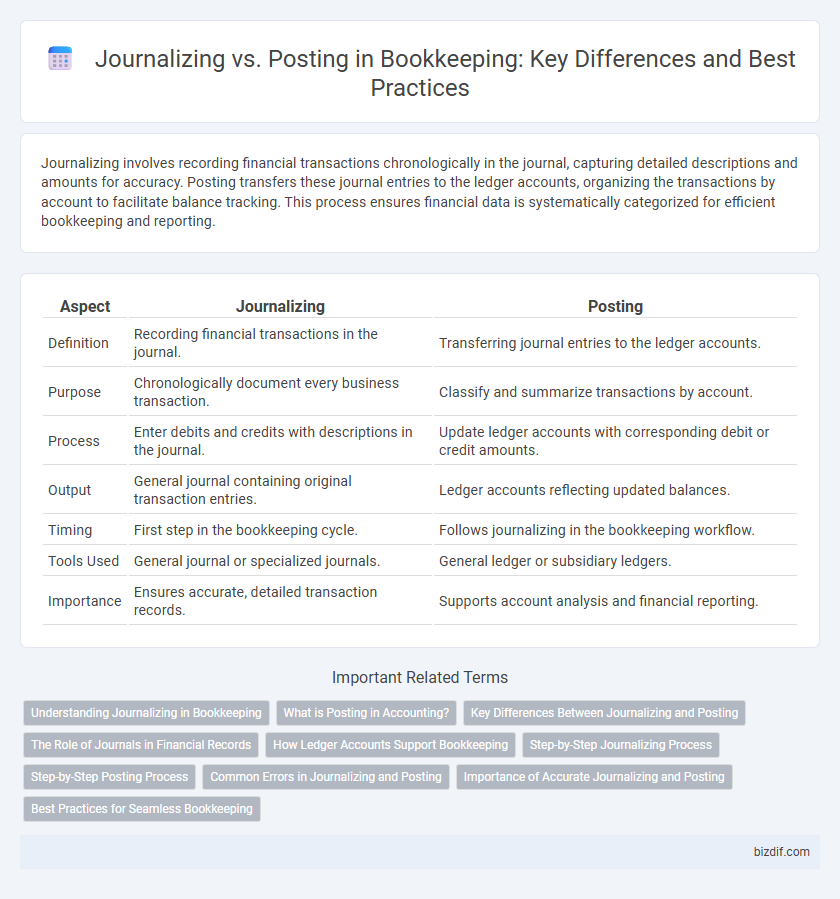

Journalizing involves recording financial transactions chronologically in the journal, capturing detailed descriptions and amounts for accuracy. Posting transfers these journal entries to the ledger accounts, organizing the transactions by account to facilitate balance tracking. This process ensures financial data is systematically categorized for efficient bookkeeping and reporting.

Table of Comparison

| Aspect | Journalizing | Posting |

|---|---|---|

| Definition | Recording financial transactions in the journal. | Transferring journal entries to the ledger accounts. |

| Purpose | Chronologically document every business transaction. | Classify and summarize transactions by account. |

| Process | Enter debits and credits with descriptions in the journal. | Update ledger accounts with corresponding debit or credit amounts. |

| Output | General journal containing original transaction entries. | Ledger accounts reflecting updated balances. |

| Timing | First step in the bookkeeping cycle. | Follows journalizing in the bookkeeping workflow. |

| Tools Used | General journal or specialized journals. | General ledger or subsidiary ledgers. |

| Importance | Ensures accurate, detailed transaction records. | Supports account analysis and financial reporting. |

Understanding Journalizing in Bookkeeping

Journalizing in bookkeeping involves recording all financial transactions systematically in the journal, the book of original entry. Each journal entry includes the date, accounts affected, debit and credit amounts, and a brief description, providing a detailed chronological record of business activities. Accurate journalizing is essential for maintaining financial integrity and ensuring that subsequent posting to the ledger reflects true financial data.

What is Posting in Accounting?

Posting in accounting is the process of transferring journal entries from the general journal to individual accounts in the general ledger. This step organizes financial data by categorizing transactions into specific accounts, allowing for accurate tracking of debits and credits. Effective posting ensures that financial statements reflect precise account balances for audit and reporting purposes.

Key Differences Between Journalizing and Posting

Journalizing involves recording financial transactions chronologically in the journal, providing a detailed account of each transaction. Posting transfers these journal entries into individual accounts in the ledger, organizing transactions by account to facilitate summary and reporting. The primary difference lies in journalizing capturing transaction details, while posting categorizes and summarizes these details for financial statement preparation.

The Role of Journals in Financial Records

Journals serve as the initial point for recording all financial transactions in chronological order, providing a detailed and organized log before entries are transferred to ledgers. Accurate journalizing ensures the integrity of financial data, which is crucial for maintaining reliable and audit-ready records. Posting these journal entries to the ledger allows businesses to summarize and categorize transactions, enabling effective financial analysis and reporting.

How Ledger Accounts Support Bookkeeping

Ledger accounts support bookkeeping by organizing and summarizing all financial transactions recorded during journalizing, making it easier to track account balances. Posting transfers journal entries into specific ledger accounts, enabling detailed analysis and reconciliation of financial data. These processes ensure accuracy in financial statements by maintaining a clear audit trail within the ledger system.

Step-by-Step Journalizing Process

The step-by-step journalizing process begins with identifying the financial transaction and determining the accounts affected, followed by analyzing whether each account is debited or credited according to accounting rules. Next, the transaction is recorded in the general journal with the date, accounts involved, debit and credit amounts, and a brief description. Accurate journalizing ensures that posting to the general ledger can be performed effectively, maintaining the integrity of financial records.

Step-by-Step Posting Process

The step-by-step posting process begins with transferring journal entries from the general journal to the general ledger accounts, ensuring accurate classification of transactions. Each entry is posted by recording the date, description, debit or credit amount, and reference number in the ledger to maintain chronological order and traceability. Regularly reconciling ledger balances after posting guarantees the accuracy and completeness of financial records for effective bookkeeping.

Common Errors in Journalizing and Posting

Common errors in journalizing include incorrect date entries, misclassifying accounts, and omitting transaction details, which can lead to inaccurate financial records. Posting mistakes often involve transferring amounts to the wrong ledger accounts or double-posting transactions, causing discrepancies between the journal and ledger. Ensuring accuracy in both journalizing and posting is critical for maintaining reliable financial statements and avoiding bookkeeping errors.

Importance of Accurate Journalizing and Posting

Accurate journalizing ensures that all financial transactions are recorded promptly and correctly, forming the foundation of reliable accounting records. Precise posting transfers these entries to the appropriate ledger accounts, enabling systematic tracking and analysis of financial data. Together, meticulous journalizing and posting prevent errors, support financial transparency, and facilitate effective decision-making in business operations.

Best Practices for Seamless Bookkeeping

Accurate journalizing lays the foundation for seamless bookkeeping by ensuring every financial transaction is recorded promptly with clear, detailed entries. Posting these journal entries to the general ledger should follow a consistent schedule to maintain real-time accuracy and enable effective financial analysis. Implementing regular reconciliations after posting reinforces data integrity, minimizes errors, and supports compliant financial reporting.

Journalizing vs Posting Infographic

bizdif.com

bizdif.com