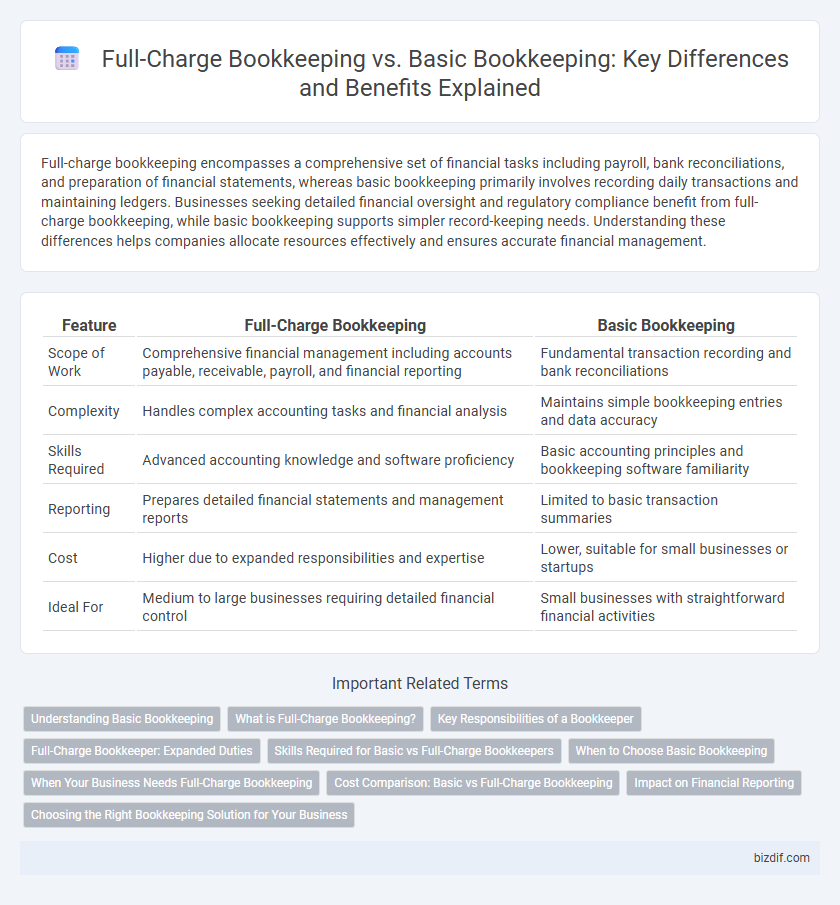

Full-charge bookkeeping encompasses a comprehensive set of financial tasks including payroll, bank reconciliations, and preparation of financial statements, whereas basic bookkeeping primarily involves recording daily transactions and maintaining ledgers. Businesses seeking detailed financial oversight and regulatory compliance benefit from full-charge bookkeeping, while basic bookkeeping supports simpler record-keeping needs. Understanding these differences helps companies allocate resources effectively and ensures accurate financial management.

Table of Comparison

| Feature | Full-Charge Bookkeeping | Basic Bookkeeping |

|---|---|---|

| Scope of Work | Comprehensive financial management including accounts payable, receivable, payroll, and financial reporting | Fundamental transaction recording and bank reconciliations |

| Complexity | Handles complex accounting tasks and financial analysis | Maintains simple bookkeeping entries and data accuracy |

| Skills Required | Advanced accounting knowledge and software proficiency | Basic accounting principles and bookkeeping software familiarity |

| Reporting | Prepares detailed financial statements and management reports | Limited to basic transaction summaries |

| Cost | Higher due to expanded responsibilities and expertise | Lower, suitable for small businesses or startups |

| Ideal For | Medium to large businesses requiring detailed financial control | Small businesses with straightforward financial activities |

Understanding Basic Bookkeeping

Basic bookkeeping involves recording daily financial transactions such as sales, purchases, receipts, and payments, providing a foundational record for businesses. It ensures accuracy in tracking income and expenses, essential for maintaining clear financial statements and tax filings. Understanding basic bookkeeping enables small business owners to manage cash flow effectively without the complexity of advanced accounting processes.

What is Full-Charge Bookkeeping?

