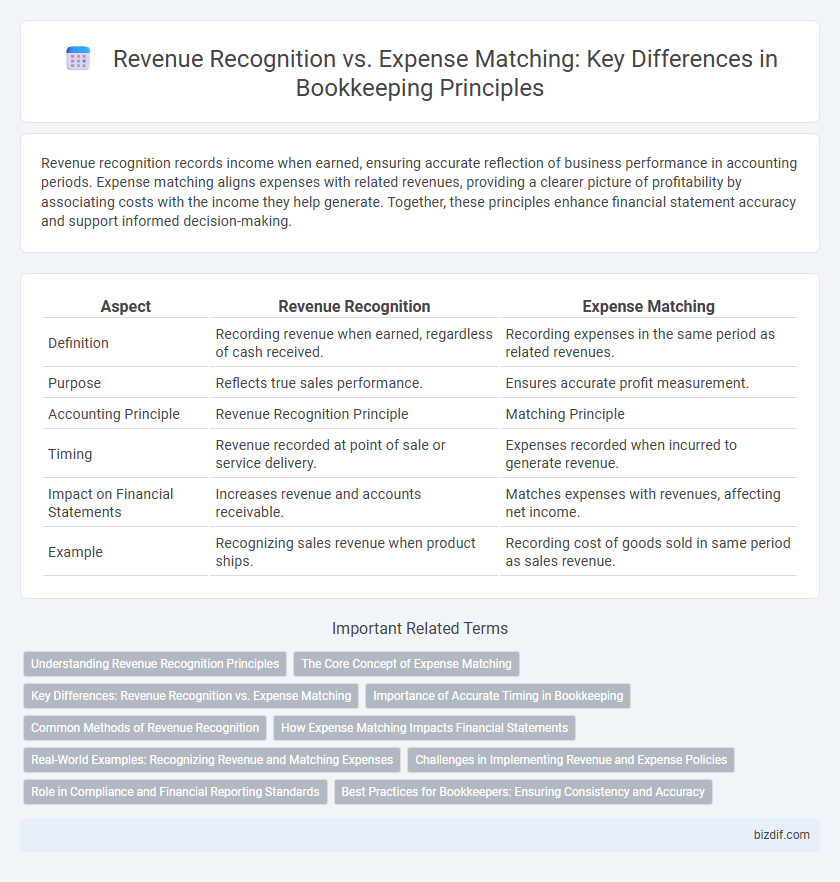

Revenue recognition records income when earned, ensuring accurate reflection of business performance in accounting periods. Expense matching aligns expenses with related revenues, providing a clearer picture of profitability by associating costs with the income they help generate. Together, these principles enhance financial statement accuracy and support informed decision-making.

Table of Comparison

| Aspect | Revenue Recognition | Expense Matching |

|---|---|---|

| Definition | Recording revenue when earned, regardless of cash received. | Recording expenses in the same period as related revenues. |

| Purpose | Reflects true sales performance. | Ensures accurate profit measurement. |

| Accounting Principle | Revenue Recognition Principle | Matching Principle |

| Timing | Revenue recorded at point of sale or service delivery. | Expenses recorded when incurred to generate revenue. |

| Impact on Financial Statements | Increases revenue and accounts receivable. | Matches expenses with revenues, affecting net income. |

| Example | Recognizing sales revenue when product ships. | Recording cost of goods sold in same period as sales revenue. |

Understanding Revenue Recognition Principles

Revenue recognition principles require recording revenue when it is earned, regardless of when cash is received, ensuring accurate reflection of a company's financial performance. This contrasts with expense matching, which aligns expenses with the revenues they help generate within the same accounting period. Understanding these principles is crucial for compliance with GAAP and for producing reliable financial statements that provide stakeholders with a clear view of business profitability.

The Core Concept of Expense Matching

The core concept of expense matching requires recording expenses in the same period as the revenues they help generate, ensuring accurate financial reporting. This principle aligns expenses directly with related revenues, providing a clear picture of business profitability within a specific accounting period. Accurate expense matching improves financial analysis, compliance with GAAP, and the overall reliability of income statements.

Key Differences: Revenue Recognition vs. Expense Matching

Revenue recognition records income when earned, aligning with accrual accounting principles, while expense matching allocates expenses to the same period as the related revenues for accurate profit measurement. The key difference lies in timing: revenue recognition emphasizes when revenue is realized, whereas expense matching ensures costs correspond to the revenue generation period. Together, these principles maintain financial statement accuracy and compliance with GAAP standards.

Importance of Accurate Timing in Bookkeeping

Accurate timing in bookkeeping ensures that revenue recognition aligns with the period in which earnings are realized, preventing overstated income. Expense matching accurately records costs in the same period as the corresponding revenues, improving financial statement reliability. Precise timing enhances financial analysis, regulatory compliance, and informed business decisions.

Common Methods of Revenue Recognition

Common methods of revenue recognition include the percentage-of-completion method, completed-contract method, and sales basis method, each aligning revenue recognition with the timing of service delivery or product transfer. The percentage-of-completion method recognizes revenue proportionally to the work completed, ideal for long-term projects, while the completed-contract method defers revenue recognition until the project finishes. These methods contrast with expense matching, which aligns expenses with the revenues they help generate to accurately reflect profitability within the same accounting period.

How Expense Matching Impacts Financial Statements

Expense matching directly impacts financial statements by ensuring expenses are recorded in the same period as the revenues they help generate, which provides a more accurate representation of a company's profitability. This matching principle prevents misleading financial results by avoiding the overstatement of earnings in one period and understatement in another. Accurate expense matching enhances the reliability of income statements and supports better decision-making by stakeholders.

Real-World Examples: Recognizing Revenue and Matching Expenses

Revenue recognition in bookkeeping involves recording income when it is earned, such as recognizing sales revenue at the point of delivery, while expense matching requires aligning costs with related revenues within the same period, exemplified by matching the cost of goods sold with corresponding sales. For instance, a software company recognizes subscription revenue over the service period and matches expenses like server costs accordingly. Retail businesses recognize revenue upon item sale and match expenses such as inventory cost and sales commissions to ensure accurate profit measurement.

Challenges in Implementing Revenue and Expense Policies

Implementing revenue recognition and expense matching policies presents challenges such as accurately timing the recording of income and costs to comply with GAAP standards and avoid misstated financial statements. Complexities arise from variable payment terms, multi-element contracts, and estimating accruals for expenses incurred but not yet invoiced. Ensuring proper documentation and robust internal controls is critical to address discrepancies and maintain audit readiness.

Role in Compliance and Financial Reporting Standards

Revenue recognition and expense matching are critical for compliance with GAAP and IFRS financial reporting standards, ensuring accurate reflection of financial performance. Revenue recognition dictates when income is recorded, aligning with earned revenue principles, while expense matching allocates costs to corresponding revenues in the same period. This alignment enhances transparency and accuracy in financial statements, supporting regulatory adherence and informed stakeholder decision-making.

Best Practices for Bookkeepers: Ensuring Consistency and Accuracy

Implementing best practices in revenue recognition and expense matching ensures consistency and accuracy in bookkeeping by adhering to established accounting principles such as GAAP or IFRS. Bookkeepers should systematically record revenues when earned and expenses when incurred, leveraging automated accounting software to minimize errors and maintain clear audit trails. Regular reconciliations and periodic reviews further enhance data integrity, supporting accurate financial reporting and informed business decisions.

Revenue recognition vs Expense matching Infographic

bizdif.com

bizdif.com