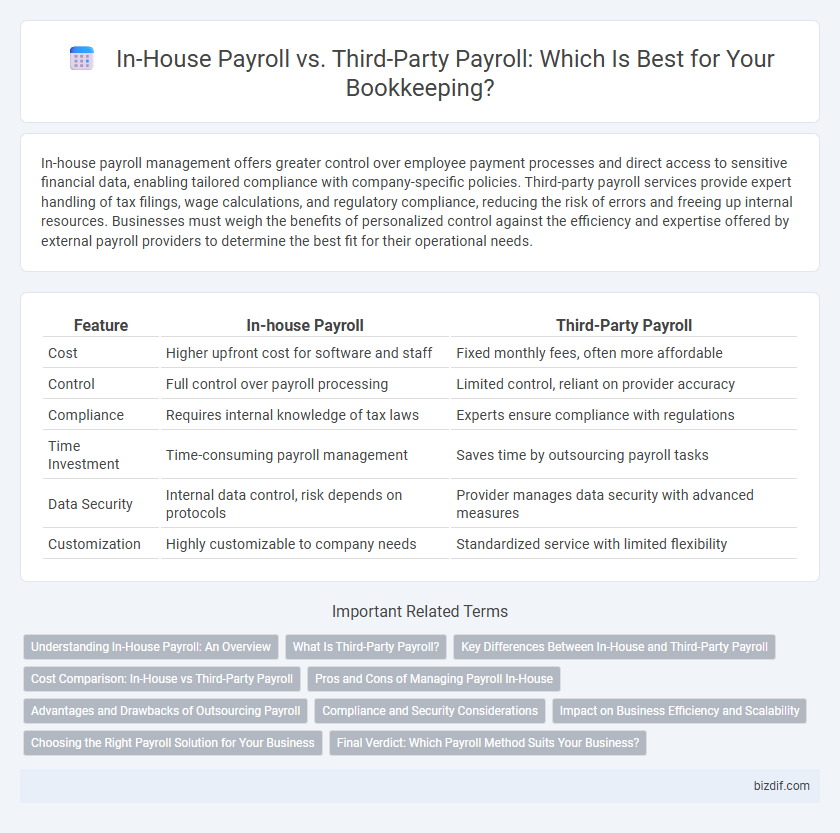

In-house payroll management offers greater control over employee payment processes and direct access to sensitive financial data, enabling tailored compliance with company-specific policies. Third-party payroll services provide expert handling of tax filings, wage calculations, and regulatory compliance, reducing the risk of errors and freeing up internal resources. Businesses must weigh the benefits of personalized control against the efficiency and expertise offered by external payroll providers to determine the best fit for their operational needs.

Table of Comparison

| Feature | In-house Payroll | Third-Party Payroll |

|---|---|---|

| Cost | Higher upfront cost for software and staff | Fixed monthly fees, often more affordable |

| Control | Full control over payroll processing | Limited control, reliant on provider accuracy |

| Compliance | Requires internal knowledge of tax laws | Experts ensure compliance with regulations |

| Time Investment | Time-consuming payroll management | Saves time by outsourcing payroll tasks |

| Data Security | Internal data control, risk depends on protocols | Provider manages data security with advanced measures |

| Customization | Highly customizable to company needs | Standardized service with limited flexibility |

Understanding In-House Payroll: An Overview

In-house payroll involves managing employee compensation, tax deductions, and compliance internally using dedicated software and trained staff. This method allows businesses greater control over payroll processes, ensuring real-time updates and customization tailored to specific organizational needs. Key considerations include the cost of payroll software, employee expertise, and risks associated with data security and regulatory compliance.

What Is Third-Party Payroll?

Third-party payroll refers to outsourcing payroll processing to an external company specializing in managing employee wages, tax deductions, and compliance with government regulations. This service reduces administrative burden and minimizes errors by leveraging experts who stay updated on tax laws and reporting requirements. Businesses benefit from enhanced accuracy, time savings, and improved regulatory compliance compared to managing payroll in-house.

Key Differences Between In-House and Third-Party Payroll

In-house payroll involves managing employee compensation, tax withholdings, and compliance internally, offering direct control and customization but requiring dedicated resources and expertise. Third-party payroll services outsource these tasks to specialized providers, ensuring compliance with evolving regulations and reducing administrative burden while potentially increasing costs. Key differences include cost efficiency, accuracy, scalability, data security, and the level of control over payroll processes.

Cost Comparison: In-House vs Third-Party Payroll

In-house payroll typically involves higher upfront costs, including payroll software, employee salaries, and ongoing training, making it more expensive for small businesses. Third-party payroll services offer scalable pricing models and reduce overhead by handling tax filings, compliance, and direct deposits, often resulting in lower overall costs. Companies must weigh the fixed expenses of in-house management against the variable fees and potential cost savings of outsourcing payroll functions.

Pros and Cons of Managing Payroll In-House

Managing payroll in-house offers direct control over employee compensation processes and immediate access to payroll data, facilitating quick adjustments and ensuring confidentiality. However, it demands significant time investment, specialized knowledge of tax regulations, and ongoing updates to compliance requirements, which can increase the risk of errors and penalties. The in-house approach may be cost-effective for small businesses but can become inefficient and resource-intensive as payroll complexity grows.

Advantages and Drawbacks of Outsourcing Payroll

Outsourcing payroll to third-party services offers advantages such as reduced administrative burden, compliance with tax regulations, and access to specialized expertise that minimizes errors and penalties. However, drawbacks include potential data security risks, less control over payroll processes, and dependency on the provider's reliability and responsiveness. Evaluating the balance between cost savings and maintaining confidentiality is crucial for businesses considering third-party payroll solutions.

Compliance and Security Considerations

In-house payroll offers direct control over compliance with tax regulations and employee data security, enabling businesses to tailor processes to specific legal requirements. Third-party payroll services leverage specialized expertise and advanced encryption technologies to reduce the risk of non-compliance and protect sensitive information from breaches. Choosing between in-house and third-party payroll solutions requires assessing the company's capacity to manage regulatory updates and implement robust cybersecurity measures effectively.

Impact on Business Efficiency and Scalability

In-house payroll management allows businesses to maintain direct control over employee compensation and internal data security, which can enhance customization and prompt issue resolution but may demand significant time and resource investment, potentially limiting scalability. Third-party payroll services offer streamlined processing, automatic updates on tax regulations, and reduced administrative burden, enabling firms to scale operations efficiently while focusing on core activities. Choosing between in-house and third-party payroll impacts business efficiency by balancing control and resource allocation with scalability and compliance management.

Choosing the Right Payroll Solution for Your Business

Selecting the right payroll solution depends on factors like business size, budget, and compliance complexity. In-house payroll offers greater control and customization but requires dedicated resources and expertise. Third-party payroll services provide efficiency and regulatory assurance, making them ideal for businesses seeking to reduce administrative burden and minimize errors.

Final Verdict: Which Payroll Method Suits Your Business?

In-house payroll offers greater control and customization for businesses with dedicated HR teams, while third-party payroll services provide time-saving automation and compliance expertise ideal for small to medium enterprises. Evaluating factors such as company size, budget, regulatory complexity, and internal resources determines the optimal payroll method. Businesses prioritizing accuracy and scalability often benefit from third-party solutions, whereas those needing tailored processes may prefer in-house payroll management.

In-house payroll vs Third-party payroll Infographic

bizdif.com

bizdif.com