Full-charge bookkeeping involves managing all aspects of a company's financial record-keeping, including accounts payable and receivable, payroll processing, bank reconciliations, and financial statement preparation. This comprehensive role requires a deep understanding of accounting principles, tax regulations, and financial reporting standards to ensure complete and accurate financial data management. Unlike basic bookkeeping, which primarily focuses on transaction recording and ledger maintenance, full-charge bookkeeping provides a broader scope, enabling businesses to rely on one professional for end-to-end financial oversight.

Key Responsibilities of a Bookkeeper

Full-Charge Bookkeeping encompasses managing comprehensive accounting tasks, including accounts payable and receivable, payroll processing, bank reconciliations, financial reporting, and tax preparation. Basic Bookkeeping primarily involves recording daily financial transactions and maintaining ledgers. Key responsibilities of a bookkeeper vary from recording journal entries to preparing trial balances, with full-charge bookkeepers handling more advanced duties like managing payroll and generating financial statements.

Full-Charge Bookkeeper: Expanded Duties

A full-charge bookkeeper handles comprehensive financial tasks including accounts payable and receivable, payroll processing, and financial statement preparation, ensuring accurate and timely reporting for business decisions. They often manage tax filings and compliance, providing a broader scope of service than basic bookkeeping which focuses primarily on transaction recording and bank reconciliations. This expanded role supports small to mid-sized businesses by bridging the gap between bookkeeping and accounting functions, enhancing internal financial control and insight.

Skills Required for Basic vs Full-Charge Bookkeepers

Basic bookkeeping requires fundamental skills such as recording transactions, maintaining ledgers, and reconciling accounts, focusing on accuracy and detail orientation. Full-charge bookkeeping demands advanced skills including managing payroll, preparing tax filings, generating financial statements, and overseeing accounts payable and receivable, often requiring proficiency in accounting software like QuickBooks or Xero. The contrast highlights that full-charge bookkeepers serve as comprehensive financial managers for small businesses, while basic bookkeepers handle routine financial record-keeping tasks.

When to Choose Basic Bookkeeping

Basic bookkeeping is ideal for small businesses with straightforward financial transactions and limited accounting needs, as it covers essential tasks like recording daily sales, expenses, and bank reconciliations. Choosing basic bookkeeping helps maintain accurate financial records without the complexity or cost associated with full-charge bookkeeping, which includes payroll, tax filings, and financial reporting. Startups and sole proprietors often benefit from basic bookkeeping to ensure compliance and simplify tax preparation during early growth stages.

When Your Business Needs Full-Charge Bookkeeping

Full-charge bookkeeping is essential for businesses experiencing rapid growth or increased transaction volume, requiring comprehensive financial management beyond basic data entry and reconciliation. This service includes managing payroll, preparing financial statements, and ensuring compliance with tax regulations, providing a more detailed and strategic approach to accounting. When accuracy, real-time financial insights, and regulatory adherence become critical, full-charge bookkeeping supports informed decision-making and operational efficiency.

Cost Comparison: Basic vs Full-Charge Bookkeeping

Basic bookkeeping services typically cost between $20 to $50 per hour, covering essential tasks like data entry and reconciliations. Full-charge bookkeeping averages $40 to $70 per hour but includes comprehensive financial reporting, payroll processing, and tax preparation support. Investing in full-charge bookkeeping can save money long-term by reducing errors and improving financial insights, despite higher upfront costs.

Impact on Financial Reporting

Full-charge bookkeeping provides comprehensive financial management, including payroll, tax filings, and detailed account reconciliations, which leads to more accurate and timely financial reporting. Basic bookkeeping typically involves recording daily transactions without in-depth analysis, resulting in limited insight for financial decision-making. The enhanced data accuracy and completeness from full-charge bookkeeping significantly improve the reliability of financial statements and overall business performance assessment.

Choosing the Right Bookkeeping Solution for Your Business

Full-charge bookkeeping offers comprehensive financial management, including payroll, tax preparation, and detailed reporting, while basic bookkeeping primarily focuses on recording transactions and maintaining financial records. Selecting the right bookkeeping solution depends on your business's size, complexity, and specific financial reporting needs. Investing in full-charge bookkeeping can streamline operations and ensure compliance, whereas basic bookkeeping suits smaller businesses with simpler accounting requirements.

Full-Charge Bookkeeping vs Basic Bookkeeping Infographic

bizdif.com

bizdif.com