Petty cash management involves tracking and controlling small, daily cash expenses to ensure accuracy and prevent misuse, while bank reconciliation systematically compares company records to bank statements to identify discrepancies and verify financial accuracy. Effective petty cash management helps maintain liquidity for minor purchases, whereas bank reconciliation ensures the overall integrity of recorded transactions and detects errors or fraud. Both processes are essential for comprehensive financial oversight and maintaining accurate bookkeeping records.

Table of Comparison

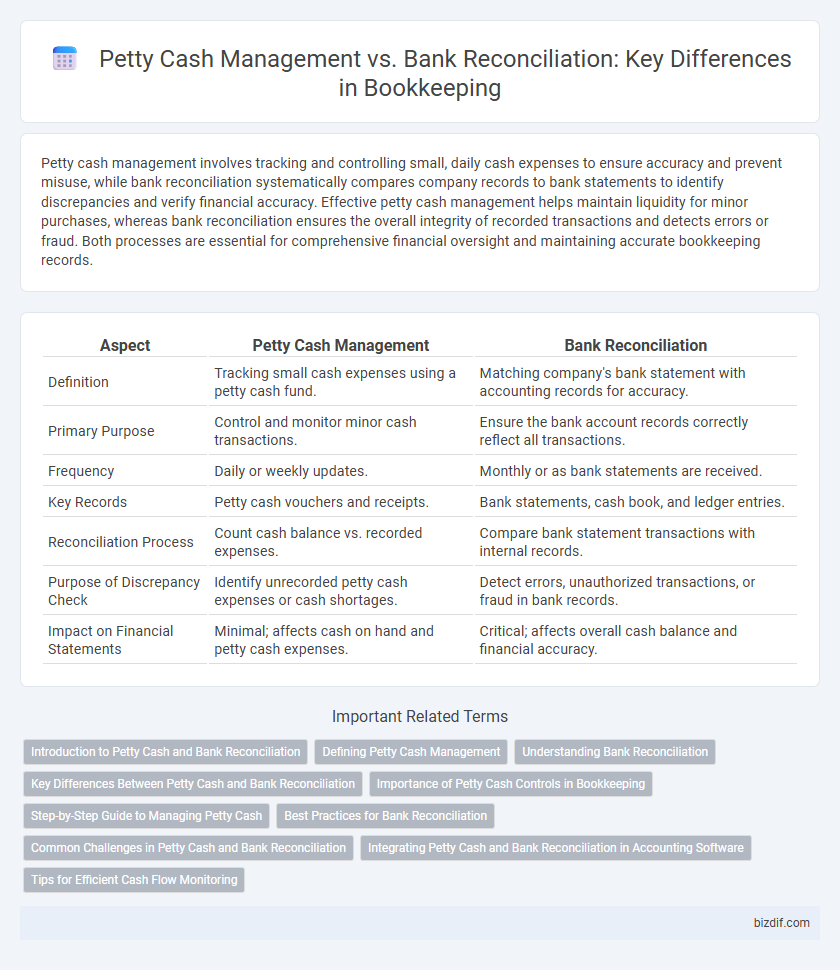

| Aspect | Petty Cash Management | Bank Reconciliation |

|---|---|---|

| Definition | Tracking small cash expenses using a petty cash fund. | Matching company's bank statement with accounting records for accuracy. |

| Primary Purpose | Control and monitor minor cash transactions. | Ensure the bank account records correctly reflect all transactions. |

| Frequency | Daily or weekly updates. | Monthly or as bank statements are received. |

| Key Records | Petty cash vouchers and receipts. | Bank statements, cash book, and ledger entries. |

| Reconciliation Process | Count cash balance vs. recorded expenses. | Compare bank statement transactions with internal records. |

| Purpose of Discrepancy Check | Identify unrecorded petty cash expenses or cash shortages. | Detect errors, unauthorized transactions, or fraud in bank records. |

| Impact on Financial Statements | Minimal; affects cash on hand and petty cash expenses. | Critical; affects overall cash balance and financial accuracy. |

Introduction to Petty Cash and Bank Reconciliation

Petty cash management involves tracking small, incidental expenses using a designated cash fund for immediate, minor purchases to streamline daily business operations. Bank reconciliation is the process of comparing a company's recorded cash transactions with the bank statement to identify discrepancies and ensure accuracy in financial records. Both are essential bookkeeping practices that maintain cash flow integrity and support accurate financial reporting.

