The trial balance is a summary of all ledger accounts showing their balances at a specific point in time to ensure that total debits equal total credits. The general ledger is the complete record of all financial transactions and individual account details for an organization. Accurate bookkeeping requires reconciling the trial balance with the general ledger to detect discrepancies and maintain financial integrity.

Table of Comparison

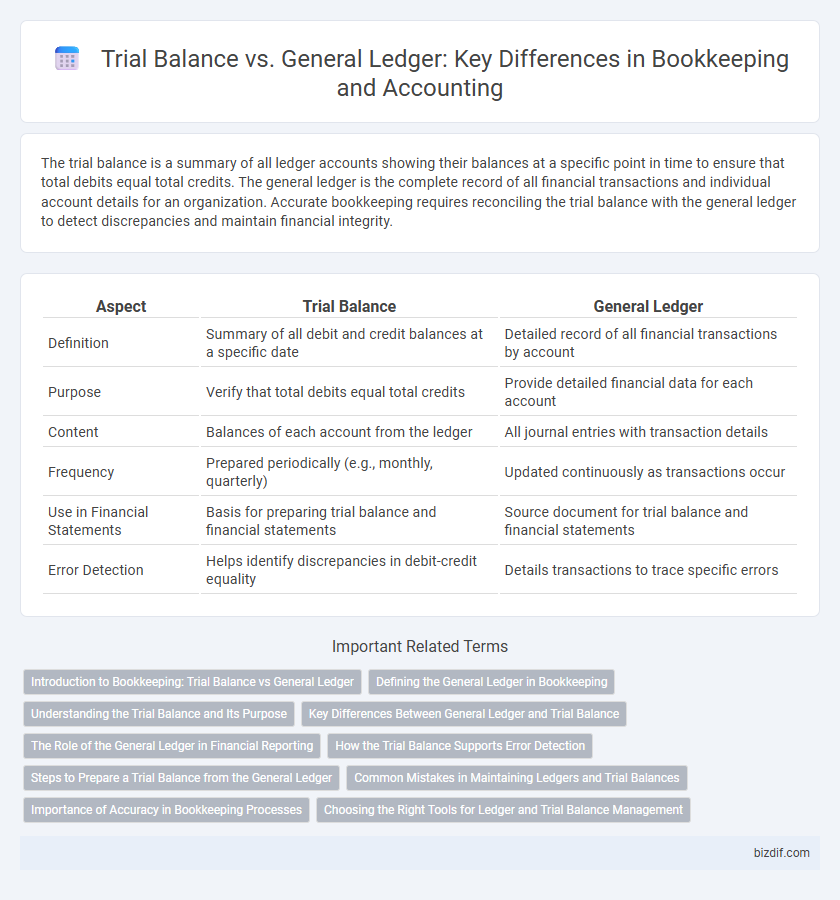

| Aspect | Trial Balance | General Ledger |

|---|---|---|

| Definition | Summary of all debit and credit balances at a specific date | Detailed record of all financial transactions by account |

| Purpose | Verify that total debits equal total credits | Provide detailed financial data for each account |

| Content | Balances of each account from the ledger | All journal entries with transaction details |

| Frequency | Prepared periodically (e.g., monthly, quarterly) | Updated continuously as transactions occur |

| Use in Financial Statements | Basis for preparing trial balance and financial statements | Source document for trial balance and financial statements |

| Error Detection | Helps identify discrepancies in debit-credit equality | Details transactions to trace specific errors |

Introduction to Bookkeeping: Trial Balance vs General Ledger

The trial balance serves as a summarized report that lists all ledger account balances to verify that total debits equal total credits, ensuring the accuracy of bookkeeping records. The general ledger is a detailed record of all financial transactions organized by accounts, providing comprehensive data for preparation of the trial balance. Understanding the distinction between the trial balance and general ledger is essential for maintaining organized, accurate financial statements in bookkeeping.

Defining the General Ledger in Bookkeeping

The General Ledger in bookkeeping serves as the central repository for all financial transactions recorded by a business, providing a comprehensive and organized compilation of accounts. Each account in the General Ledger includes detailed entries from various sources such as journals and sub-ledgers, ensuring accuracy and completeness in financial records. Maintaining an updated General Ledger is essential for preparing accurate financial statements and conducting effective audits.

Understanding the Trial Balance and Its Purpose

The trial balance is a crucial accounting report that consolidates all ledger account balances to verify the accuracy of bookkeeping entries. It ensures that total debits equal total credits, highlighting discrepancies before financial statements are prepared. By summarizing the general ledger accounts, the trial balance facilitates error detection and streamlines the financial closing process.

Key Differences Between General Ledger and Trial Balance

The general ledger is a comprehensive record of all financial transactions organized by accounts, while the trial balance is a summary report that lists the balances of all ledger accounts at a specific point in time. The general ledger provides detailed transaction data used for preparing financial statements, whereas the trial balance serves primarily as an accuracy check to ensure that total debits equal total credits. Key differences include the level of detail, with the general ledger containing granular entries and the trial balance presenting aggregated account balances for error detection.

The Role of the General Ledger in Financial Reporting

The General Ledger serves as the central repository for all financial transactions, aggregating data from various journals to provide a comprehensive record. It enables accurate financial reporting by organizing accounts and facilitating the preparation of key statements such as the balance sheet and income statement. Unlike the Trial Balance, which is a summary used to check the mathematical accuracy of ledger entries, the General Ledger holds detailed account-level information critical for in-depth financial analysis and auditing.

How the Trial Balance Supports Error Detection

The trial balance compiles all ledger account balances, enabling a quick check for arithmetic accuracy by ensuring total debits equal total credits. It highlights discrepancies like transposition errors or misposted entries, facilitating early identification of accounting mistakes. By summarizing the general ledger data, the trial balance serves as a crucial checkpoint before preparing financial statements.

Steps to Prepare a Trial Balance from the General Ledger

To prepare a trial balance from the general ledger, first extract all ledger account balances after posting journal entries. Next, list these balances in a trial balance worksheet, separating debits and credits to ensure accuracy. Finally, sum both columns to confirm that total debits equal total credits, verifying the ledger's balance and identifying any discrepancies.

Common Mistakes in Maintaining Ledgers and Trial Balances

Common mistakes in maintaining ledgers and trial balances include posting errors such as incorrect account entries or misclassified transactions, which lead to discrepancies between the general ledger and trial balance. Failure to regularly reconcile the trial balance with subsidiary ledgers results in undetected errors, impacting the accuracy of financial statements. Neglecting to record adjustments or failing to update ledger balances timely further causes imbalances and inaccurate financial reporting.

Importance of Accuracy in Bookkeeping Processes

Accurate bookkeeping hinges on the precise recording of financial data in both the general ledger and trial balance, ensuring the integrity of financial statements. The general ledger consolidates all transaction accounts, while the trial balance verifies that debits and credits are equal, serving as a critical checkpoint for error detection. Maintaining accuracy in these processes minimizes discrepancies, supports compliance with accounting standards, and enhances decision-making based on reliable financial information.

Choosing the Right Tools for Ledger and Trial Balance Management

Selecting the right tools for ledger and trial balance management enhances accuracy and efficiency in bookkeeping. Advanced accounting software integrates real-time ledger updates with automated trial balance generation, minimizing errors and saving time. Prioritizing solutions that offer seamless data synchronization and robust reporting features supports better financial decision-making.

Trial Balance vs General Ledger Infographic

bizdif.com

bizdif.com