Manual bookkeeping involves recording financial transactions by hand, which can be time-consuming and prone to human error, particularly for pet businesses managing numerous expenses and sales. Cloud bookkeeping offers real-time access to data, automated updates, and seamless integration with other financial tools, simplifying financial management for pet service providers. Choosing cloud bookkeeping enhances accuracy, improves efficiency, and provides scalable solutions tailored to the unique needs of pet-related businesses.

Table of Comparison

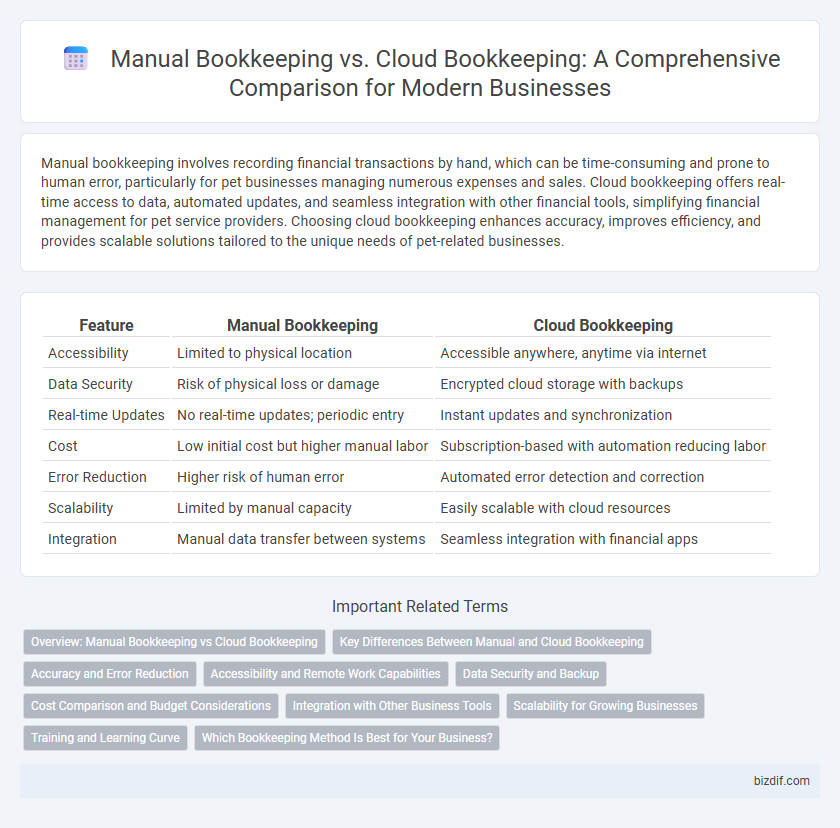

| Feature | Manual Bookkeeping | Cloud Bookkeeping |

|---|---|---|

| Accessibility | Limited to physical location | Accessible anywhere, anytime via internet |

| Data Security | Risk of physical loss or damage | Encrypted cloud storage with backups |

| Real-time Updates | No real-time updates; periodic entry | Instant updates and synchronization |

| Cost | Low initial cost but higher manual labor | Subscription-based with automation reducing labor |

| Error Reduction | Higher risk of human error | Automated error detection and correction |

| Scalability | Limited by manual capacity | Easily scalable with cloud resources |

| Integration | Manual data transfer between systems | Seamless integration with financial apps |

Overview: Manual Bookkeeping vs Cloud Bookkeeping

Manual bookkeeping involves recording financial transactions by hand using physical ledgers, which can be time-consuming and prone to errors. Cloud bookkeeping utilizes online software to automate data entry, provide real-time access, and streamline collaboration across devices. Businesses benefit from cloud solutions through enhanced accuracy, scalability, and integration with other financial tools.

