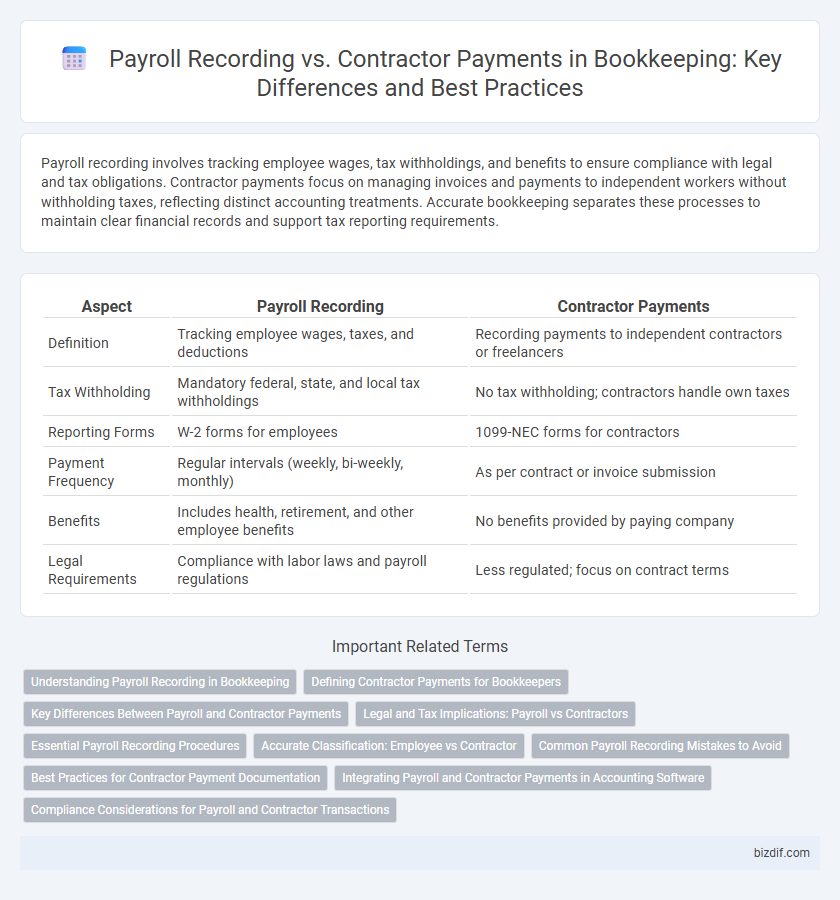

Payroll recording involves tracking employee wages, tax withholdings, and benefits to ensure compliance with legal and tax obligations. Contractor payments focus on managing invoices and payments to independent workers without withholding taxes, reflecting distinct accounting treatments. Accurate bookkeeping separates these processes to maintain clear financial records and support tax reporting requirements.

Table of Comparison

| Aspect | Payroll Recording | Contractor Payments |

|---|---|---|

| Definition | Tracking employee wages, taxes, and deductions | Recording payments to independent contractors or freelancers |

| Tax Withholding | Mandatory federal, state, and local tax withholdings | No tax withholding; contractors handle own taxes |

| Reporting Forms | W-2 forms for employees | 1099-NEC forms for contractors |

| Payment Frequency | Regular intervals (weekly, bi-weekly, monthly) | As per contract or invoice submission |

| Benefits | Includes health, retirement, and other employee benefits | No benefits provided by paying company |

| Legal Requirements | Compliance with labor laws and payroll regulations | Less regulated; focus on contract terms |

Understanding Payroll Recording in Bookkeeping

Payroll recording in bookkeeping involves accurately tracking employee wages, taxes, deductions, and benefits to ensure compliance with tax regulations and financial reporting standards. This process requires detailed documentation of employee hours, gross pay, withholdings for Social Security, Medicare, and income taxes, along with employer contributions. Proper payroll recording helps maintain clear financial records, simplifies tax filings, and prevents legal issues related to employee compensation.

