Traditional bookkeepers manage financial records on-site, offering personalized service but often limited by office hours and physical presence. Virtual bookkeepers utilize cloud-based technology to provide flexible, real-time access to financial data from anywhere, enhancing efficiency and collaboration. Businesses increasingly prefer virtual bookkeeping for cost-effectiveness, scalability, and seamless integration with modern accounting software.

Table of Comparison

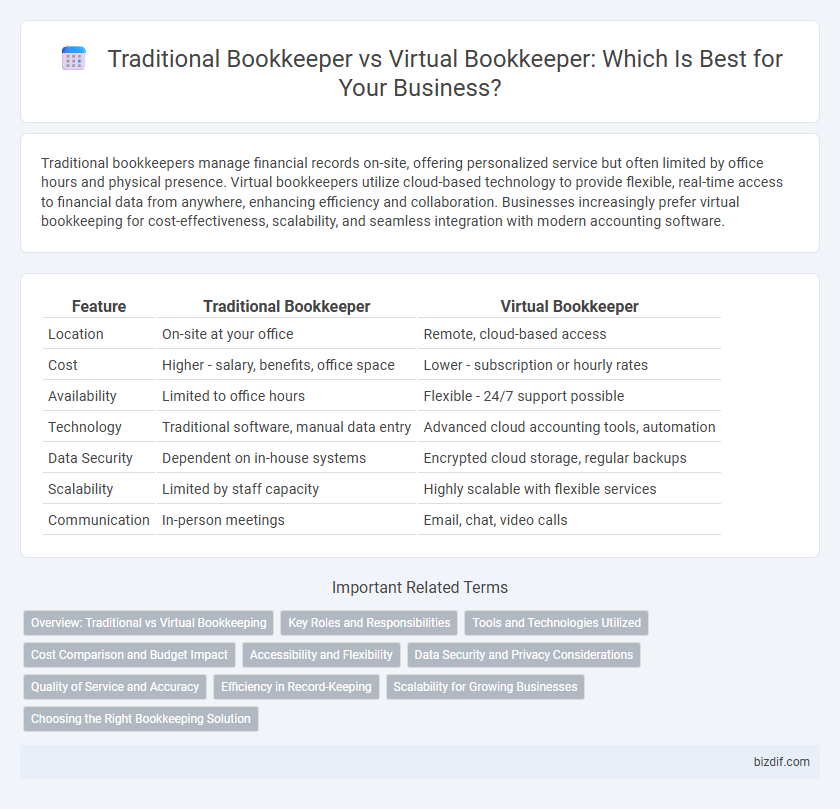

| Feature | Traditional Bookkeeper | Virtual Bookkeeper |

|---|---|---|

| Location | On-site at your office | Remote, cloud-based access |

| Cost | Higher - salary, benefits, office space | Lower - subscription or hourly rates |

| Availability | Limited to office hours | Flexible - 24/7 support possible |

| Technology | Traditional software, manual data entry | Advanced cloud accounting tools, automation |

| Data Security | Dependent on in-house systems | Encrypted cloud storage, regular backups |

| Scalability | Limited by staff capacity | Highly scalable with flexible services |

| Communication | In-person meetings | Email, chat, video calls |

Overview: Traditional vs Virtual Bookkeeping

Traditional bookkeeping involves physically managing financial records, often requiring on-site presence and paper-based documentation, which can limit accessibility and flexibility. Virtual bookkeeping utilizes cloud-based software and remote access, enabling real-time financial updates, enhanced collaboration, and cost efficiency for businesses. Both methods aim to maintain accurate financial records, but virtual bookkeeping offers scalability and integration with modern accounting tools.

