Interim closing in bookkeeping pet management provides a snapshot of financial performance at specific intervals, aiding in timely decision-making and cash flow management. Year-end closing summarizes the entire fiscal year's financial data, ensuring accurate tax reporting and compliance with accounting standards. Understanding the differences between interim and year-end closing helps streamline financial processes and maintain accurate records throughout the year.

Table of Comparison

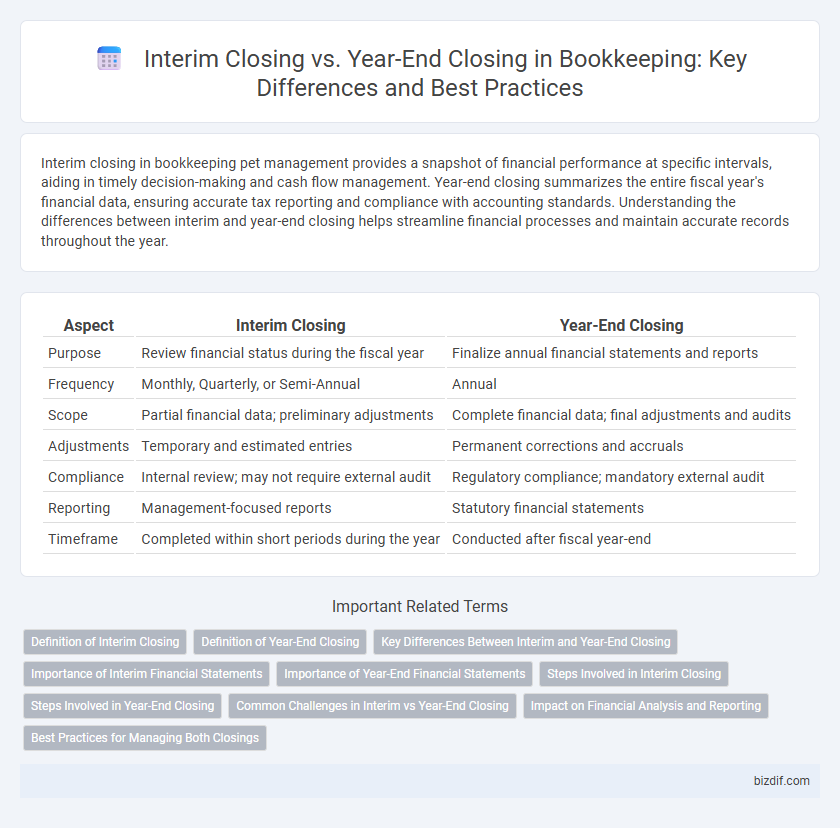

| Aspect | Interim Closing | Year-End Closing |

|---|---|---|

| Purpose | Review financial status during the fiscal year | Finalize annual financial statements and reports |

| Frequency | Monthly, Quarterly, or Semi-Annual | Annual |

| Scope | Partial financial data; preliminary adjustments | Complete financial data; final adjustments and audits |

| Adjustments | Temporary and estimated entries | Permanent corrections and accruals |

| Compliance | Internal review; may not require external audit | Regulatory compliance; mandatory external audit |

| Reporting | Management-focused reports | Statutory financial statements |

| Timeframe | Completed within short periods during the year | Conducted after fiscal year-end |

Definition of Interim Closing

Interim closing refers to the process of temporarily finalizing financial records and statements at specific intervals within the fiscal year, such as monthly or quarterly periods. This practice enables businesses to assess their financial performance and make informed decisions without waiting for the fiscal year-end. Interim closing enhances timely financial reporting and helps maintain accurate bookkeeping throughout the year.

Definition of Year-End Closing

Year-end closing is the accounting process that finalizes all financial transactions for a fiscal year, ensuring accurate preparation of annual financial statements. This procedure involves reconciling accounts, adjusting entries, and closing temporary accounts to zero out revenue and expense balances. Proper execution of year-end closing is essential for compliance with tax regulations and providing clear financial insights for stakeholders.

Key Differences Between Interim and Year-End Closing

Interim closing involves preparing financial statements for a shorter period within the fiscal year, typically quarterly or monthly, allowing businesses to monitor performance and make timely decisions. Year-end closing finalizes all transactions for the entire fiscal year, ensuring accurate reporting of annual financial results and compliance with accounting standards. Key differences include the scope of transactions recorded, the detail of adjustments made, and the level of audit scrutiny applied during year-end closing.

Importance of Interim Financial Statements

Interim financial statements provide crucial insights into a company's financial health during the fiscal year, enabling timely decision-making and trend analysis. They help identify potential issues early, improve cash flow management, and enhance stakeholder confidence before the comprehensive evaluation conducted at year-end closing. Regular interim reporting supports compliance with accounting standards like IFRS and GAAP, ensuring accurate and transparent financial monitoring.

Importance of Year-End Financial Statements

Year-end financial statements provide a comprehensive overview of a company's financial position, crucial for accurate tax reporting, regulatory compliance, and strategic decision-making. Unlike interim closing, which offers a snapshot of financial performance during a specific period, year-end closing consolidates all transactions to reflect the full fiscal year's results. Accurate year-end statements enable stakeholders to assess profitability, liquidity, and overall business health, supporting investor confidence and long-term planning.

Steps Involved in Interim Closing

Interim closing involves recording and reconciling all transactions within a shorter accounting period, typically quarterly or semi-annually, to assess financial performance mid-year. Steps include preparing trial balances, adjusting entries for accruals and deferrals, and verifying account reconciliations to ensure accuracy. This process helps identify discrepancies early and supports timely financial reporting before the comprehensive year-end closing.

Steps Involved in Year-End Closing

Year-end closing involves finalizing all financial transactions by reconciling accounts, adjusting entries for accrued expenses and revenues, and verifying the accuracy of ledgers. This process includes preparing financial statements, conducting inventory counts, and ensuring compliance with tax regulations. Accurate year-end closing is crucial for generating reliable annual reports and supporting informed business decisions.

Common Challenges in Interim vs Year-End Closing

Interim closing often faces challenges like incomplete data and rushed reconciliations due to shorter reporting periods, impacting financial accuracy. Year-end closing involves complexities such as comprehensive adjustments, audit preparations, and finalizing depreciation schedules, which demand more time and resources. Both processes require precise coordination to ensure accurate financial statements and regulatory compliance.

Impact on Financial Analysis and Reporting

Interim closing provides businesses with timely financial data to assess performance, enabling more frequent adjustments and strategic decision-making throughout the fiscal year. Year-end closing delivers a comprehensive and finalized financial position, crucial for regulatory compliance, tax reporting, and annual stakeholder assessment. The combination of both enhances accuracy and insight in financial analysis, supporting robust and informed financial reporting processes.

Best Practices for Managing Both Closings

Maintaining accurate interim closing records ensures timely financial insights and smoother year-end closing processes. Implementing consistent reconciliation schedules and automating data entry reduces errors and enhances efficiency throughout both closing periods. Clear documentation and regular communication among accounting teams optimize the accuracy and compliance of financial statements.

Interim closing vs Year-end closing Infographic

bizdif.com

bizdif.com