Defining Contractor Payments for Bookkeepers

Contractor payments refer to the compensation paid to independent contractors for services rendered, which differs from regular payroll wages subjected to tax withholdings and employee benefits. Bookkeepers must accurately record contractor payments by tracking invoices, payment dates, and tax forms such as 1099-MISC or 1099-NEC to ensure proper tax reporting and compliance. These payments are typically classified under accounts payable or contractor expense categories, distinct from employee payroll expenses in the accounting records.

Key Differences Between Payroll and Contractor Payments

Payroll recording involves tracking wages, tax withholdings, and employee benefits for salaried or hourly workers, ensuring compliance with payroll tax regulations. Contractor payments pertain to non-employee service providers, requiring issuance of 1099 forms without payroll tax withholdings, reflecting their status as independent entities. Key differences include tax withholding obligations, reporting requirements, and the legal relationship between employer and worker.

Legal and Tax Implications: Payroll vs Contractors

Payroll recording requires strict adherence to employment tax regulations, including withholding income taxes, Social Security, and Medicare contributions, which employers must accurately report to tax authorities. Contractor payments bypass payroll taxes but demand careful classification to avoid misclassification penalties, as contractors are responsible for their own tax filings and Social Security contributions. Misclassifying employees as contractors can result in significant legal and financial repercussions, including back taxes, fines, and enforcement actions by the IRS or labor departments.

Essential Payroll Recording Procedures

Essential payroll recording procedures involve accurately tracking employee hours, calculating wages, withholding taxes, and ensuring compliance with labor laws. Payroll records must include detailed documentation of salaries, bonuses, tax withholdings, benefit deductions, and employer contributions to social security and Medicare. In contrast, contractor payments do not require tax withholding but must be documented separately with Form 1099-NEC issued for independent contractors, highlighting the distinction in bookkeeping treatment.

Accurate Classification: Employee vs Contractor

Accurate classification of payroll recording and contractor payments is essential for compliance with tax regulations and labor laws. Payroll recording involves documenting wages, taxes, and benefits for employees, whereas contractor payments track invoices and fees paid to independent contractors without withholding taxes. Misclassification can lead to costly penalties, making precise distinction between employees and contractors crucial in bookkeeping practices.

Common Payroll Recording Mistakes to Avoid

Common payroll recording mistakes include misclassifying employees as contractors, failing to accurately track hours worked, and neglecting to record payroll taxes and deductions properly. These errors can lead to compliance issues, inaccurate financial statements, and potential IRS penalties. Implementing detailed time tracking, proper employee classification, and regular payroll audits helps maintain accurate and compliant bookkeeping records.

Best Practices for Contractor Payment Documentation

Maintaining clear and accurate contractor payment documentation is essential for compliance and tax purposes, involving detailed records such as invoices, contracts, payment dates, and amounts. Unlike payroll recording, contractor payments require tracking independent contractor status to avoid misclassification and potential legal issues. Best practices include verifying contractor credentials, using standardized payment forms, and retaining all related correspondence to ensure transparency and audit readiness.

Integrating Payroll and Contractor Payments in Accounting Software

Integrating payroll recording and contractor payments in accounting software streamlines financial management by consolidating employee wages and independent contractor fees in a single platform. This integration ensures accurate tax compliance, reduces errors in payment processing, and provides comprehensive reporting for both payroll taxes and contractor liabilities. Utilizing software with dedicated modules for payroll and contractor payments facilitates real-time tracking and enhances audit readiness by maintaining clear, organized records.

Compliance Considerations for Payroll and Contractor Transactions

Payroll recording must comply with tax regulations, employment laws, and reporting requirements to ensure accurate withholding of income taxes, Social Security, and Medicare contributions. Contractor payments require adherence to IRS guidelines, including proper classification as independent contractors and issuance of Form 1099-MISC for transactions exceeding $600 annually. Misclassification risks penalties, making it crucial to maintain detailed records distinguishing payroll from contractor expenses for audit readiness and regulatory compliance.

Payroll Recording vs Contractor Payments Infographic

bizdif.com

bizdif.com