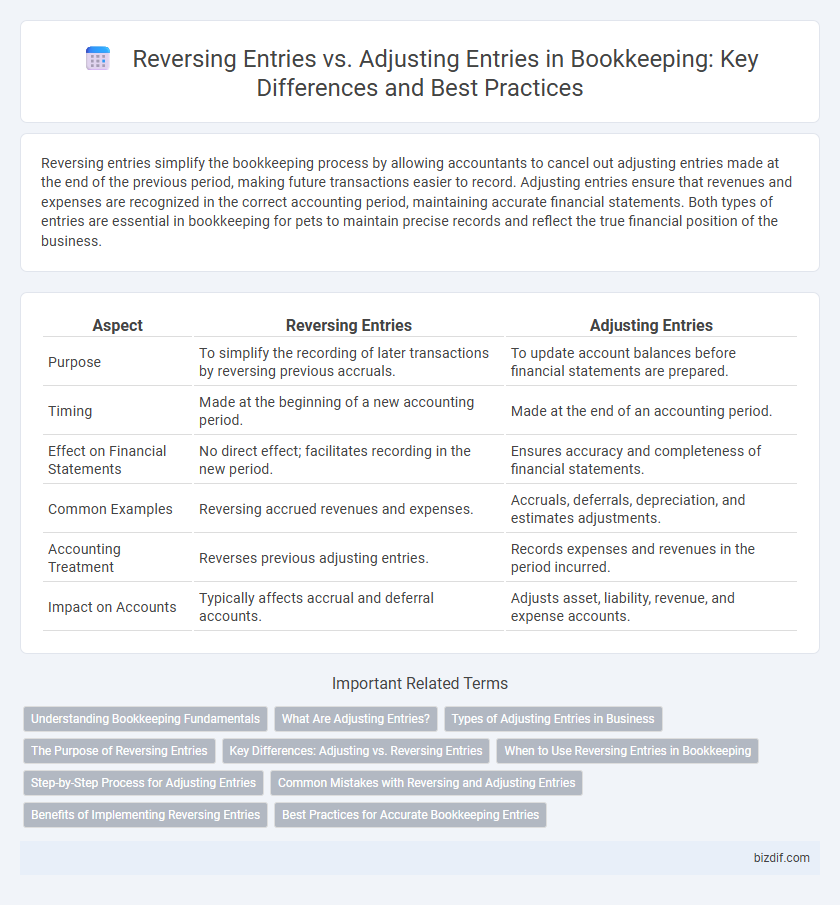

Reversing entries simplify the bookkeeping process by allowing accountants to cancel out adjusting entries made at the end of the previous period, making future transactions easier to record. Adjusting entries ensure that revenues and expenses are recognized in the correct accounting period, maintaining accurate financial statements. Both types of entries are essential in bookkeeping for pets to maintain precise records and reflect the true financial position of the business.

Table of Comparison

| Aspect | Reversing Entries | Adjusting Entries |

|---|---|---|

| Purpose | To simplify the recording of later transactions by reversing previous accruals. | To update account balances before financial statements are prepared. |

| Timing | Made at the beginning of a new accounting period. | Made at the end of an accounting period. |

| Effect on Financial Statements | No direct effect; facilitates recording in the new period. | Ensures accuracy and completeness of financial statements. |

| Common Examples | Reversing accrued revenues and expenses. | Accruals, deferrals, depreciation, and estimates adjustments. |

| Accounting Treatment | Reverses previous adjusting entries. | Records expenses and revenues in the period incurred. |

| Impact on Accounts | Typically affects accrual and deferral accounts. | Adjusts asset, liability, revenue, and expense accounts. |

Understanding Bookkeeping Fundamentals

Reversing entries are made at the beginning of an accounting period to cancel out adjusting entries from the previous period, simplifying the recording of subsequent transactions. Adjusting entries update account balances to reflect accrued revenues, expenses, deferrals, and estimates, ensuring accurate financial statements. Mastering the distinction between reversing and adjusting entries is essential for accurate bookkeeping and maintaining precise financial records.

