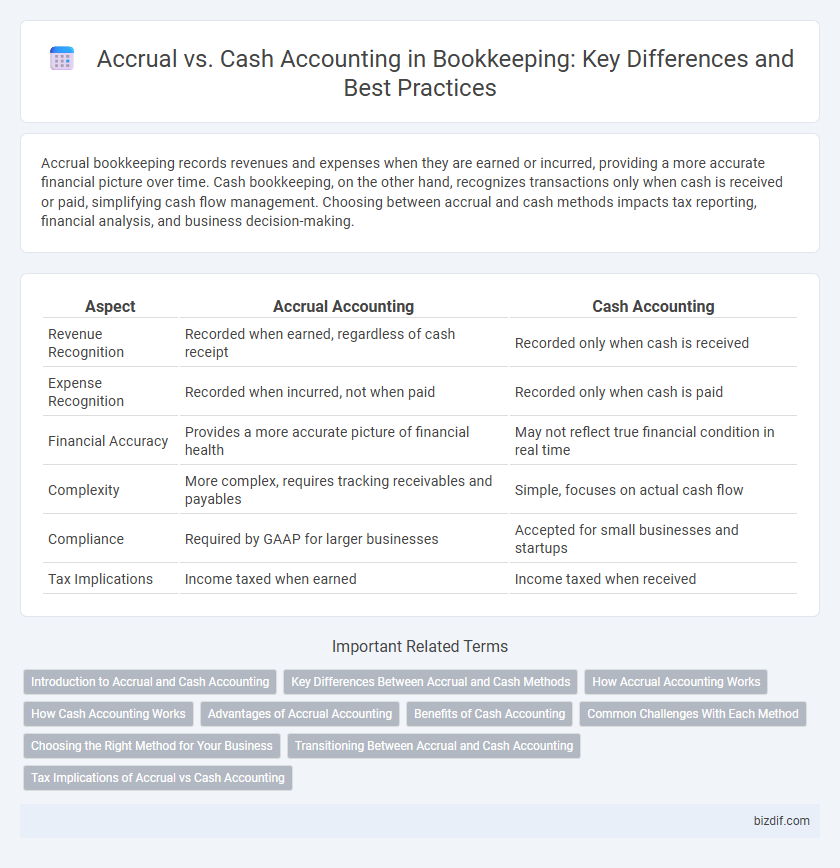

Accrual bookkeeping records revenues and expenses when they are earned or incurred, providing a more accurate financial picture over time. Cash bookkeeping, on the other hand, recognizes transactions only when cash is received or paid, simplifying cash flow management. Choosing between accrual and cash methods impacts tax reporting, financial analysis, and business decision-making.

Table of Comparison

| Aspect | Accrual Accounting | Cash Accounting |

|---|---|---|

| Revenue Recognition | Recorded when earned, regardless of cash receipt | Recorded only when cash is received |

| Expense Recognition | Recorded when incurred, not when paid | Recorded only when cash is paid |

| Financial Accuracy | Provides a more accurate picture of financial health | May not reflect true financial condition in real time |

| Complexity | More complex, requires tracking receivables and payables | Simple, focuses on actual cash flow |

| Compliance | Required by GAAP for larger businesses | Accepted for small businesses and startups |

| Tax Implications | Income taxed when earned | Income taxed when received |

Introduction to Accrual and Cash Accounting

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash flow, providing a more accurate financial picture over specific periods. Cash accounting recognizes transactions only when cash is exchanged, offering simplicity but potentially misrepresenting financial health. Businesses often choose accrual for compliance with GAAP and detailed analysis, while small enterprises prefer cash accounting for straightforward cash flow tracking.

Key Differences Between Accrual and Cash Methods

Accrual bookkeeping records revenues and expenses when they are earned or incurred, providing a more accurate financial picture by matching income with related costs. Cash bookkeeping records transactions only when cash changes hands, offering simplicity but less precise timing of financial events. Key differences include timing of revenue recognition, expense recording, and impact on financial reporting and tax obligations.

How Accrual Accounting Works

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of when cash transactions occur, providing a more accurate financial picture. This method recognizes accounts receivable and accounts payable, ensuring that financial statements reflect all obligations and income within an accounting period. Businesses adopting accrual accounting comply with Generally Accepted Accounting Principles (GAAP), improving consistency and comparability in financial reporting.

How Cash Accounting Works

Cash accounting records revenues and expenses only when money changes hands, providing a straightforward view of cash flow for small businesses. Income is recognized when payments are received, and expenses are logged at the time they are paid, simplifying tax reporting and financial tracking. This method offers clear liquidity insights but may not reflect the true financial position during periods of credit transactions.

Advantages of Accrual Accounting

Accrual accounting provides a more accurate financial picture by recording revenues and expenses when they are earned or incurred, regardless of cash flow timing. This method enhances financial decision-making by matching income with related expenses within the same period, offering a clear view of profitability. Businesses adopting accrual accounting benefit from improved compliance with accounting standards like GAAP and IFRS, facilitating better investor confidence and financial reporting.

Benefits of Cash Accounting

Cash accounting provides clear and immediate insight into cash flow by recording transactions only when money changes hands, simplifying financial management for small businesses. It enhances tax planning by deferring income recognition until payment is received, potentially lowering tax liability in the short term. This method reduces complexity and administrative overhead compared to accrual accounting, making it ideal for businesses with straightforward cash transactions.

Common Challenges With Each Method

Accrual bookkeeping often poses challenges in managing complex revenue recognition timelines and requires meticulous tracking of receivables and payables, which can lead to temporary cash flow misrepresentations. Cash basis bookkeeping, while simpler, frequently struggles with the timing of income and expenses recognition, potentially obscuring the actual financial health during periods of delayed payment or significant prepayments. Both methods demand careful attention to transaction timing to ensure accurate financial reporting and compliance with accounting standards.

Choosing the Right Method for Your Business

Choosing the right bookkeeping method depends on your business size, complexity, and cash flow needs. Accrual accounting provides a comprehensive view by recording revenues and expenses when they are earned or incurred, ideal for larger businesses seeking accurate financial health insights. Cash accounting, recognizing transactions only when cash changes hands, suits small businesses and startups prioritizing simplicity and immediate cash flow tracking.

Transitioning Between Accrual and Cash Accounting

Transitioning between accrual and cash accounting requires adjusting how revenues and expenses are recorded to match the chosen method's timing principles. Businesses must reconcile accounts receivable and payable, deferring or accelerating income and expenses to reflect accurate financial periods. Proper documentation and compliance with IRS guidelines are essential to ensure a smooth transition and maintain accurate financial reporting.

Tax Implications of Accrual vs Cash Accounting

Accrual accounting recognizes income and expenses when they are earned or incurred, impacting taxable income by including receivables and payables, potentially leading to higher initial tax liabilities. Cash accounting records transactions only when cash changes hands, often resulting in simpler tax reporting and possible deferral of taxable income. Businesses must evaluate their revenue timing and expense recognition to optimize tax strategies and compliance under IRS regulations.

Accrual vs Cash Infographic

bizdif.com

bizdif.com