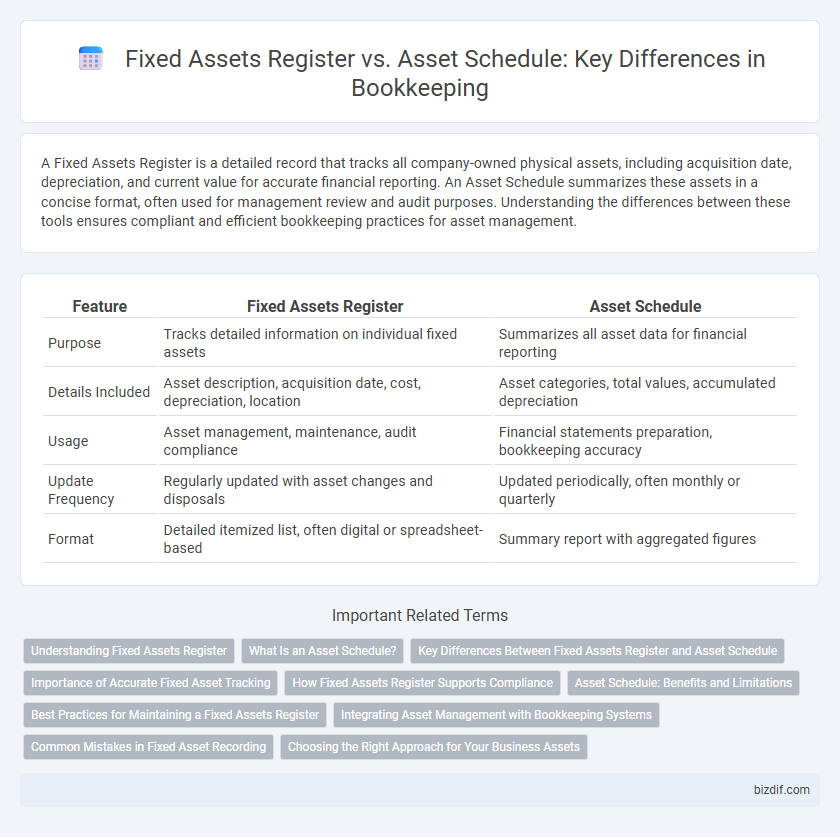

A Fixed Assets Register is a detailed record that tracks all company-owned physical assets, including acquisition date, depreciation, and current value for accurate financial reporting. An Asset Schedule summarizes these assets in a concise format, often used for management review and audit purposes. Understanding the differences between these tools ensures compliant and efficient bookkeeping practices for asset management.

Table of Comparison

| Feature | Fixed Assets Register | Asset Schedule |

|---|---|---|

| Purpose | Tracks detailed information on individual fixed assets | Summarizes all asset data for financial reporting |

| Details Included | Asset description, acquisition date, cost, depreciation, location | Asset categories, total values, accumulated depreciation |

| Usage | Asset management, maintenance, audit compliance | Financial statements preparation, bookkeeping accuracy |

| Update Frequency | Regularly updated with asset changes and disposals | Updated periodically, often monthly or quarterly |

| Format | Detailed itemized list, often digital or spreadsheet-based | Summary report with aggregated figures |

Understanding Fixed Assets Register

A Fixed Assets Register is a detailed record of a company's tangible fixed assets, capturing information such as acquisition date, cost, depreciation, and current value. This register helps businesses track asset location, manage depreciation schedules, and ensure compliance with accounting standards. Understanding the Fixed Assets Register is essential for accurate financial reporting and efficient asset management.

What Is an Asset Schedule?

An asset schedule is a detailed listing of all fixed assets owned by a business, including descriptions, acquisition dates, costs, and accumulated depreciation. Unlike a fixed assets register, which serves as a comprehensive record for asset management and compliance, the asset schedule primarily supports financial reporting and audit processes. Accurate asset schedules ensure precise calculation of depreciation expenses and aid in tracking asset value over time.

Key Differences Between Fixed Assets Register and Asset Schedule

The Fixed Assets Register provides a detailed record of all fixed assets including acquisition dates, cost, depreciation, and asset location, serving as a legal and financial control tool. In contrast, the Asset Schedule summarizes the total asset categories and values for financial reporting and audit purposes without granular details. Key differences include the Fixed Assets Register's emphasis on asset tracking and lifecycle management, whereas the Asset Schedule prioritizes aggregated reporting for balance sheet accuracy.

Importance of Accurate Fixed Asset Tracking

Accurate fixed asset tracking is essential for maintaining a reliable Fixed Assets Register and a detailed Asset Schedule, ensuring precise valuation and depreciation calculations. The Fixed Assets Register provides a comprehensive record of each asset's acquisition cost, location, and status, while the Asset Schedule organizes this data to support financial reporting and audit compliance. Proper management of these tools reduces errors, prevents asset loss, and enhances decision-making in bookkeeping and financial management.

How Fixed Assets Register Supports Compliance

A Fixed Assets Register supports compliance by maintaining detailed records of all fixed assets, including acquisition dates, cost, depreciation, and location, ensuring adherence to accounting standards and regulatory requirements. It provides audit trails required for accurate financial reporting and tax purposes, reducing the risk of errors or misstatements. Unlike an asset schedule, which summarizes asset values, the register offers granular data essential for regulatory inspections and internal controls.

Asset Schedule: Benefits and Limitations

An asset schedule provides a detailed list of all fixed assets, including purchase dates, depreciation methods, and current values, enabling precise tracking and financial reporting. Its benefits include streamlined audit processes, improved asset management, and easy identification of assets for maintenance or disposal. Limitations involve potential complexity in keeping the schedule updated and the risk of inaccuracies if data entry is not consistently monitored.

Best Practices for Maintaining a Fixed Assets Register

Maintaining a Fixed Assets Register requires consistent updates, accurate asset identification, and thorough documentation to ensure compliance with accounting standards. Unlike an Asset Schedule, which summarizes asset categories and values, the Fixed Assets Register provides detailed information such as acquisition date, depreciation method, and asset location, enabling precise tracking and audit readiness. Best practices include regular physical verifications, integration with accounting software, and timely recording of asset disposals or transfers to maintain data integrity.

Integrating Asset Management with Bookkeeping Systems

A Fixed Assets Register records detailed information about an organization's physical assets, including acquisition dates, values, depreciation, and location, ensuring accurate tracking and valuation for financial reporting. An Asset Schedule summarizes these assets in a format aligned with accounting periods, supporting depreciation calculations and balance sheet presentations. Integrating asset management systems with bookkeeping enhances accuracy, streamlines updates, and ensures compliance with accounting standards such as GAAP or IFRS.

Common Mistakes in Fixed Asset Recording

Common mistakes in fixed asset recording include failing to maintain an accurate Fixed Assets Register, leading to discrepancies in asset tracking and valuation. Confusing the Fixed Assets Register with the Asset Schedule often results in incomplete or inconsistent data, as the register should detail asset acquisition, depreciation, and disposal, while the schedule summarizes asset balances for financial reporting. Inaccurate recording impairs depreciation calculation and audit compliance, causing potential financial misstatements.

Choosing the Right Approach for Your Business Assets

A Fixed Assets Register provides a detailed, continuous record of all fixed assets, including acquisition dates, depreciation, and valuations, ideal for compliance and audit purposes. An Asset Schedule offers a summarized view of asset categories and values, suitable for financial reporting and budgeting. Selecting the right approach depends on your business size, regulatory requirements, and the level of detail needed for asset management and financial accuracy.

Fixed Assets Register vs Asset Schedule Infographic

bizdif.com

bizdif.com