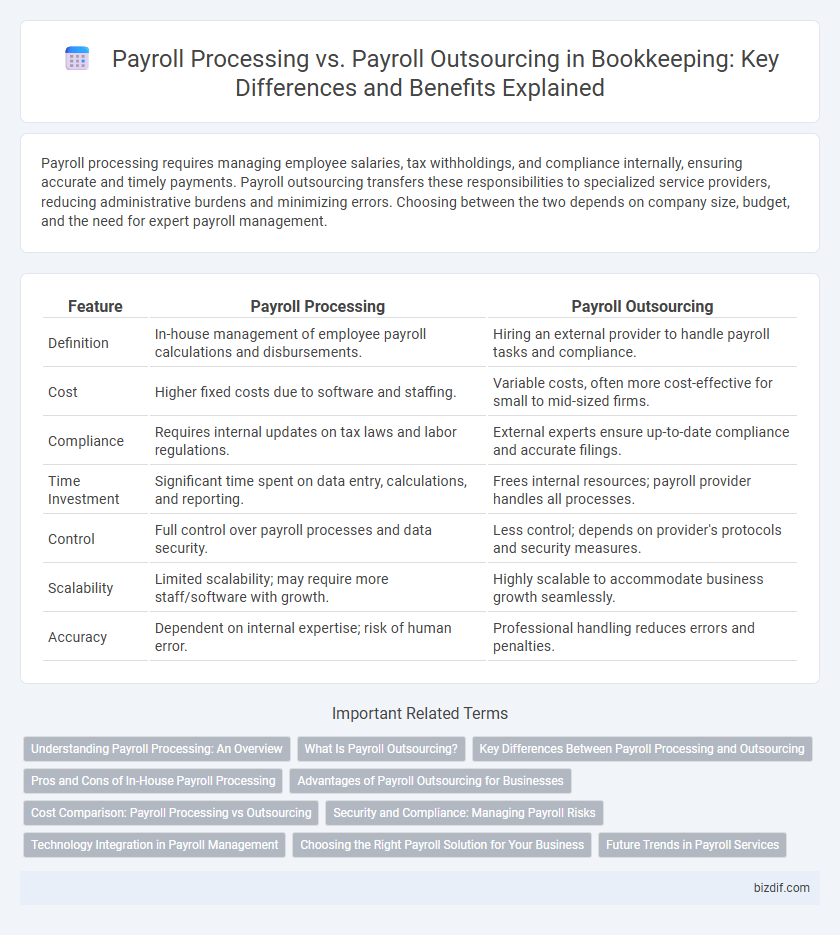

Payroll processing requires managing employee salaries, tax withholdings, and compliance internally, ensuring accurate and timely payments. Payroll outsourcing transfers these responsibilities to specialized service providers, reducing administrative burdens and minimizing errors. Choosing between the two depends on company size, budget, and the need for expert payroll management.

Table of Comparison

| Feature | Payroll Processing | Payroll Outsourcing |

|---|---|---|

| Definition | In-house management of employee payroll calculations and disbursements. | Hiring an external provider to handle payroll tasks and compliance. |

| Cost | Higher fixed costs due to software and staffing. | Variable costs, often more cost-effective for small to mid-sized firms. |

| Compliance | Requires internal updates on tax laws and labor regulations. | External experts ensure up-to-date compliance and accurate filings. |

| Time Investment | Significant time spent on data entry, calculations, and reporting. | Frees internal resources; payroll provider handles all processes. |

| Control | Full control over payroll processes and data security. | Less control; depends on provider's protocols and security measures. |

| Scalability | Limited scalability; may require more staff/software with growth. | Highly scalable to accommodate business growth seamlessly. |

| Accuracy | Dependent on internal expertise; risk of human error. | Professional handling reduces errors and penalties. |

Understanding Payroll Processing: An Overview

Payroll processing involves calculating employee wages, withholding taxes, and ensuring compliance with legal regulations, which demands precise attention to detail and understanding of tax codes. Businesses managing payroll internally must invest in specialized software and stay updated on payroll laws to avoid penalties. Efficient payroll processing ensures timely payment, accurate record-keeping, and streamlined financial reporting essential for business operations.

