A Trial Balance lists all ledger accounts and their balances at a specific point in time to verify that debits equal credits, serving as an internal check for bookkeeping accuracy. The Balance Sheet, however, is a financial statement that summarizes a company's assets, liabilities, and equity, presenting its financial position to external stakeholders. While the Trial Balance ensures accuracy of accounting records, the Balance Sheet provides a snapshot of financial health and is used for decision-making and reporting purposes.

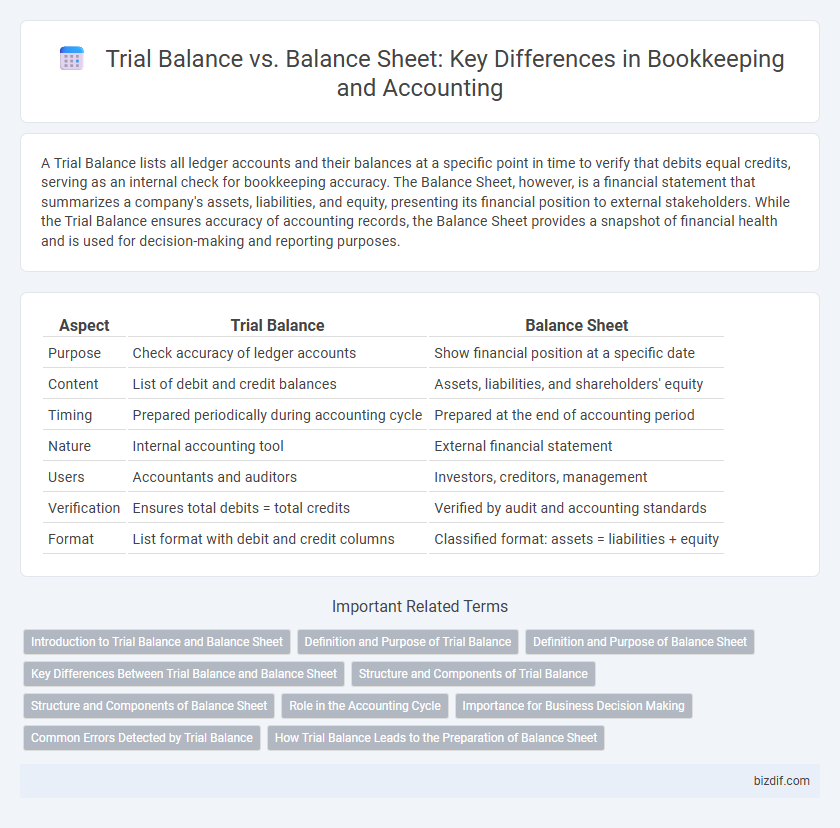

Table of Comparison

| Aspect | Trial Balance | Balance Sheet |

|---|---|---|

| Purpose | Check accuracy of ledger accounts | Show financial position at a specific date |

| Content | List of debit and credit balances | Assets, liabilities, and shareholders' equity |

| Timing | Prepared periodically during accounting cycle | Prepared at the end of accounting period |

| Nature | Internal accounting tool | External financial statement |

| Users | Accountants and auditors | Investors, creditors, management |

| Verification | Ensures total debits = total credits | Verified by audit and accounting standards |

| Format | List format with debit and credit columns | Classified format: assets = liabilities + equity |

Introduction to Trial Balance and Balance Sheet

The trial balance is a bookkeeping report that lists all ledger accounts and their balances to verify that total debits equal total credits, ensuring the accuracy of recorded transactions. The balance sheet is a financial statement that presents the company's assets, liabilities, and equity at a specific point in time, providing a snapshot of financial position. Together, the trial balance serves as the foundation for preparing a reliable balance sheet in accounting.

Definition and Purpose of Trial Balance

A trial balance is an internal accounting report that lists all general ledger accounts and their debit or credit balances to verify that total debits equal total credits, ensuring the ledger's mathematical accuracy. It serves as a preliminary check before preparing formal financial statements like the balance sheet, identifying errors in journal entries or ledger postings. Unlike the balance sheet, which presents the company's financial position at a specific date, the trial balance is primarily a tool for error detection and validation during the accounting cycle.

Definition and Purpose of Balance Sheet

A Balance Sheet is a financial statement that provides a snapshot of a company's assets, liabilities, and equity at a specific point in time, reflecting its financial position. It summarizes what the business owns and owes, helping stakeholders assess liquidity, solvency, and overall financial health. Unlike a Trial Balance, which is an internal report verifying the accuracy of ledger balances, the Balance Sheet is used for external analysis and strategic decision-making.

Key Differences Between Trial Balance and Balance Sheet

The trial balance is an internal accounting report that lists all ledger accounts and their balances to verify that total debits equal total credits, ensuring accuracy in bookkeeping. In contrast, the balance sheet is a formal financial statement presenting a company's assets, liabilities, and equity at a specific date, reflecting the business's financial position. Key differences include the trial balance being a tool for error detection during bookkeeping, while the balance sheet is used for external reporting and decision-making by stakeholders.

Structure and Components of Trial Balance

A trial balance consists of a list of all general ledger accounts with their respective debit or credit balances, organized into two columns reflecting these balances. Its primary components include account titles and ending balances reported as debits or credits, ensuring total debits equal total credits for accuracy verification. In contrast, the balance sheet presents a structured summary of assets, liabilities, and equity at a specific date, emphasizing financial position rather than account balance verification.

Structure and Components of Balance Sheet

The balance sheet is a financial statement presenting a company's assets, liabilities, and shareholders' equity at a specific point in time, organized into current and non-current sections for clarity. Key components include assets (cash, accounts receivable, inventory), liabilities (accounts payable, long-term debt), and equity (common stock, retained earnings). Unlike the trial balance, which lists all ledger accounts with debit and credit balances to verify ledger accuracy, the balance sheet summarizes these accounts to reflect the company's financial position.

Role in the Accounting Cycle

The trial balance serves as an internal checkpoint in the accounting cycle, listing all ledger account balances to verify that total debits equal total credits, ensuring accuracy before preparation of financial statements. The balance sheet, generated after the trial balance, presents a snapshot of a company's financial position at a specific date by summarizing assets, liabilities, and equity. While the trial balance aids in error detection during bookkeeping, the balance sheet provides critical insight for financial analysis and reporting.

Importance for Business Decision Making

A trial balance provides a preliminary financial check by listing all ledger accounts and their balances, ensuring accuracy before preparing formal reports. The balance sheet offers a comprehensive snapshot of a company's financial position, detailing assets, liabilities, and equity at a specific point in time. Both documents are crucial for business decision making, with the trial balance preventing errors and the balance sheet guiding strategic financial planning.

Common Errors Detected by Trial Balance

Trial balance detects common bookkeeping errors such as unmatched debit and credit entries, transaction omissions, and incorrect ledger postings, ensuring the accounting equation remains balanced. It highlights arithmetic mistakes within individual accounts before financial statements are prepared. While the trial balance verifies ledger accuracy, the balance sheet presents the company's financial position at a specific date.

How Trial Balance Leads to the Preparation of Balance Sheet

The trial balance compiles all ledger account balances, ensuring debits equal credits, which verifies the accuracy of recorded transactions. This verified data serves as the foundation for preparing the balance sheet by categorizing assets, liabilities, and equity based on trial balance figures. Accurate trial balance aids in generating a reliable balance sheet, reflecting the company's financial position at a specific point.

Trial Balance vs Balance Sheet Infographic

bizdif.com

bizdif.com