What Are Adjusting Entries?

Adjusting entries are journal entries made at the end of an accounting period to allocate income and expenses to the appropriate period, ensuring accurate financial statements. These entries typically involve accruals, deferrals, and estimates, such as accrued revenues, prepaid expenses, and depreciation. Proper use of adjusting entries adheres to the matching principle in accounting, linking revenues to related expenses within the same period.

Types of Adjusting Entries in Business

Types of adjusting entries in business include accrued revenues, accrued expenses, deferred revenues, and deferred expenses, each essential for accurately matching income and expenses to the correct accounting period. Accrued revenues recognize income earned but not yet recorded, while accrued expenses capture costs incurred but not yet paid. Deferred revenues and deferred expenses adjust for cash received or paid in advance, ensuring financial statements reflect the true financial position.

The Purpose of Reversing Entries

Reversing entries are made at the beginning of a new accounting period to simplify the recording of transactions related to accrued expenses or revenues from the previous period. They help prevent double counting by canceling out certain adjusting entries, ensuring financial statements reflect accurate and clean data. This process streamlines bookkeeping by reducing errors and improving transaction clarity in subsequent records.

Key Differences: Adjusting vs. Reversing Entries

Adjusting entries update account balances to reflect accrued or deferred revenues and expenses at the end of an accounting period, ensuring accurate financial statements. Reversing entries are made at the beginning of a new period to simplify the recording of transactions related to previous adjusting entries, preventing double counting. The key difference lies in their timing and purpose: adjusting entries correct balances for reporting, while reversing entries streamline future transaction recording.

When to Use Reversing Entries in Bookkeeping

Reversing entries are typically used at the beginning of a new accounting period to simplify the recording of subsequent transactions related to accrued expenses or revenues recognized in the previous period. These entries help avoid double counting by nullifying the effects of adjusting entries made during the closing process. Bookkeepers use reversing entries to streamline the tracking of prepaid expenses, accrued wages, and other temporary adjustments, enhancing accuracy and efficiency in financial reporting.

Step-by-Step Process for Adjusting Entries

Adjusting entries require identifying accounts needing updates after the initial trial balance, such as accrued expenses or unearned revenues. Record the necessary journal entries by debiting or crediting the appropriate accounts to reflect accurate balances at the end of the accounting period. Ensure these adjustments align with matching principles and accurately represent financial position before preparing financial statements.

Common Mistakes with Reversing and Adjusting Entries

Common mistakes with reversing and adjusting entries include failing to reverse entries properly, leading to duplicated expenses or revenues, and incorrectly estimating accruals or deferrals during adjustment, causing inaccurate financial statements. Misclassifying entries or neglecting to document them clearly can result in confusion and errors during audits. Ensuring precise timing and accuracy in both reversing and adjusting entries is critical for maintaining reliable bookkeeping records.

Benefits of Implementing Reversing Entries

Reversing entries streamline the bookkeeping process by automatically nullifying certain adjusting entries in the new accounting period, reducing the risk of errors and saving time on manual corrections. Implementing reversing entries improves accuracy in financial reporting by ensuring accruals and deferrals are correctly handled without duplicating expenses or revenues. This method enhances workflow efficiency for accountants and bookkeepers by simplifying transaction tracking and reconciliation.

Best Practices for Accurate Bookkeeping Entries

Reversing entries simplify the bookkeeping process by automatically cancelling adjusting entries made at the end of an accounting period, reducing errors and saving time when recording subsequent transactions. Adjusting entries ensure financial statements reflect accurate data by recording accrued revenues, expenses, and deferrals before closing the books. Implementing a clear procedure for both reversing and adjusting entries enhances accuracy, consistency, and compliance with accounting standards, minimizing discrepancies in financial records.

Reversing Entries vs Adjusting Entries Infographic

bizdif.com

bizdif.com