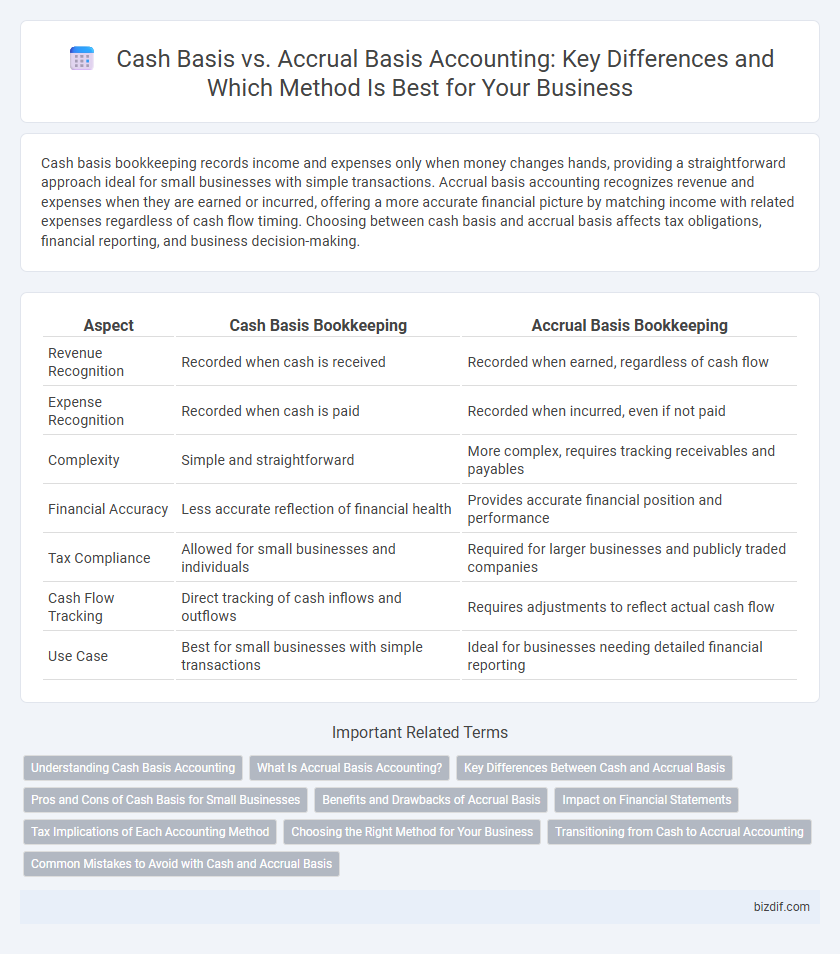

Cash basis bookkeeping records income and expenses only when money changes hands, providing a straightforward approach ideal for small businesses with simple transactions. Accrual basis accounting recognizes revenue and expenses when they are earned or incurred, offering a more accurate financial picture by matching income with related expenses regardless of cash flow timing. Choosing between cash basis and accrual basis affects tax obligations, financial reporting, and business decision-making.

Table of Comparison

| Aspect | Cash Basis Bookkeeping | Accrual Basis Bookkeeping |

|---|---|---|

| Revenue Recognition | Recorded when cash is received | Recorded when earned, regardless of cash flow |

| Expense Recognition | Recorded when cash is paid | Recorded when incurred, even if not paid |

| Complexity | Simple and straightforward | More complex, requires tracking receivables and payables |

| Financial Accuracy | Less accurate reflection of financial health | Provides accurate financial position and performance |

| Tax Compliance | Allowed for small businesses and individuals | Required for larger businesses and publicly traded companies |

| Cash Flow Tracking | Direct tracking of cash inflows and outflows | Requires adjustments to reflect actual cash flow |

| Use Case | Best for small businesses with simple transactions | Ideal for businesses needing detailed financial reporting |

Understanding Cash Basis Accounting

Cash basis accounting records revenues and expenses only when cash is received or paid, providing a straightforward and real-time view of cash flow for small businesses and sole proprietors. This method simplifies tax preparation by recognizing income strictly upon receipt and expenses upon payment, aligning with actual cash movement. Understanding cash basis accounting helps businesses maintain accurate records that reflect immediate financial status without tracking accounts receivable or payable.

