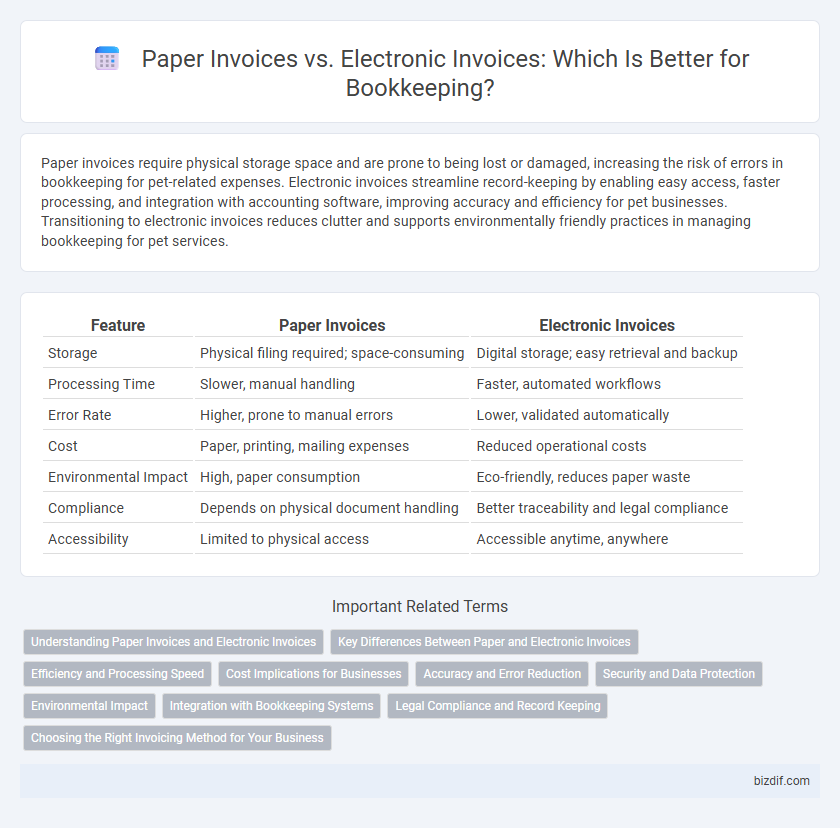

Paper invoices require physical storage space and are prone to being lost or damaged, increasing the risk of errors in bookkeeping for pet-related expenses. Electronic invoices streamline record-keeping by enabling easy access, faster processing, and integration with accounting software, improving accuracy and efficiency for pet businesses. Transitioning to electronic invoices reduces clutter and supports environmentally friendly practices in managing bookkeeping for pet services.

Table of Comparison

| Feature | Paper Invoices | Electronic Invoices |

|---|---|---|

| Storage | Physical filing required; space-consuming | Digital storage; easy retrieval and backup |

| Processing Time | Slower, manual handling | Faster, automated workflows |

| Error Rate | Higher, prone to manual errors | Lower, validated automatically |

| Cost | Paper, printing, mailing expenses | Reduced operational costs |

| Environmental Impact | High, paper consumption | Eco-friendly, reduces paper waste |

| Compliance | Depends on physical document handling | Better traceability and legal compliance |

| Accessibility | Limited to physical access | Accessible anytime, anywhere |

Understanding Paper Invoices and Electronic Invoices

Paper invoices are physical documents traditionally used for billing, requiring manual processing, storage, and retrieval, which can increase the risk of errors and delays in bookkeeping. Electronic invoices, or e-invoices, utilize digital formats that streamline data entry, enhance accuracy with automated integration into accounting software, and facilitate faster payment processing. Understanding the differences in handling, security, and compliance requirements between paper and electronic invoices is crucial for optimizing bookkeeping efficiency and maintaining accurate financial records.

Key Differences Between Paper and Electronic Invoices

Paper invoices involve physical documents that require manual processing, storage, and mailing, leading to higher costs and slower transaction times. Electronic invoices are digital, enabling automated data entry, faster delivery, and improved accuracy through integration with accounting software. The key differences include efficiency, environmental impact, and error reduction, with electronic invoicing offering streamlined workflows and real-time tracking capabilities.

Efficiency and Processing Speed

Electronic invoices significantly enhance bookkeeping efficiency by automating data entry and reducing manual errors, leading to faster processing speeds compared to traditional paper invoices. Digital formats enable instant transmission and real-time validation, cutting down invoice approval cycles and improving cash flow management. Businesses leveraging electronic invoicing benefit from streamlined workflows and lower administrative costs, accelerating overall financial operations.

Cost Implications for Businesses

Electronic invoices reduce costs significantly by eliminating paper, printing, and postage expenses associated with traditional paper invoices. Businesses adopting digital invoicing benefit from faster processing times and fewer errors, which decrease labor costs and improve cash flow management. Long-term savings also arise from reduced storage and retrieval costs linked to maintaining physical invoice records.

Accuracy and Error Reduction

Electronic invoices significantly enhance accuracy by minimizing manual data entry errors common in paper invoices, such as transcription mistakes and illegible handwriting. Automated systems validate invoice details in real-time, reducing discrepancies and streamlining reconciliation processes. This leads to more reliable financial records and decreases the time spent on error correction in bookkeeping workflows.

Security and Data Protection

Electronic invoices offer enhanced security features such as encryption and secure cloud storage, reducing the risk of unauthorized access compared to paper invoices which are vulnerable to physical loss or theft. Digital invoicing systems often include audit trails and access controls that ensure data integrity and compliance with regulations like GDPR and HIPAA. Maintaining electronic records also minimizes the chance of data breaches associated with paper handling and manual processing errors.

Environmental Impact

Paper invoices contribute significantly to deforestation and generate substantial waste, leading to increased carbon emissions from production and disposal processes. Electronic invoices reduce paper consumption, lower greenhouse gas emissions, and minimize landfill waste, supporting more sustainable business practices. Transitioning to digital invoicing platforms enhances environmental conservation efforts by decreasing reliance on physical resources.

Integration with Bookkeeping Systems

Electronic invoices streamline integration with bookkeeping systems through automated data entry, reducing errors and saving time. Paper invoices require manual input, increasing the risk of inaccuracies and slowing down financial workflows. Modern bookkeeping software often includes built-in support for electronic invoicing formats like XML or EDI, enhancing efficiency and data consistency.

Legal Compliance and Record Keeping

Electronic invoices streamline legal compliance by automatically capturing essential transaction data and ensuring adherence to digital record-keeping regulations such as GDPR and tax authority mandates. Paper invoices require meticulous physical storage and manual organization to meet legal retention periods, increasing the risk of loss or damage. Digital archiving enhances audit readiness and facilitates quick retrieval, significantly improving accuracy and efficiency in bookkeeping.

Choosing the Right Invoicing Method for Your Business

Selecting the appropriate invoicing method depends on your business size, transaction volume, and environmental goals; electronic invoices streamline bookkeeping, reduce errors, and speed up payment cycles. Paper invoices may suit small businesses with low transaction counts or clients preferring hard copies, yet they increase risks of loss and processing delays. Integrating electronic invoicing software enhances financial accuracy, supports compliance with tax regulations, and offers scalable solutions for future growth.

Paper Invoices vs Electronic Invoices Infographic

bizdif.com

bizdif.com