Bank reconciliation involves matching the company's bank statement with its internal financial records to identify discrepancies and ensure accuracy in recorded transactions. Petty cash reconciliation requires verifying the physical cash on hand against the recorded petty cash expenses to prevent fraud and maintain budget control. Both processes are crucial for accurate financial reporting but focus on different types of cash management within a business.

Table of Comparison

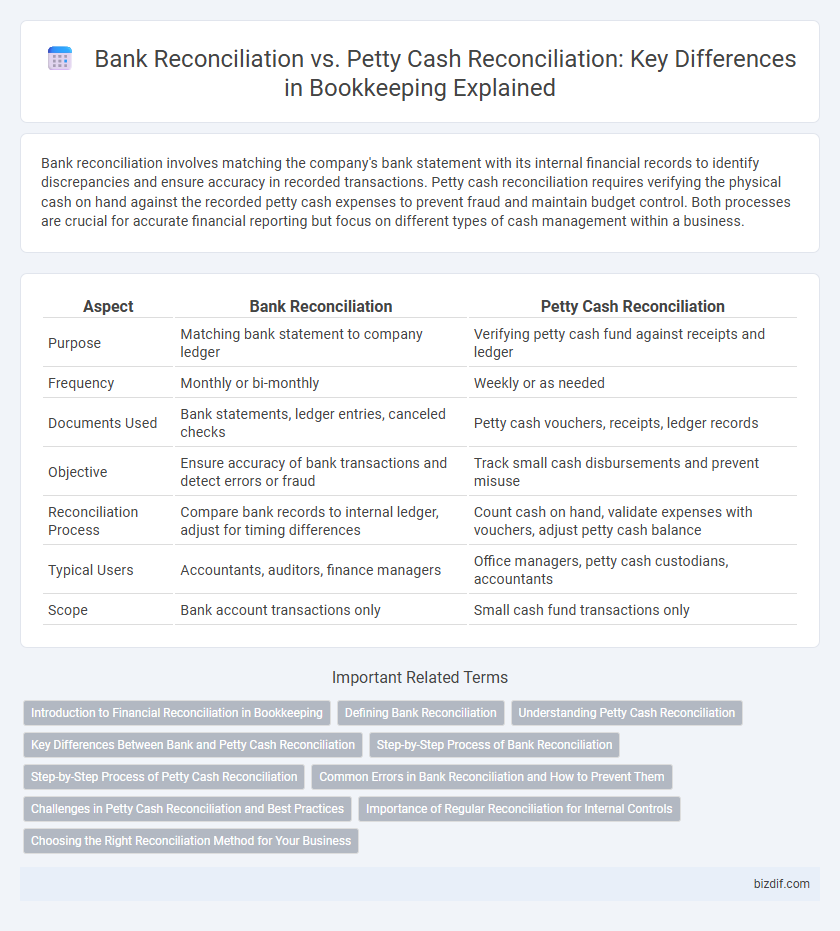

| Aspect | Bank Reconciliation | Petty Cash Reconciliation |

|---|---|---|

| Purpose | Matching bank statement to company ledger | Verifying petty cash fund against receipts and ledger |

| Frequency | Monthly or bi-monthly | Weekly or as needed |

| Documents Used | Bank statements, ledger entries, canceled checks | Petty cash vouchers, receipts, ledger records |

| Objective | Ensure accuracy of bank transactions and detect errors or fraud | Track small cash disbursements and prevent misuse |

| Reconciliation Process | Compare bank records to internal ledger, adjust for timing differences | Count cash on hand, validate expenses with vouchers, adjust petty cash balance |

| Typical Users | Accountants, auditors, finance managers | Office managers, petty cash custodians, accountants |

| Scope | Bank account transactions only | Small cash fund transactions only |

Introduction to Financial Reconciliation in Bookkeeping

Bank reconciliation involves matching the company's bank statement with its internal financial records to identify and resolve discrepancies, ensuring accurate cash balances. Petty cash reconciliation focuses on verifying small cash expenditures against recorded receipts to maintain accountability for on-hand funds. Both processes are crucial for comprehensive financial reconciliation, preventing errors, and enhancing the accuracy of bookkeeping.