Key Differences Between Manual and Cloud Bookkeeping

Manual bookkeeping involves recording financial transactions by hand in physical ledgers, which increases the risk of errors and requires more time for data entry and reconciliation. Cloud bookkeeping leverages online software platforms, offering real-time access, automated data backups, and seamless integration with other financial tools for enhanced accuracy and efficiency. Key differences include the level of automation, ease of collaboration, data security, and scalability between the two methods.

Accuracy and Error Reduction

Manual bookkeeping requires meticulous data entry and frequent cross-checking to minimize errors, but it remains susceptible to human mistakes such as transcription errors and miscalculations. Cloud bookkeeping software leverages automation and real-time data validation, significantly enhancing accuracy and reducing the risk of errors through built-in checks and integration capabilities. The use of cloud solutions facilitates instant updates and error tracking, leading to more reliable financial records compared to traditional manual methods.

Accessibility and Remote Work Capabilities

Manual bookkeeping limits accessibility to physical locations and restricts collaboration, as records are stored in paper form or local servers. Cloud bookkeeping enhances remote work capabilities by allowing real-time access to financial data from any device with internet connectivity, facilitating seamless collaboration among teams and accountants. The cloud-based approach supports automatic backups and updates, reducing the risk of data loss and ensuring up-to-date information is available at all times.

Data Security and Backup

Manual bookkeeping relies on physical records stored on-site, increasing the risk of data loss from theft, fire, or natural disasters due to the lack of automatic backup systems. Cloud bookkeeping employs encrypted storage and regular automated backups across multiple servers, significantly enhancing data security and ensuring swift recovery in case of data breaches or hardware failures. Businesses adopting cloud solutions benefit from real-time access and secure data redundancy, reducing vulnerabilities compared to traditional manual methods.

Cost Comparison and Budget Considerations

Manual bookkeeping often incurs higher long-term costs due to expenses for physical supplies, increased labor hours, and potential for human error affecting financial accuracy. Cloud bookkeeping reduces upfront investment by leveraging subscription-based software, minimizing paper use, and automating data entry, which leads to cost-efficiency and scalability for small businesses. Budget considerations favor cloud solutions for their low maintenance fees and real-time access, offering better control over financial resources compared to traditional manual methods.

Integration with Other Business Tools

Manual bookkeeping often lacks seamless integration with other business tools, requiring more time-consuming data entry and increasing the risk of errors. Cloud bookkeeping platforms typically offer automatic syncing with accounting software, CRM systems, and payroll services, streamlining workflow and enhancing data accuracy. This integration enables real-time financial reporting and improved collaboration across departments, boosting overall business efficiency.

Scalability for Growing Businesses

Manual bookkeeping limits scalability due to time-intensive data entry and increased risk of errors as transaction volumes grow. Cloud bookkeeping offers automated processes and real-time data access, enabling seamless scaling for expanding businesses. Integration with other cloud-based tools enhances financial management efficiency, supporting business growth.

Training and Learning Curve

Manual bookkeeping requires extensive training to master traditional accounting methods and ledger management, often demanding proficiency in physical documentation and manual calculations. Cloud bookkeeping platforms streamline learning with intuitive interfaces, automated processes, and integrated tutorials, significantly reducing the time needed to achieve competency. Businesses leveraging cloud solutions benefit from real-time updates and scalable training resources that accelerate skill acquisition compared to conventional manual systems.

Which Bookkeeping Method Is Best for Your Business?

Choosing the best bookkeeping method depends on your business size, budget, and need for real-time data access; manual bookkeeping suits small operations with simple transactions and limited technology use, while cloud bookkeeping offers scalability, automated updates, and remote access ideal for growing businesses. Cloud bookkeeping platforms like QuickBooks Online and Xero enhance accuracy and collaboration with accountants through synchronized data and integrated financial tools. Evaluate your business's complexity and prefer workflow automation to decide, as cloud solutions typically improve efficiency but require internet connectivity and some technical proficiency.

Manual Bookkeeping vs Cloud Bookkeeping Infographic

bizdif.com

bizdif.com