next, updated account balances are listed to verify that total debits equal total credits after adjustments. This process identifies any errors and provides accurate financial data for preparing the financial statements.

Importance of the Adjusted Trial Balance for Financial Statements

The adjusted trial balance is crucial for ensuring the accuracy of financial statements by incorporating all necessary adjustments for accrued revenues, expenses, and other modifying entries. Unlike the trial balance, which lists accounts before adjustments, the adjusted trial balance reflects the true financial position and performance of a business at period-end. Accurate adjusted trial balances provide the foundation for preparing reliable income statements, balance sheets, and cash flow statements that comply with accounting standards.

Trial Balance and Adjusted Trial Balance: Common Errors and Solutions

Trial balance errors often include transposition mistakes, omission of ledger entries, and incorrect account balances, which can result in a mismatch between debit and credit totals. Adjusted trial balance errors typically arise from incorrect or missing adjustments such as accrued expenses, depreciation, and prepaid expenses, leading to inaccurate financial statements. Regular reconciliation, thorough review of journal entries, and use of accounting software can effectively identify and correct these common errors.

Trial balance vs Adjusted trial balance Infographic

bizdif.com

bizdif.com