Defining Bank Reconciliation

Bank reconciliation is the process of comparing and matching a company's internal financial records with the corresponding bank statement to ensure accuracy and identify discrepancies. It involves verifying transactions, deposits, withdrawals, and balances to detect errors or fraudulent activity in the cash account. Unlike petty cash reconciliation, which tracks small cash expenditures, bank reconciliation provides a comprehensive overview of all bank account activities.

Understanding Petty Cash Reconciliation

Petty cash reconciliation involves verifying the balance of a small on-hand cash fund used for minor business expenses by matching the recorded disbursements and receipts to the physical cash available. This process ensures accurate tracking of petty cash transactions and prevents misappropriation or errors. Unlike bank reconciliation, which reconciles bank statements with ledger accounts, petty cash reconciliation focuses on managing and documenting low-value cash expenditures within the organization.

Key Differences Between Bank and Petty Cash Reconciliation

Bank reconciliation involves comparing the company's bank statement with its accounting records to identify discrepancies such as outstanding checks or deposits in transit, ensuring the bank balance matches the ledger. Petty cash reconciliation focuses on verifying the physical cash on hand against petty cash vouchers and receipts, tracking small, day-to-day business expenses. Key differences include the source of funds--bank accounts versus physical cash--and the frequency and level of detail in reconciliation, with bank reconciliations typically performed monthly and petty cash reconciliations conducted more frequently for minor transactions.

Step-by-Step Process of Bank Reconciliation

Bank reconciliation involves systematically matching the company's bank statement transactions with its internal records to identify discrepancies and ensure accuracy. Key steps include verifying daily deposits and withdrawals, adjusting for outstanding checks and deposits in transit, and correcting bank errors or accounting mistakes. This thorough process ensures the cash balance on the company's books aligns precisely with the bank's reported balance, enhancing financial accuracy and fraud detection.

Step-by-Step Process of Petty Cash Reconciliation

Petty cash reconciliation involves systematically verifying cash on hand against recorded transactions by first counting the physical cash and receipts, then matching each expense to the petty cash log to ensure all disbursements are accurately documented. Next, identify any discrepancies, such as missing receipts or unrecorded expenses, and make appropriate adjustments in the accounting records. This step-by-step process maintains accurate petty cash balances, supports internal controls, and ensures financial records remain reliable.

Common Errors in Bank Reconciliation and How to Prevent Them

Common errors in bank reconciliation include timing differences, missed transactions, and data entry mistakes, leading to discrepancies between the bank statement and company records. To prevent these errors, regularly compare bank statements with internal records, ensure all deposits and withdrawals are recorded accurately, and use automated reconciliation software to minimize manual input mistakes. Consistent bank reconciliation practices improve financial accuracy and help identify potential fraud early.

Challenges in Petty Cash Reconciliation and Best Practices

Petty cash reconciliation presents challenges such as tracking numerous small transactions, risk of mismanagement, and difficulty in verifying receipts compared to bank reconciliation's structured records. Best practices include maintaining a detailed petty cash log, regularly auditing physical cash against records, and implementing strict approval processes to minimize errors and fraud. Automated expense tracking tools can further enhance accuracy and streamline the reconciliation of petty cash accounts.

Importance of Regular Reconciliation for Internal Controls

Regular bank reconciliation and petty cash reconciliation are crucial internal control measures that ensure accuracy in financial records and prevent fraud. Bank reconciliation verifies transactions and balances against bank statements, while petty cash reconciliation tracks small cash expenses to avoid misuse. Consistent reconciliation detects discrepancies early and strengthens overall financial integrity in bookkeeping.

Choosing the Right Reconciliation Method for Your Business

Bank reconciliation involves verifying and matching the company's bank statements with its accounting records to identify discrepancies, ideal for maintaining accurate financial statements and detecting errors or fraud. Petty cash reconciliation focuses on tracking small cash expenditures and ensuring receipts match the recorded amounts, suitable for businesses handling frequent minor cash transactions. Selecting the right reconciliation method depends on your business size, transaction volume, and the need for detailed cash flow tracking to enhance overall financial accuracy.

Bank Reconciliation vs Petty Cash Reconciliation Infographic

bizdif.com

bizdif.com