Defining Petty Cash Management

Petty Cash Management involves tracking and controlling small cash expenditures used for minor business expenses, ensuring accurate recording and replenishment of the petty cash fund. This process includes maintaining receipts, setting spending limits, and regularly reconciling the petty cash balance to prevent discrepancies. Effective petty cash management streamlines daily financial operations and supports overall cash flow control within a business.

Understanding Bank Reconciliation

Bank reconciliation is a critical financial process that ensures the accuracy of a company's cash records by comparing the bank statement with the internal ledger. This procedure helps identify discrepancies such as outstanding checks, bank fees, and errors, thereby maintaining accurate financial records. Effective bank reconciliation supports better cash flow management and fraud detection in bookkeeping practices.

Key Differences Between Petty Cash and Bank Reconciliation

Petty cash management involves tracking small daily expenses using a fixed cash fund, while bank reconciliation focuses on matching the company's bank statement with its accounting records to identify discrepancies. Petty cash is recorded in a petty cash log or petty cash book, whereas bank reconciliation requires a detailed comparison of deposits, withdrawals, and bank fees against ledger entries. The key difference lies in petty cash handling immediate minor transactions, contrasting with bank reconciliation's role in verifying overall bank account accuracy and detecting errors or fraud.

Importance of Petty Cash Controls in Bookkeeping

Effective petty cash management is crucial for accurate bookkeeping as it ensures small, everyday expenses are tracked and controlled, preventing misuse or discrepancies. Implementing strict petty cash controls supports reliable financial records and simplifies bank reconciliation by minimizing unexplained cash variances. Maintaining detailed petty cash logs and regular audits enhances transparency and strengthens overall financial accountability in business operations.

Step-by-Step Guide to Managing Petty Cash

Managing petty cash involves systematically recording all small expenses, maintaining a detailed log of disbursements, and regularly reconciling the cash on hand with receipts to ensure accuracy. Establishing a clear approval process for expenditures and setting a predefined replenishment threshold helps maintain control and prevents shortages. Unlike bank reconciliation, which matches bank statements with accounting records, petty cash management focuses on documenting and verifying minor transactions within the organization.

Best Practices for Bank Reconciliation

Bank reconciliation best practices include regularly comparing bank statements with internal records to identify discrepancies promptly, ensuring accurate and up-to-date financial data. Maintaining detailed documentation of transactions and adjusting entries for errors or omissions improves accuracy and accountability. Implementing automated reconciliation tools enhances efficiency and reduces the risk of manual errors in the bank reconciliation process.

Common Challenges in Petty Cash and Bank Reconciliation

Common challenges in petty cash management include tracking small, frequent transactions and preventing misappropriation due to lack of detailed records. Bank reconciliation difficulties often arise from timing differences, unidentified transactions, and errors in recording deposits or withdrawals. Both processes require meticulous record-keeping to ensure accuracy and prevent discrepancies in financial reporting.

Integrating Petty Cash and Bank Reconciliation in Accounting Software

Integrating petty cash management with bank reconciliation in accounting software streamlines financial reporting and improves accuracy by automatically syncing transactions and reducing manual data entry errors. This integration enables real-time monitoring of petty cash expenditures alongside bank account activities, providing a comprehensive overview of cash flow. Efficient reconciliation processes enhance internal controls and facilitate audit readiness by ensuring all cash movements are consistently tracked and verified within a single platform.

Tips for Efficient Cash Flow Monitoring

Petty cash management requires precise tracking of daily small expenditures to prevent discrepancies, making frequent reconciliations essential for maintaining accuracy. Bank reconciliation involves matching the company's financial records with bank statements to identify and resolve differences, ensuring the cash flow status is up to date. Implementing strict receipt controls and scheduling regular reconciliation reviews optimize cash flow monitoring and reduce the risk of errors or fraud.

Petty Cash Management vs Bank Reconciliation Infographic

bizdif.com

bizdif.com