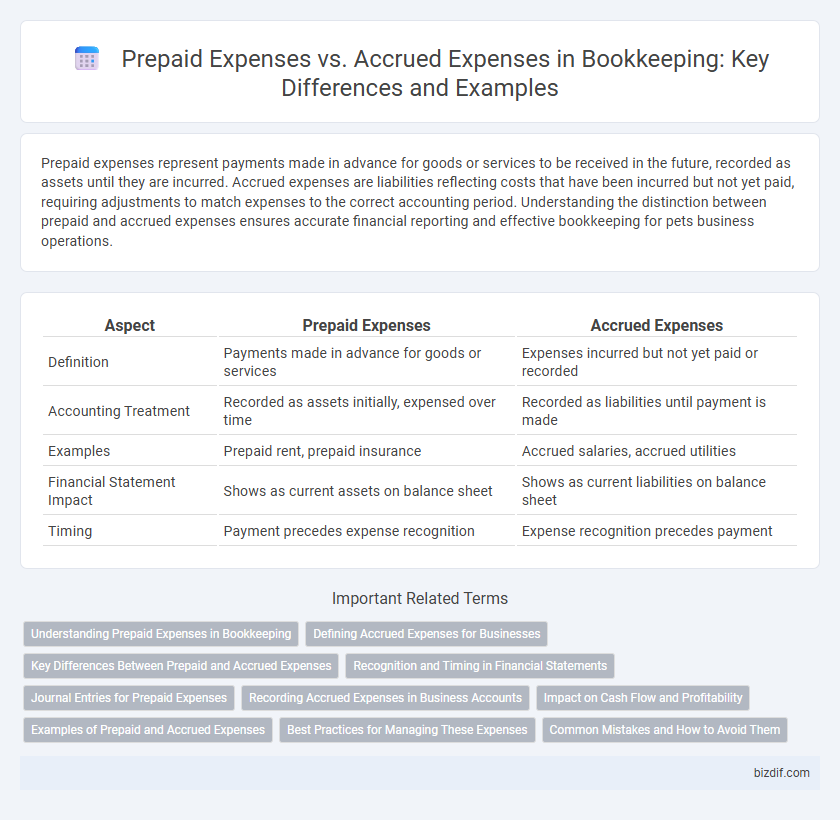

Prepaid expenses represent payments made in advance for goods or services to be received in the future, recorded as assets until they are incurred. Accrued expenses are liabilities reflecting costs that have been incurred but not yet paid, requiring adjustments to match expenses to the correct accounting period. Understanding the distinction between prepaid and accrued expenses ensures accurate financial reporting and effective bookkeeping for pets business operations.

Table of Comparison

| Aspect | Prepaid Expenses | Accrued Expenses |

|---|---|---|

| Definition | Payments made in advance for goods or services | Expenses incurred but not yet paid or recorded |

| Accounting Treatment | Recorded as assets initially, expensed over time | Recorded as liabilities until payment is made |

| Examples | Prepaid rent, prepaid insurance | Accrued salaries, accrued utilities |

| Financial Statement Impact | Shows as current assets on balance sheet | Shows as current liabilities on balance sheet |

| Timing | Payment precedes expense recognition | Expense recognition precedes payment |

Understanding Prepaid Expenses in Bookkeeping

Prepaid expenses in bookkeeping represent payments made in advance for goods or services to be received in the future, recorded as assets until they are realized. Common examples include prepaid insurance, rent, and subscriptions, which are gradually expensed over the coverage period. Properly tracking prepaid expenses improves financial accuracy by matching costs with the appropriate accounting periods.

Defining Accrued Expenses for Businesses

Accrued expenses are liabilities representing costs a business has incurred but not yet paid or recorded through an invoice, such as wages, utilities, and interest. These expenses are recognized in the accounting period they occur, following the matching principle, ensuring accurate financial statements. Properly recording accrued expenses improves expense tracking, cash flow management, and financial forecasting for businesses.

Key Differences Between Prepaid and Accrued Expenses

Prepaid expenses represent payments made in advance for goods or services to be received in the future, recorded as assets until they are realized as expenses. Accrued expenses, on the other hand, are incurred liabilities for goods or services already received but not yet paid, recognized as expenses before cash outflow. The key difference lies in timing and cash flow: prepaid expenses involve early cash disbursement, while accrued expenses reflect obligations for which cash payment is pending.

Recognition and Timing in Financial Statements

Prepaid expenses are recognized as assets on the balance sheet when paid in advance and gradually expensed over time as the benefits are consumed. Accrued expenses are recorded as liabilities representing incurred costs not yet paid, ensuring expenses are matched with the period they relate to. Proper timing in financial statements distinguishes prepaid expenses' deferred recognition from accrued expenses' immediate liability acknowledgment.

Journal Entries for Prepaid Expenses

Journal entries for prepaid expenses involve debiting the prepaid expense account and crediting cash or bank upon payment, reflecting an asset created by paying in advance. Over time, adjusting entries are made to debit the expense account and credit the prepaid expense account to recognize expense allocation accurately. This process ensures proper matching of expenses with the corresponding accounting periods in accrual-based bookkeeping systems.

Recording Accrued Expenses in Business Accounts

Recording accrued expenses involves recognizing expenses that have been incurred but not yet paid or recorded by the end of an accounting period, ensuring liabilities are accurately reflected on financial statements. Businesses debit the appropriate expense account and credit accrued expenses or accounts payable to maintain accurate matching of expenses with revenues. Proper accrual accounting improves financial transparency and compliance with GAAP by reflecting true financial obligations.

Impact on Cash Flow and Profitability

Prepaid expenses reduce cash flow immediately as payments are made upfront, but they are gradually recognized as expenses over time, smoothing profitability. Accrued expenses increase liabilities and decrease net income before cash is paid, delaying cash outflows and potentially improving short-term cash flow. Managing the timing and recognition of these expenses directly affects liquidity and profit margins by aligning expenses with corresponding revenue periods.

Examples of Prepaid and Accrued Expenses

Prepaid expenses include payments made in advance for goods or services, such as prepaid rent, insurance premiums, and subscription fees, which are recorded as assets until they are used. Accrued expenses represent obligations for costs incurred but not yet paid, like utilities, wages, and interest expenses, which are recognized as liabilities. Understanding these distinctions ensures accurate financial reporting and effective cash flow management.

Best Practices for Managing These Expenses

Effective management of prepaid and accrued expenses requires accurate tracking through separate ledger accounts to ensure timely recognition and prevent misstatements. Implementing automated accounting software enhances the monitoring of expense timing, ensuring that prepaid expenses are amortized appropriately and accrued expenses are recorded in the correct period. Regular reconciliation and detailed documentation support compliance with accounting standards such as GAAP and IFRS, improving financial reporting accuracy.

Common Mistakes and How to Avoid Them

Confusing prepaid expenses with accrued expenses often leads to inaccurate financial statements, as prepaid expenses are payments made in advance while accrued expenses are incurred but not yet paid. A common mistake is failing to adjust prepaid expenses over time, causing overstated assets, or overlooking accrued expenses, which results in understated liabilities and expenses. To avoid these errors, maintain clear records of payment dates, apply proper period adjustments, and perform regular reconciliations to ensure expenses are recognized in the correct accounting periods.

Prepaid expenses vs Accrued expenses Infographic

bizdif.com

bizdif.com