What Is Accrual Basis Accounting?

Accrual basis accounting records revenues and expenses when they are earned or incurred, regardless of when cash transactions occur. This method provides a more accurate financial picture by matching income and expenses to the relevant accounting periods. It is widely used by businesses to comply with Generally Accepted Accounting Principles (GAAP) and improve financial decision-making.

Key Differences Between Cash and Accrual Basis

Cash basis accounting records revenue and expenses only when cash is exchanged, providing a straightforward method ideal for small businesses with simple transactions. Accrual basis accounting recognizes income and expenses when they are earned or incurred, regardless of cash flow, offering a more accurate financial picture for larger businesses with complex operations. Key differences include timing of recognition, impact on financial statements, and tax implications, with accrual basis aligning better with GAAP standards.

Pros and Cons of Cash Basis for Small Businesses

Cash basis bookkeeping offers simplicity and straightforward tracking of cash flow, making it ideal for small businesses with limited transactions and simpler financial operations. However, it may not provide an accurate financial picture during periods of credit sales or large receivables, potentially leading to misleading profit reporting. This method also limits expense recognition to when payments occur, which can affect tax planning and financial decision-making.

Benefits and Drawbacks of Accrual Basis

Accrual basis bookkeeping records revenues and expenses when they are incurred, providing a more accurate financial picture of business performance and financial position. This method benefits companies by matching income and expenses to the relevant accounting periods, improving decision-making and compliance with GAAP standards. However, accrual accounting can be complex to implement, requires detailed record-keeping, and may obscure actual cash flow, complicating short-term liquidity management.

Impact on Financial Statements

Cash basis accounting records revenues and expenses only when cash is received or paid, resulting in financial statements that may not reflect all earned revenues or incurred expenses within a period. Accrual basis accounting recognizes revenues and expenses when they are earned or incurred, providing a more accurate representation of a company's financial position and performance. This distinction critically impacts income statements and balance sheets by influencing reported net income and accounts receivable or payable balances.

Tax Implications of Each Accounting Method

Cash basis accounting reports income and expenses when cash changes hands, simplifying tax reporting but potentially deferring taxable income or deductions. Accrual basis accounting recognizes revenue and expenses when earned or incurred, aligning with GAAP standards and providing a more accurate financial picture for tax purposes. The IRS allows small businesses to choose either method, but switching between methods requires formal approval, impacting tax planning and compliance.

Choosing the Right Method for Your Business

Selecting between cash basis and accrual basis accounting depends on your business size, complexity, and financial reporting needs. Cash basis offers simplicity with revenue and expenses recorded only when money changes hands, ideal for small businesses with straightforward transactions. Accrual basis provides a more accurate financial picture by recording income and expenses when they are earned or incurred, essential for businesses managing inventory or seeking external financing.

Transitioning from Cash to Accrual Accounting

Transitioning from cash basis to accrual basis accounting improves financial accuracy by recognizing revenues and expenses when they are earned or incurred, rather than when cash changes hands. This shift involves adjusting accounts receivable, accounts payable, and inventory to reflect true financial positions, ensuring compliance with Generally Accepted Accounting Principles (GAAP). Businesses often implement accounting software capable of handling accrual entries to streamline the transition and maintain detailed financial records.

Common Mistakes to Avoid with Cash and Accrual Basis

Common mistakes to avoid with cash basis bookkeeping include failing to record transactions when cash changes hands, leading to inaccurate financial reports that do not reflect outstanding receivables or payables. In accrual basis accounting, errors often occur by neglecting to match revenues with related expenses in the correct period, resulting in misleading profit or loss figures. Both methods require diligent tracking of timing differences to ensure compliance with accounting principles and accurate financial statements.

Cash Basis vs Accrual Basis Infographic

bizdif.com

bizdif.com