What Is Payroll Outsourcing?

Payroll outsourcing involves hiring specialized external firms to manage employee compensation, tax compliance, and benefits administration, ensuring accuracy and legal adherence. This service reduces in-house workload, minimizes errors, and leverages expert knowledge for timely tax filings and regulatory updates. Business owners benefit from scalable solutions tailored to various payroll complexities and jurisdictions.

Key Differences Between Payroll Processing and Outsourcing

Payroll processing involves handling employee compensation calculations, tax withholdings, and compliance internally using software or manual methods, ensuring direct control over payroll activities. Payroll outsourcing delegates these tasks to specialized third-party providers who manage payroll administration, tax filings, and regulatory adherence, reducing internal workload and risk of errors. The key differences lie in control level, cost structure, compliance responsibility, and resource allocation, with outsourcing offering expertise and time savings while processing maintains internal oversight.

Pros and Cons of In-House Payroll Processing

In-house payroll processing offers direct control over employee data and customization to company-specific needs, enhancing data security and compliance accuracy. However, it demands substantial time investment, specialized knowledge, and the risk of errors due to evolving tax regulations and payroll complexities. Businesses must weigh these factors against costs, as in-house management often requires dedicated staff and ongoing training compared to potentially lower operational expenses through outsourcing.

Advantages of Payroll Outsourcing for Businesses

Payroll outsourcing offers businesses access to specialized expertise, reducing the risk of compliance errors and penalties associated with complex tax regulations. Outsourcing payroll streamlines operations by saving time and resources, allowing companies to focus on core activities while ensuring accurate and timely employee compensation. This approach enhances data security through advanced technology platforms and minimizes administrative burdens linked to in-house payroll management.

Cost Comparison: Payroll Processing vs Outsourcing

Payroll processing in-house typically involves expenses such as software licenses, employee salaries, and training costs, which can total between $4,000 and $12,000 annually for small to medium businesses. Payroll outsourcing often reduces overhead by consolidating tasks into a fixed monthly fee ranging from $50 to $200 per employee, eliminating costs related to system maintenance and compliance updates. Companies must weigh these direct and indirect costs, factoring in scalability and error reduction when comparing payroll processing versus outsourcing options.

Security and Compliance: Managing Payroll Risks

Payroll processing in-house allows businesses direct control over sensitive employee data, ensuring compliance with internal security protocols and regulatory requirements such as GDPR and IRS tax filings. Payroll outsourcing leverages specialized vendors with advanced encryption technologies and updated compliance frameworks to mitigate risks related to data breaches and legal penalties. Choosing between in-house versus outsourced payroll depends on balancing control with expertise in managing payroll security risks and regulatory adherence.

Technology Integration in Payroll Management

Payroll processing utilizes integrated software solutions that automate tax calculations, time tracking, and compliance reporting, ensuring real-time accuracy and efficiency within a company's internal systems. Payroll outsourcing leverages specialized third-party platforms equipped with advanced technologies such as AI-driven analytics and cloud-based security to enhance data accuracy and reduce manual intervention. The choice between in-house processing and outsourcing heavily depends on the organization's ability to integrate scalable, compliant technology with existing payroll workflows.

Choosing the Right Payroll Solution for Your Business

Selecting the right payroll solution depends on your business size, budget, and internal expertise; payroll processing in-house offers direct control but requires dedicated resources and compliance knowledge. Payroll outsourcing provides access to specialized professionals, reduces administrative burden, and ensures up-to-date regulatory adherence, making it ideal for small to medium-sized enterprises seeking efficiency. Evaluating factors like cost-effectiveness, data security, and scalability helps determine whether payroll processing or outsourcing best aligns with your company's operational goals.

Future Trends in Payroll Services

Future trends in payroll services emphasize automation and AI integration to enhance accuracy and efficiency in payroll processing. Payroll outsourcing is increasingly adopting cloud-based platforms and real-time data analytics, enabling businesses to reduce costs and comply with evolving regulations seamlessly. The convergence of blockchain technology and biometric authentication is set to revolutionize security and transparency in payroll management.

Payroll Processing vs Payroll Outsourcing Infographic

bizdif.com

bizdif.com