Key Roles and Responsibilities

Traditional bookkeepers manage physical financial records, handle in-person transactions, and provide on-site support for tasks such as data entry, payroll processing, and reconciliation. Virtual bookkeepers perform similar duties remotely by utilizing cloud accounting software, offering real-time financial reporting, and supporting digital invoicing and payment processing. Both roles require accuracy in maintaining general ledgers, managing accounts payable and receivable, and ensuring compliance with financial regulations, but virtual bookkeepers emphasize technology-driven efficiency and accessibility.

Tools and Technologies Utilized

Traditional bookkeepers rely heavily on manual record-keeping methods and desktop accounting software such as QuickBooks Desktop or Sage 50, often requiring physical storage of paper documents. In contrast, virtual bookkeepers leverage cloud-based platforms like Xero, QuickBooks Online, and automation tools such as Receipt Bank and Hubdoc to streamline data entry and real-time financial tracking. The use of APIs and integration capabilities also enables virtual bookkeepers to connect multiple financial systems, enhancing accuracy and efficiency in bookkeeping tasks.

Cost Comparison and Budget Impact

Traditional bookkeepers typically involve higher overhead costs including office space, equipment, and employee benefits, resulting in greater overall expenses for businesses. Virtual bookkeepers leverage cloud-based software and remote access, significantly reducing fixed costs and offering flexible pricing models that align better with smaller or fluctuating budgets. This cost efficiency enables companies to allocate more resources toward growth initiatives while maintaining accurate financial records.

Accessibility and Flexibility

Traditional bookkeepers typically operate from a fixed physical location and adhere to standard business hours, which can limit accessibility and flexibility for clients. Virtual bookkeepers offer 24/7 availability through cloud-based platforms, enabling real-time access to financial data from any location worldwide. This flexibility allows businesses to manage bookkeeping tasks efficiently without geographical or time constraints.

Data Security and Privacy Considerations

Traditional bookkeepers typically manage physical records and onsite data storage, which may increase the risk of unauthorized access or data loss due to theft or natural disasters. Virtual bookkeepers rely on encrypted cloud-based platforms with multi-factor authentication, enhancing data security and ensuring privacy compliance with regulations like GDPR and HIPAA. Businesses must evaluate access controls, backup protocols, and vendor security certifications when choosing between these bookkeeping options.

Quality of Service and Accuracy

Traditional bookkeepers offer personalized, face-to-face interactions that can enhance communication clarity, but may lack the scalability and real-time data access found in virtual bookkeeping services. Virtual bookkeepers leverage cloud-based software and automation, improving accuracy through reduced manual errors and instant data synchronization. Quality of service in virtual bookkeeping is often elevated by continuous updates and remote accessibility, ensuring timely financial reporting and compliance.

Efficiency in Record-Keeping

Traditional bookkeepers rely on manual data entry and physical paperwork, which can slow down the record-keeping process and increase the risk of errors. Virtual bookkeepers use cloud-based accounting software, enabling real-time updates and automated data synchronization that significantly enhance accuracy and speed. This digital approach streamlines financial management, allowing businesses to access and analyze their records efficiently from anywhere.

Scalability for Growing Businesses

Traditional bookkeepers often face limitations in scalability due to fixed office hours and manual processes, making it challenging for growing businesses to manage increasing transaction volumes efficiently. Virtual bookkeepers leverage cloud-based software and automated tools, enabling seamless integration with multiple financial platforms and real-time data access, which supports rapid business expansion. Scalability in virtual bookkeeping allows companies to easily adjust service levels, handle complex financial operations, and reduce overhead costs compared to traditional methods.

Choosing the Right Bookkeeping Solution

Choosing the right bookkeeping solution depends on business size, budget, and technology preferences. Traditional bookkeepers offer personalized, face-to-face services with a deep understanding of local tax laws, while virtual bookkeepers provide cost-effective, cloud-based access and real-time financial updates from anywhere. Evaluating factors like data security, software integration, and response time ensures the selection aligns with operational needs and growth goals.

Traditional Bookkeeper vs Virtual Bookkeeper Infographic

bizdif.com

bizdif.com